Marketers love to prey upon you because they know that you’re searching. And, I quote: “Make 10 million in just 10 minutes a day.” I was approached to mail that to my newsletter subscribers. You can’t make this stuff up. No one knows exactly what a market will do-not you, not me, and not the guy who screams on TV. This is huge. The fact that there is no secret allows the hard-working little guy to compete with the big boys.

2. Average Intelligence Is Adequate

In fact, the smarter you are, the longer it might take because you’ll be tempted to try to outsmart the markets vs. simply following along. As William Eckhardt said: “I haven’t seen much correlation between good trading and intelligence….Many outstandingly intelligent people are horrible traders. Average intelligence is enough. Beyond that, emotional makeup is more important.” This brings us to our next point.

Source: Turtletrader.com

" I haven’t seen much correlation between good trading and intelligence….Many outstandingly intelligent people are horrible traders. Average intelligence is enough. Beyond that, emotional makeup is more important."

3. Attitude Is More Important Than Aptitude

A market will do whatever it wants regardless of what you think it should do or how you feel about it. The distance between you and your success is the distance between your ears. As Jesse Livermore once said: “A stock speculator sometimes makes mistakes and knows that he is making them.” You often might not like what the market is doing but, what is, is.

4. a market can only do 3 things: go up, go down, or go sideways

That might seem like a big Captain Obvious statement, but many fight the trends or try to make one where there is none. Above is my business card (and no, the bull is not humping the bear and smiling about it). Before you even think about plotting any indicator, ask yourself, is the market higher, lower, or about the same as it was days, weeks, months, and even years ago? The only way to profit from a trade is to capture a trend, period. You must sell higher than you bought (or cover lower than you shorted). So focus on just that—finding trends and getting on them. Study price and only price. This brings us to our next point.

5. News Is Noise

The media would have you believe that it’s very easy to connect the dots between what’s happening in the world and its effect on stocks. If that’s all you had to do, a lot more journalist would become traders. This is not to say that news doesn’t move markets. It does. However, often the reaction to the news is muted or even completely opposite of what it logically should be. This is because big funds might use the liquidity to exit on good news or the news might already be “baked into the cake.”

6. Every Methodology Has Its Nuances

Learn and embrace them. There will be times when you print money. You can’t let that go to your head. There will be times when you lose money. You can’t become distraught. And, there will be times where there is nothing to do. You’ll have to let the market come to you. If conditions aren’t conducive to your system, you’ll have to learn how to wait. For a trend following methodology, this means waiting patiently while a market is trading sideways. Do nothing unless there is something to do. Peter Mauthe said it best: “Don’t invent trades.” When it comes time for me to pick a protégé, I’d pick someone who’s patient any day over someone who’s smart.

7. Trading, Done Properly, Can Often Be Quite Boring

Speaking of waiting, don’t look to the market for entertainment. Go to Vegas instead-it’s a lot cheaper. Or, as I often joke, have an affair, at least that way you only lose half of your money. Seriously, patience is probably the best-kept secret when it comes to trading. I often quote Jimmy Rogers: “I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.” In spite of all my teaching and preaching, any time that I suggest that we mostly sit on our hands, my inbox begins filling with emails: “There has to be something we can do!??…What if we…?..”

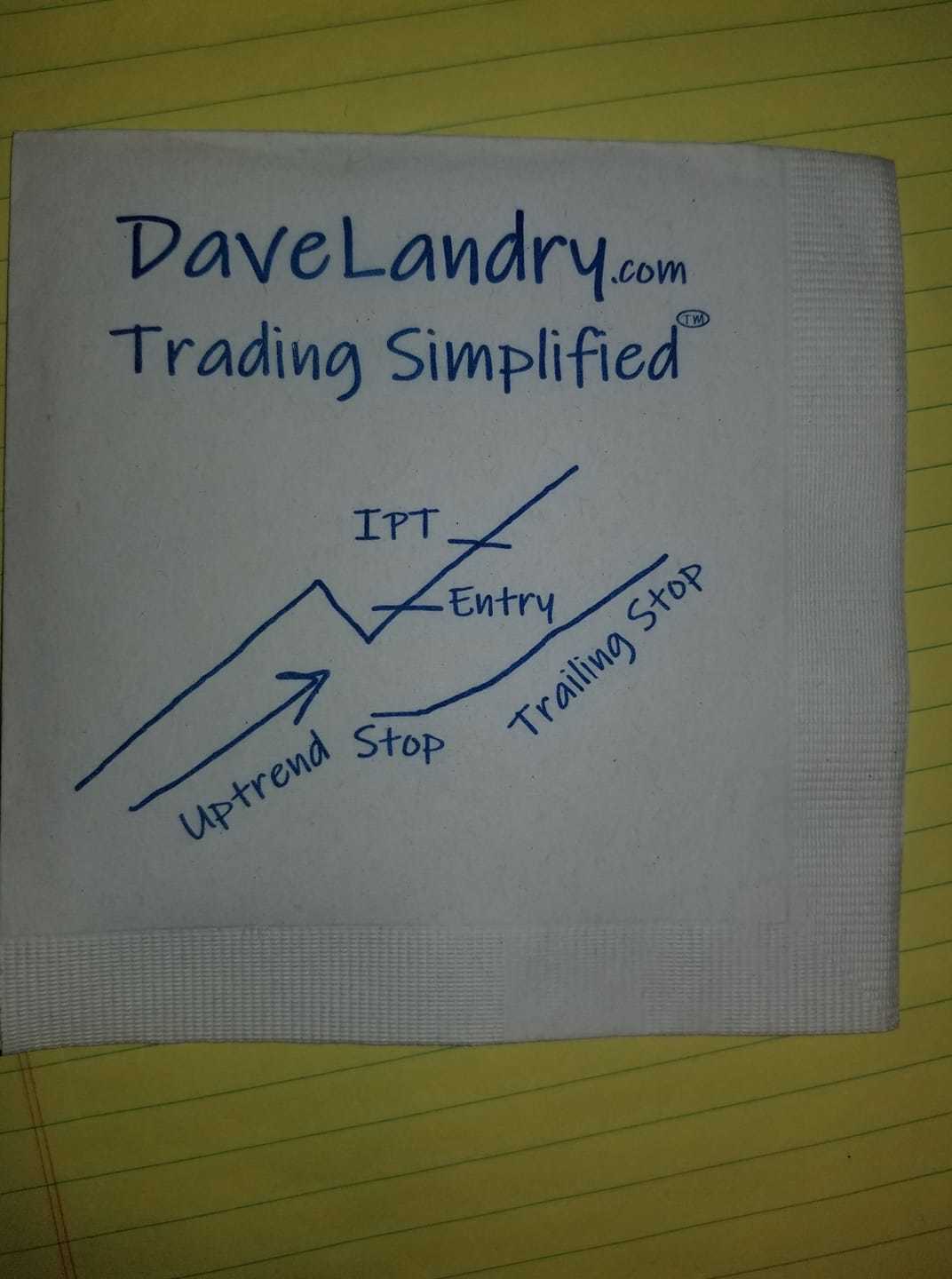

8. You Just Need One, And Only One Simple Methodology

I’ve told this story ad nauseam, but I’m going to keep telling it until everyone gets it. I used to spend a lot of time programming trading systems. Every day I’d come up with a new system, sometimes more than just one. When I arrived at home, I’d tell my bride Marcy how excited I was about my latest discoveries, spouting off the statistics. And, she would suffer a fool gladly until one day she had a question (as you married guys know, sometimes your wife can ask some tough questions). She asked, how many trading systems do you really need? That was an epiphany for me. You need one, just one. You need: the one that’s conceptually correct, the one that makes sense to you, and above all, the one that you can follow consistently. If you can’t trade one system, what makes you think that you can trade a dozen? Do one thing and do it well. And, by the way, keep it simple. It'll be much easier to follow a simple system than a more complex one. Further, most complex systems can be boiled down to something much simpler anyway. The next time someone shows you their latest "grail," plot a moving average on the chart--or better yet, draw some arrows--and see if you can get similar (or better!) results. I'm just saying....

9. You Must Plan The Trade And Trade The Plan

Yes, that’s cliché’, but most don’t. They’d rather wing it. People wing it because the moment that you make the plan is the moment that you admit that you could be wrong. And, many of those who do plan the trade fail to follow the plan because they think they can outsmart the market by interjecting logic into the equation. “The market’s headed higher, but my stock is not, I better get out.” “The stock has had a pretty good run, I don’t think it will go any further.” Or worse, they let hope rear its ugly head: “My stop has been hit, but the stock is oversold, I’m going to wait to see if it will come back.” Next to overtrading, lack of planning and micromanagement of the plan are the biggest sins that I see. Yes, winging it and micromanagement will occasionally pay off shorter-term but never longer-term. You must obsess before you get into a trade, not afterwards. Write that down.

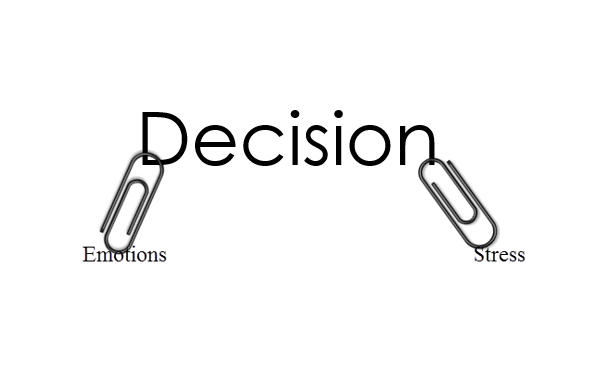

10. You Cannot Separate Emotions From Trading

Many preach that you must eliminate emotions from trading. Unfortunately, it is impossible to make a decision, ANY DECISION, without emotions (Schull, Damasio). Through illness or injury, the unfortunate who have had their emotional part of their brain damaged can no longer make decisions-ANY decision. One decision has no emotional consequence over the other, so they arrive at a stalemate. Therefore, you must embrace and not try to eliminate your emotions. At some point, ALL trades will go against you. You’ll either get stopped out or give up some open profits in the end.

11. The Market Is A Really Bad Teacher

It’ll encourage you to take small profits before they evaporate and then you watch in anguish as the stock takes off without you. It’ll encourage you to not use stops because the last 10 times the stocks came right back after stopping you out. This time though, you end up with a huge loss. In mediocre times it’ll encourage you to jump ship over to the “Church Of What’s Happening Now” instead of just staying the course. You’ll never reap the rewards of a methodology if you’re constantly changing methodologies. Write that down.

12. You’re Going To Be Wrong A Lot-Get Used To It

I’d make a lot more money in my educational business if I spent more time touting how great the methodology is and less time talking about how you can and will often be wrong.

A few years back, when the market was looking quite iffy, I received the following:

“You have been pounding the table the past month saying that the market is in a lot of trouble. Have you ever thought about picking another line of work?”

Yeah, I think about another line of work every time I get my ass handed to me, when I get stopped out to the tick and then watch the market take off without me, when the market is trendless, when I hit buy instead of sell, and, of course, when the SHTF, and when I wake up and find a turd like yours in my inbox.

I’ve given up trying to look smart many years ago and now just follow along. This has earned me the badge Trend Following Moron. Although initially offended, I’ve since taken that ball and ran with it. I’ve acquired the domain, put arrows on the back of my business cards, and it also inspired me to trademark Trading Simplified.

Gary Kaltbaum was one once kind enough to say that although I’m not right all the time (and will admit when I’m wrong), but I’m right over time. And, like the hokey pokey, that’s what trend following is all about—being right over time.

TIP-How To Reduce The Amount Of F-bombs: If you are getting stopped out a lot either your stock picking could be better and/or your stops are too tight. Make sure that your stops are outside of the normal volatility: see Trading Full Circle and join Dave Landry's Members) and make sure you truly are "picking the best and leaving the rest." See the Stock Selection Course for an intensive study on this.

13. Money & Position Management Is Crucial

George Carlin once said that when you buy a pet, it's going to end badly. That goes for trading too. Any trade, no matter how well thought, has the potential to become a loser. And, BTW, all trades-even the good ones-will end badly. The trend will eventually turn against you. As I wrote in Layman’s “money management will cure a multitude of sins.” If you’re trading at a proper size, then it will be much easier to follow the methodology.

14. Your Best Defense Is A Good Offense

It’s safe to say that money management is crucial, but you must avoid as many losing trades as possible to begin with. You want to pick the best and leave the rest. On every potential trade, ask yourself, could you walk away and be okay? If you feel like you have the mother-of-all setups, then take it. If not, pass.

15. You Will Need Some Experience.

You don’t decide to become a surgeon on Friday, read a book over the weekend, and then begin cutting on people on Monday. Yet, in trading, many just dive right in. In fact, the more successful people are in their current or prior career, the more they think they can transfer that success to trading. You didn’t become a doctor, a lawyer, or an automatic transmission mechanic overnight. Trading, even if done only casually, should be treated no differently.

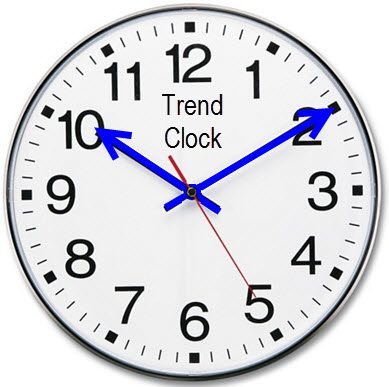

16. The Market Doesn’t Move On Your Time Frame

Even with experience, it’s still going to take some time. You cannot put self-imposed deadlines upon yourself. Unfortunately, in spite of what certain system sellers might tell you, a market will not give you a steady paycheck. Sometimes you’ll just have to wait. You’re not going to get rich overnight but if you work hard, longer-term you’ll be pleasantly surprised.

17. You Must Be Present To Win

You never know when the next big trends will come along. Last year, someone in my Core Trading Service, someone said that they were taking a break because there will not be any new setups for the “foreseeable future.” I certainly couldn’t argue with him because I didn’t see anything on the horizon either. However, the next day, I continued with my analysis as usual and found two stocks which turned into the two biggest of the year. As Seykota sang in the Whipsaw Song “One big winner pays for them all.” (check it out: see my "liked" YouTube videos). You don’t trade when it’s convenient. You trade when an opportunity presents itself.

"One To Grow On:" 18. You Know What You're Doing Wrong

I won't beat the dead horse here too much since I have beaten the dead horse here. I just feel like I'd be remiss if I didn't include this as a secret. Paraphrasing Livermore (from #3 above), traders make mistakes and know that they are making them. I know I do! Over and over when people come to me for help, I ask them what they are doing wrong, and they usually tell me. And, if they don't tell me, I can coax a confession quickly through some trade forensics.

Be cognizant when you're doing the wrong thing. And, believe me, if you've been trading for just a short while, you know when you're doing the wrong thing. Get a notebook and label it "Shame!*" Write in it when you're doing the wrong thing. I know that you can't get a "little bit" pregnant, but if you still can't resist being a gunslinger, winging it, or generally not following the plan, open a small account and mess around there. Just make sure that you are extra prudent to stay true to your core methodology in your main account(s), specifically following the process. Taken one step further, as Charlie Kirk once suggested, compare all that S&G trading to your performance in your main account. Was it worth it?

In Summary

The secret to trading is that there is no secret. That's liberating. That means that a simple methodology can work. And, make sure that you keep it simple. Embrace your emotions, knowing that you will be wrong quite often. Be patient in waiting for setups and waiting for the market to move once you get into a trade. You won't be right every time, but you'll be right over time.

May the trend be with you!

Thoughts? Comments? Errors? Omissions? I welcome feedback. Leave a comment below to let me know what you think.

*As mentioned before, Casey, from the 2019 Charles Kirk Trader's Retreat, suggested starting a confession journal in addition to your trading journal.