Professional Endorsements

Greg Morris

Greg Morris

Retired money manager who oversaw the management of over $6 Billion in assets using technical analysis.

Dave Landry is a real trader who knows his stuff. Too many in this business are fakes. Anyone who can teach others to trade must also trade. Dave's books and courses are valuable; I have no problem recommending them.

Dave is not going to tell you what you want to hear, he’s going to tell you what you need to hear. He explains the importance of money management and the need to eliminate losing trades. He teaches the discipline to wait for the proper time to enter a trade. He also teaches you when to accept a loss and move on to the next trade. He is both a successful trader and a remarkably talented instructor. Dave has the temperament, knowledge, and experience that is needed in this industry. He’s also a genuinely nice guy with a wild sense of humor.

Let me be blunt. If anyone of you out there believes that anyone in our business is going to be right all of the time, I have some news for you. Better yet, I have a few yards of swampland in the Everglades I would like to sell you. Writing your feelings, doing radio, getting on TV and just putting yourself out there is not easy . . . especially when it has to do with the markets, which are psychotic most of the time. I don’t need to defend Mr. Landry. Mr. Landry does just fine on his own. But coming from me – someone who is my own biggest critic as well as a critic of Wall Street – you best realize that Mr. Landry is in the top 1% of people on Wall Street. He is clear, he is concise, and he is right more than he is wrong. AND more importantly, when he is wrong he doesn’t just sit there and fight the tape. He adjusts unlike [many] of the bonehead strategists on Wall Street; stop reading and listening to him at your own risk.

Jeffrey Saut

Chief Investment Strategist at Raymond James

(Mentioned Dave in his column at RaymondJames.com and re-quoted the above from Gary Kaltbaum )

If you don’t have rules for buying stock and following trends, now’s the time to adopt some. Pick up a copy of @AlphaTrends book or start following Dave Landry. Both are seasoned traders who’ve seen ups, downs and everything in between. They follow rules not emotions…

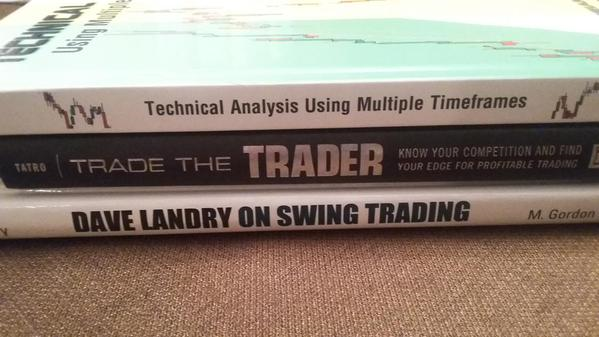

Brian Shannon

CEO at Alpha Trends

(in reply to the above) Thanks Q,, You forgot another good one! (Dave Landry On Swing Trading)

Endorsements From Private Traders

Dave, Thank you for the survey: #1 = Yes / #2 = Straightforward, engaging, focused, and you keep it realistic. I have tried many others over the last two years and your method/education is the best I have selected, and gone through. Thank you! Ken S.

(P.S. Yes…you may use my comments and I can certainly expand if you would like. I rarely endorse anyone/anything and I would certainly endorse you. )

Rick Paulmbo

Private Trader

You turned my whole trading world upside down and fixed it.....

You may use anything you want that I said. You could also add that I was using one plan then another then another then back to the first one. I wasn't always using stops and was placing them too tight. I just didn't have the cocktail napkin: stop, entry, move stop, target, take 1/2 and move stop up, in place....my money management was horrible, with no idea of risk factors. Thanks you've made me a better trader. Also, thanks for the education section of your website. Much Success!

Thanks, Rick

John Ross

Private Trader

The "Buy @ B" has worked well for me. My account is at an all time high, mostly due to that single pattern.

Bret Matsumoto

Los Angeles, CA

I’m really grateful for all the free education you give out....your stuff is awesome!

Chris Agresta

Clevland, Ohio

Hi Dave, I just wanted to send you a quick note to thank you for beating the dead horse on dead money. Having fashioned myself as a “trader” I probably would have jettisoned this position weeks ago but I stayed the course thanks to months of religiously watching your Week in Charts shows. I thought I would send along this chart in case you wanted to use it as an example in upcoming chart shows, hopefully an example like this one will help some other traders that struggle with this issue. I bought the shares @ $10.37 off of what I identified as a TKO pattern on 11/15 and recently sold half the loaf. Thanks again Dave for all your hard work.

BLUF (Bottom Line Up Front): you keep the readers engaged ...Your article was like a mini book on stock trading, a Cliffs Notes on how to trade. I liked reading it as it rings true to me and as usual your smart/funny whit kept me wandering from the text which saves me time as many times while reading other subjects I’ll go “what the heck was I just reading” and have to go back and try and find where I last was really comprehending what I was reading.

I am truly impressed with the excellence and simplicity of your posts! Glad to be a member for 10 plus years off and on and look forward to many more years!

Dave, I loved your last week in charts! It literally changed the way I will be trading from now on. My "next trade" will not be a marginal setup and I vow to trade only the best setups, and leave the rest!

Dave, You are such an entertaining genius! This newsletter, in particular, grabbed my interest… I've always loved your work and find you to be one of the smartest men producing financial material worth reading every time I read it. I just wanted to send you this note to encourage you in the fact that you are awesome, though hopefully this you are already are well aware of and need not hear it from a subscriber to your newsletter...Keep up your excellent work and I hope you make lots and lots of money and continue to help many many people as you have already and is indeed my favorite part about you. And of course, your wit! Oh, your wit is such a gift so few people have it in spades as you do. Keep on brother! Doing a thorough, excellent and all around bang up job!

Gary Bertoline

Private Trader

1. I am very happy with the training so far.

2. Although some of the material I know, it is good to review it along with the new material for me. The key elements of the training for me are the simplicity and discipline that you stress in trading. This is something that I lacked along with over-trading. I am already seeing better results with less stress. Dave's Stress Free Trading!

Okay with me if you shared my comments.

Thanks,

Gary

Charles Mathosi

Hi Dave,

I've been trading Forex for a couple of years now, with very mixed results. A while back I came across your website and registered and went through the free material you're offering, articles, webinars anything I could find I read and watched. I never really sat down and developed a trading methodology that I followed "like a true gospel.” Frustrated with the results I was getting I went back to the drawing board, looked at the trading material I had accumulated over the years, I god rid of almost everything in my trading library except your material. Beginning of this year I really immersed myself in your teachings, I put together a simple plan that would have me trade trends, I would not even try play a trend reversal trade no matter how great the setup looked.

I was very surprised with the results, sticking to the plan turned my trading from shooting from the hip and getting mediocre results, to consistently making small profits. Best thing is my trading became more stress free.

So I made a decision that I would like to be mentored by you as it was your teachings that turned around my trading.

Charles Mathonsi

I participated in your AMSC and am long CLOV @ 3 per your recommendation. I just feel like I am seeing things very well and my 25 years of instincts are paying dividends. I have already bought some CSLR on the deep pullback. But.......I am not getting excited and I'm taking things one day at a time.

Right or wrong, I sold half my ACIA @ 44.66 this afternoon...$1.06 less than initial profit target! I'm not greedy, and as you say IPO's can be very volatile. I'll let rest ride as long as possible.You have kept me out of "action trades" with my own discipline and your preaching of patience. My only regret is that I didn't join your service a few years ago. And this doesn't mean there won't be losing trades, I know there will be. And you can quote me if you want!

As an ex-Trading service member, I can say I have tried every reasoning possible. This included doubting, guessing, second guessing, etc. and found the only times I was profitable is when I followed your methodology to a "T". Even though I did it mechanically, I still outperformed any attempts I made to modify/change your methodology. The method works, period. Yes, it can be boring (and negative) at times, but over time it is successful.

What Steve said.

I still love your book Layman's Guide. I read it every week to this day because I learn something new every time that makes me a little bit better at this game!

Thank you for doing your education services and shows. I think it has HUGE VALUE to everyone who want to be successful in this HARD business….”

….I think I told you that I watched you on www.hardrightedge.com for about a year (along with quite a few others) and you seemed to have the most intelligent system of anyone … and that’s proven to be the case…..your desire to educate comes through loud and clear. You turned on a big light for me and made all this gel. You’ve helped me pick up a skill that I can use for many years to come …..So, it’s great to be part of the family for the long term.And I’ll add one more thing . . . if this keeps up the way it’s going today, I will have doubled my principal in the space of 6 months with you (actually, more than that, cause I doubled the first amount, then added to it and have doubled that) … and I’m certainly willing to write you up a testimonial you can use when and if you want….”

I’m about a year into trading. Your new book arrived from Amazon on Saturday and I’ve devoured it! Up until now, I’ve read several books…..……I only wish that I would have read your book first. This book will be highly recommended in my five star rating on Amazon. There is too much self absorbed jibberish to sort out for the average novice. Your book is a concise, straight forward, and very informative aid that will help many. I plan to order your other books today. I’m signed up for your newsletter and plan to follow your work in any way that I can…..…..Thanks for a very helpful and usable guide….All the Best

....thanks again for making what would have been a depressing holiday into a cheerful one, by keeping us on the right side of the market again...

"Dave, I’m really enjoying watching the IPO course and the stock picking course.You did a great job. Thanks"

I came across you I think around March of this year, have purchased and been through all your Week in Charts and all articles everything I can get my hands on. Instead of just being in and out of the market, your approach is awesome….It has brought me back to look more at the trend and ride it out as long as possible. I’m currently on your service, and catch all your shows which I love, All the education you offer really..helped with…my learning curve.Thanks for what you do. Your Week in the Charts are awesome, your wit and humor and knowledge makes the shows enjoyable Great Job!!!! Thanks

I thought your presentation was informative, brisk, to the point and enthusiastic and really timed well to the allotted time. Nice presentation. You are an inspiration to me that keeps me diving back into the charts in the effort to cram your years of experience into profitable actions in the market. I am pleased to be a client of yours

Alvan

I have watched you Thursday shows for years now. I wish everyone would realize that your book is essential and worth every penny. My first trade was at 21 and I am now 71 years old and I'm convinced that you are the best teacher around."

DonJ.

While I have a library of books and materials (and I'm not kidding here), The Layman's put everything in perspective as a repeatable, effective trend following system (especially the money management section).

Eric F.

Followed you for years and just want to say THANKS. You are the BEST.

Just one of my periodic thank you notes for your help and consistent over all market perspective. Your commentary helps keep me on track. Nothing in particular prompted my comment, just your long range consistency and generosity. The traders I know can't keep a consistent strategy for a month, much less years. There's always the temptation to switch horses when things aren't setting up -- especially in sideways markets. It seems to me what successful trading strategies have in common is that they always wait till the odds tilt in their favor before making a trade. It's waiting for that tilt that can be the hardest part. And you, my friend, are a good waiter. Ever think about going into the restaurant business?

Dave, Love your Market in a Minute--great info in a concentrated and appealing manner. Very cool..Thanks

As always, you put on a terrific show. Thank you for all of your time an efforts. I consider you a mentor. Since I revamped my screenings using your methods and market review, I have become a consistently profitable trader. There really isn’t a value that you can put on that . . .

From Amazon.com: The Book That Keeps On Giving “Through the creative use of the internet Dave Landry has revolutionized the concept of a book. Imagine reading a book that you really enjoyed and benefited from, and then had the opportunity, free of any extra cost, of continuing to receive information and developing understanding related to the book directly from the author in an interactive framework. Literally, a book that doesn’t end – it just keeps giving. This is what Dave Landry has done, and he deserves the highest order of praise and appreciation for this creative and innovative contribution. Sure, Dave has a service that he’d like you to subscribe to, but that is completely optional, and doesn’t detract one bit from what he is offering – something new under the sun. After you buy the book and read it, Dave offers an ongoing weekly discussion of the book as it relates to the current market. These discussions are not primarily teasers so you will spend more, but they are genuine discussions that have use and value. Dave consistently follows through on the book’s material by clarifying concepts and entertaining questions from readers. Dave loves his work, he loves trying to help laymen become more successful investors, and he achieves success in a generous and good natured way. He is confident enough and capable enough to do this. When you buy this book, you not only buy a great investment book, that has been documented by so many of its readers, but you enter into a true innovation of investment education – a book that keeps on giving. “

Hey Dave, I just read your “Random Thoughts”, like I do every morning, and as long as you continue doing what you do best, keep em coming. Especially including what you wished someone would’ve told you 25 years ago. PRICELESS ADVICE (every word of it) AND THANKS!

Your Week In Charts is one awesome learning tool!

I would like to thank you. I learn more through your weekly reports than I could have imagined – very practical and well explained

Absolutely great webinar ! You answered all my questions. I love the way you keep things so simple and down-to-earth. Thank You Very Much,

Great webinar! I have been in this business for over 20 years. That might have been the best explanation of how to make money in the market that I have ever witnessed. And it only took one hour out of my whole life. I hope the rookies out there understand that you didn’t hand them a fish tonight, you taught them how to fish

I like your first book Swing Trading. Excellent book. Rather than just academic interest, I applied your methodsreal-time and it works really well. That itself talks about the power of your methods.

Your markets in a min are great. More info in less time than anyone has ever broadcast. Thanks!

I got to listen to your first market minute. Precise summary; quickly covering the market’s activity

Your markets in a min are great. More info in less time than anyone has ever broadcast. Thanks!

I must extend my sincere compliments to you. You provide so much more than just “stock picks.” You actually teach the methodology and are accessible. If you hadn’t saved me so much in “tuition money” to the market, I would have qualified for my own Federal bailout plan. In all seriousness, thank you.

And this one also from Ryan...

as usual .. .. great job with the service .. ..even I can find setups when the market is trending .. .. you however .. can keep me from trading when the market is “questionable” .. .. you are like the calming Trading Jedi .. ..and please .. .. stop apologizing for not putting out setups all the time .. ..thanks again..

I’ve been in the stock market about 40 years, mostly as an investor. Like you and other members, I’ve studied about a gazillion systems, most of which are not only worthless but frequently misleading (the ignorant preying on the ignorant). Your methodology has evolved into the best I am aware of currently, especially for the average guy (which is me).

I do want to tell you one thing. You have helped me more than you can possibly know. I don’t know if you remember but I was vigorously complaining about why the markets seemed to be going up in the face of what I felt was a mountain of evidence that things were bad and only going to get worse as time went on. I couldn’t figure out why this was happening. You admonished me with these words “Tony you are thinking to much”.As I thought about those words I realized I was expending a lot

Don’t forget Dave’s subscription service. Even better way to learn with“the man” by your side. Even if you have a good handle on his approach andcan duplicate his work on your own, his service is very valuable (at leastto me) for times when you can’t put a lot of your own time into theevening scans because of other commitments and priorities (family, job,vacation, etc.) You can just blindly trust his picks/comments for a fewdays or weeks until you’re up to speed again. You can also use the picksto supplement your own ideas or other strategies.

I just wanted to thank you again for writing “The Layman’s Guide” and for being so free with your time and knowledge. You are one of the very few beacons of light on the internet amoungst the money stealing slugs out there.

…..one last side note–you are one of what I feel are a select few in the market place that I consider to be legit –I tend to hold you up there with the John Murphy’s of the world—-you just tell it like it is and it is nice–I refer to you and recommend you to traders I know–you do an excellent job with the analysis-and in present market conditions–this is that time where many traders/active investors will get hurt if they do not follow a plan and you are always good to make traders watching your videos etc aware of being systematic in their approach-anyway just wanted to let you know that your commentary and videos are appreciated–enjoy your weekend.

I was matching the “Market in a Minute” a few days back and saw that you mentioned TSO. I bought some calls a few days back and so far the stock has run up about 9 points. Thanks for the idea!

I have found your first book, “Dave Landry on Swing Trading,” to be extremely helpful.I have been trading equities for about 2 years. Your emphasis on trend and patience (waiting for confirmation), has saved me many times. With the current market behavior, the lesson has certainly kept me from making large mistakes, and has even taught me when I should be taking profits (one of my biggest challenges).As I said in my previous email, thanks for all you do, your commitment to educate is very much valued and appreciated!

Hey Dave, hope your doing fine and that you and your family had a nice holidays. I’ve been doing some video blogs on youtube and getting e-mails from people wanting to know how they can learn price action from the charts… I had be be honest and tell them it was you that taught me about everything I know.I hope you did not mind me mentioning you and your website… Now for the most part these guys are all Forex traders, but price action is price action…

Dave, I wanted to check with you before I mention how awesome you are. If this is a problem just let me know… I’m not sure how you would take me talking about you (in a positive way).

I just want to take this moment to convey my heartfelt Thanks to you. I have been a reader of your books and the books and your weekly presentations have been very useful in my trading.

I want to thank you for all you do, for me, and for others….I just wrote a post regarding decision-making to a trading board I’m on (covered calls) and found myself repeating some of your chestnuts like “as traders we are paid to make decisions and live with them” “obsess before the trade, not after” “every method has its sweet spot” and so on.Should you write another book, I encourage you to gather as many of those as you can into a “psychology” section of the book.Those who have followed your presentations from TM and TC should have gleaned a ton of info about the nuances of your method. Your first two books had the skeleton – I think your next one needs to address as many nuances as possible in some detail.Most of your trading wisdoms apply to *any* method, that is awesome. Your wealth of swing-trading info is impressive, but your psychological understanding of traders and the market is even more impressive.Thanks again, you da man!

I’ve been using your methodology in Forex market and just wanted too let you know things have been going well. I use the daily and 4h charts and all your patterns you talk about happen time and time again even in the Forex. I love the persistent trends out of a base and pull back the most. The trend knock outs also happen often.Just wanted too thank you for teaching this hard head a thing or two…..

…more important though is the process of your education. I have been trading successfully now and with progressive improvement pretty well since you started teaching me your methodology, and while our approach differs somewhat in that I look to stay in a trend longer than you do, and combine your technical methodology with my original fundamental approach – particularly in finding stocks to buy, it doesn’t differ at all when it comes to the technical chart analysis. That is not altogether surprising considering that you have provided me with the bulk of my “technical” education, and it’s an approach that absolutely suits my mentality.

I just wanted to say a quick thank you for your daily “market in a minute” commentary & your two books which are priceless IMO. Keep up the good work. It is really appreciatedKyle W.I just would like to thank you for all your work, and tell you a little bit about my “learning to trade” experience.I have bought many courses and books……. and of course your two books. After 4 years all I can say is that by far, you have the best, simplest and effective trading methodology of all the people mentioned above. Now I mostly execute your methodology,Josue R.“Mate, you have blown me away with the chart show. Thank you so much for addressing my questions, especially in such detail. A trader over here introduced me to your system 12 months ago. I’ve read a heap of books and looked at umpteen systems but yours resonated with me from day one, although I just didn’t follow it to the letter. Why? I have no idea… I am one of those professionals you talk about, I don’t think I’m smart but I know I over think everything.My trader friend said to me one day I would have an “a-ha!” moment and I would have to find my own way to that point. You can’t believe what a week in trading I have had this week emotionally, but the upshot of that is that I think I had that “a-ha!” moment. You even said you have to find your own path there by making all the same mistakes first, just as he did, and exactly as he said would happen.I know there is still a long way to go but I dunno, I feel like the planets aligned and the light bulb went on JDave, thank you.”Glenn

Well done on your reply to the email from Glenn. As a part time trader for a few years the issues you addressed are spot on. We all need to hear those things from time to time….many thanks and I enjoy your videos.

P.S. I am from “down under” …as well…..G’day mate…

My name is Abhishek.

I am from India.

Have been learning from you for the past 3 years.

I want to thank you for your videos and articles.

You have made a great difference in my trading.

Thanks a ton

Regards,

Abhishek.

Abhishek Shroof

New Delhi, India