Random Thoughts

The original source of this article came from a series of articles that I wrote for TRADERS' magazine several years ago. Below is an updated and expanded version.

For those new to trading, new to me, or my methodology, I think the following ground rules will help you to understand my philosophy towards trading and the markets. And, I think for those of you who find yourself plotting the 15th oscillator, attempting to implement some arcane price bar counting technique, being fleeced by a guru, confusing the issue with facts by interjecting news or fundamentals into your trades, trading during less-than-ideal conditions, picking tops/bottoms, and generally just trying to outsmart the markets will also benefit.

Dave Landry's Trading Ground Rules

1. Technical analysis leads the way

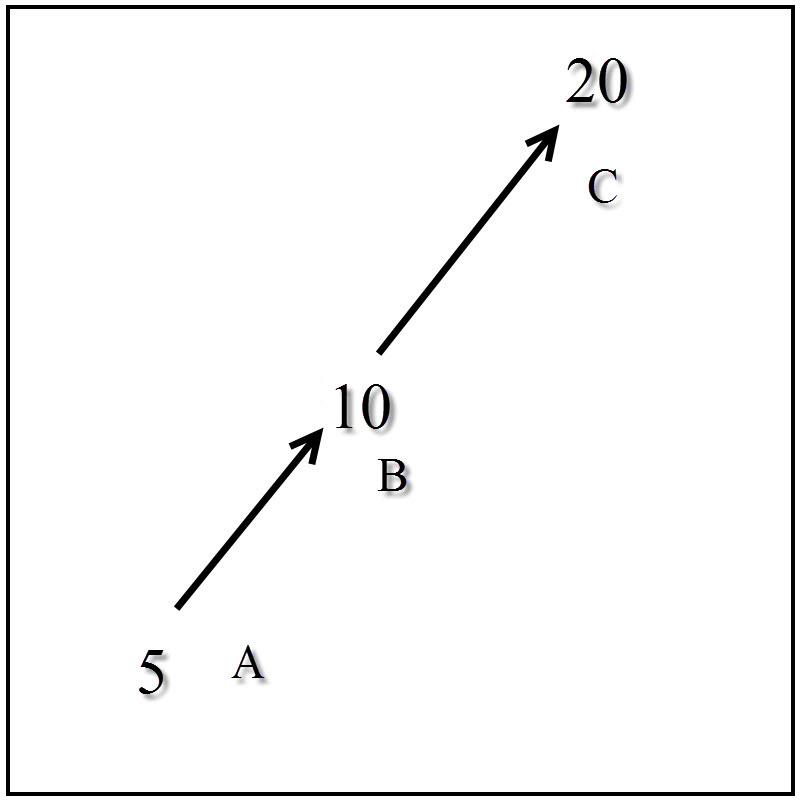

If a market is going from A to C and A < B < C, then it must pass through B on its way to C. There are no hard and fast rules like this when it comes to fundamental analysis. “…the fundamental factors suggest what ought to happen in the market, while the technical factors suggest what actually is happening in the market” R.W. Schabacker, Stock Market Profits.

2. Considering #1, all news and all fundamentals are ignored.

Price and only price leads the way. “Remember: All of the financial theories and all of the fundamentals will never be any better than what the trend of the market will allow.” Greg Morris, Investing With The Trend

Jesse Livermore

Not even a world war can keep the stock market from being a bull market when conditions are bullish, or a bear market when conditions are bearish. And all a man needs to know to make money is to appraise conditions.

3. the Trend Is Your Friend

Trade only in the direction of the established trend. As you gain knowledge, you can then also look to trade emerging trends.

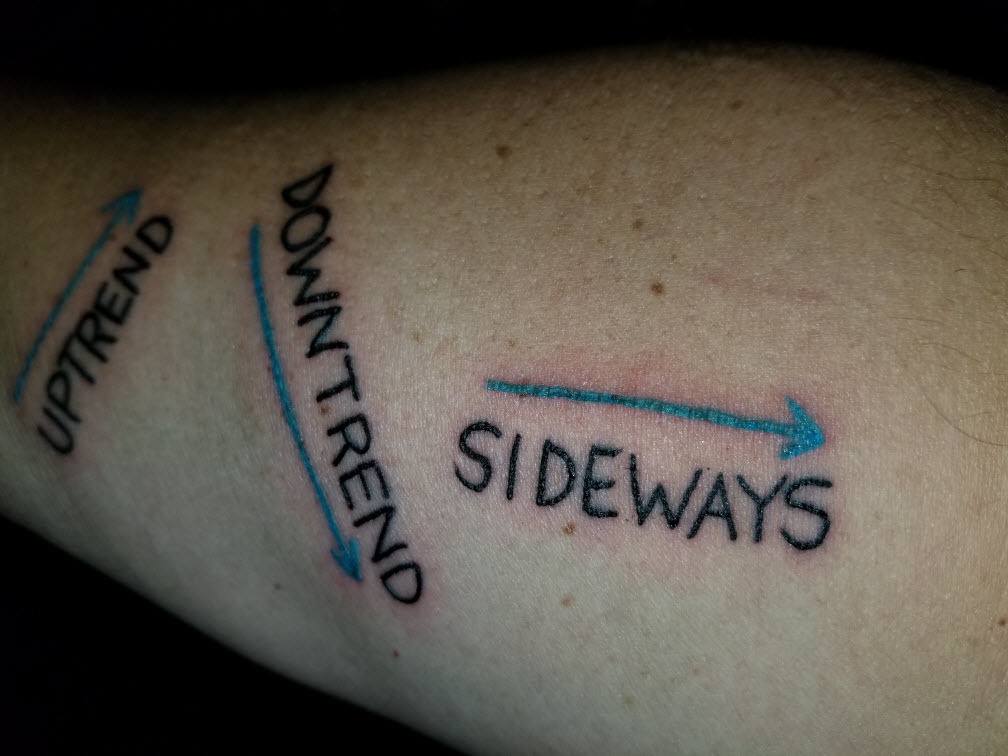

Regardless of the methodology, all successful trades must capture a trend. So, why not start with the trend? I know I can be a little "tongue in cheek" with my uptrend, downtrend, and sideways arrows, but you'd be surprised how many people fight trends, trying to outsmart the market. ALWAYS start by asking yourself, "self, is the market in an obvious uptrend, downtrend, or is it just going sideways?"

Yes, above is my actual business card. It serves as a constant reminder of what I stand for. And, NO, the bull is not humping the bear and smiling about it!-at least that wasn't my original intention.

4. It's Not My Way Or The Highway

There are many ways to trade. Yes, I am biased, especially when it comes to methodologies that I know "will work until they don't." If you are already a successful trader, then use only what you feel will improve your trading. If you are not currently successful, then consider the methodology in its entirety since it is a simple and straightforward approach.

5. Keep it simple

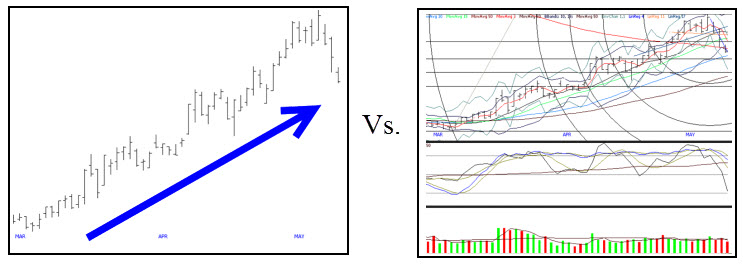

Other than the occasional moving average, no indicators are used.

Again, the only way to profit from a trade is to capture a trend. So, focus on that. Draw your arrows. Use simple concepts such as persistency--drawing a line through as many bars as possible and "net net" price change-is the market higher?, lower?, or about the same as it was? Once you look at the blank chart and ask yourself these questions, then and only then, add in a moving average or two and ask yourself is there "DaveLight"--lows > the moving average.

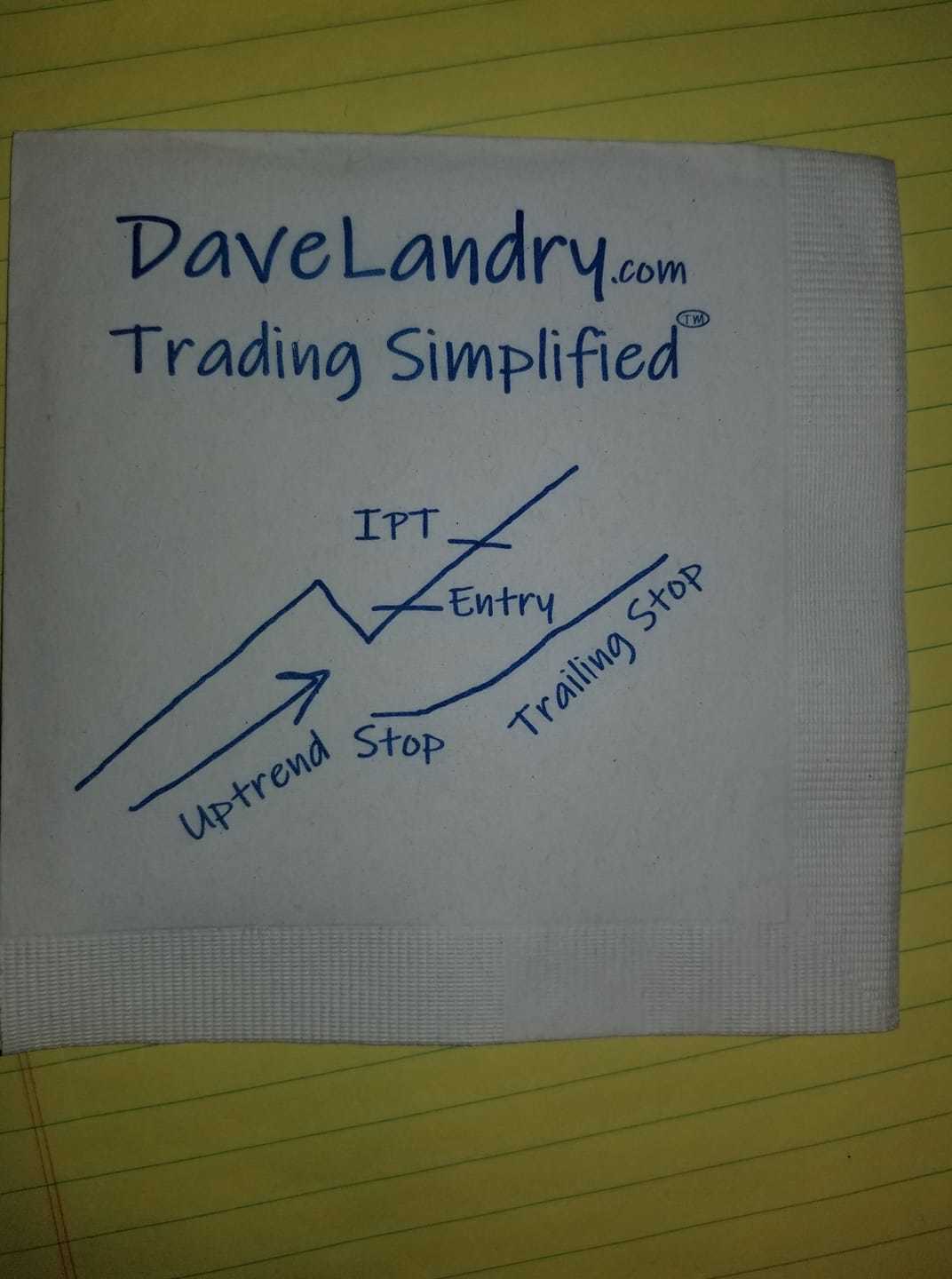

You should be able to put your entire methodology onto a cocktail napkin-and I did!

6. Only the short-term can be predicted when it comes to markets

When it comes to markets, only the short-term can be predicted with any degree of accuracy. Unfortunately, you don't make enough trading the short-term. And, eventually, something bad will happen. This will make it difficult to survive both mentally and monetarily. Longer-term trends are nearly impossible to predict (statistically, there's over a 70% chance that you'll be wrong), but that's where the money is. The good news is that you can "have your cake and eat it too." You can trade for short-term gains but stick with a portion of the position just in case a longer-term trend materializes-see the aforementioned cocktail napkin for details (IPT= initial profit target).

7. Money & position management are key

You must position yourself for both shorter-term and longer-term gains. No matter how great a trade might look, there is always a risk of loss. Therefore, stops must be used.

8. a good offense is often your best defense.

Although a good defense is crucial, a good offense is often your best defense. Pick the best, and leave the rest. Do not take mediocre trades or try to make something happen in less than ideal conditions. “Don’t invent trades.” (Peter Mauthe)

9. The methodology is repeatable

There are a lot of disingenuous gurus out there, leading you to believe that they have the magical system, and all you have to do is give them a sizable portion of your hard-earned cash and they will give it to you. True, some of these gurus have done some amazing things. And, you can't take that away from them. However, being in the right place at the right time and parlaying a small account is one thing. Repeating these feats is another. If they truly could turn 10k into 10 million, why wouldn't they just "rinse and repeat?" I know I would!

Although it's hard to sell reality, I take the high road when it comes to my educational business. I once told my youngest that I could make a lot more money if I "sold out," thinking that would be an excellent virtuous lesson. She then begins screaming: "SELL OUT! Sell OUT!" LOL

Getting back to my methodology: There are no secret formulas. Execution is not extremely crucial. With some experience, you should be able to recognize trends/emerging trends and the patterns to get aboard them.

I'm proud to say that I've helped a lot of people throughout my career. Most seem to have to go off to chase rainbows and empty promises before they get it.

10. Embracing your emotions is key

As I preach, I use the word "embrace" and not "eliminate" because you cannot eliminate your emotions. It's part of our physiological makeup. If you had no emotions, unless you're in a padded cell, you'd be dead within a week. So how do you embrace your emotions? You do this by understanding the methodology, trading at a reasonable size, planning your trades, and only trading the best. “Obsess before you get into a trade, not afterwards.” (Dave Landry, The Layman’s Guide To Trading Stocks)

In Summary

Use technical analysis and only technical analysis to trade, but keep that simple. Draw arrows and study the "net net" before plotting any indicators. Never forget that in order to profit from a trade, you MUST capture a trend. Sprinkle in a little money management, and learn to embrace your emotions and you'll do just fine!

May the trend be with you!

Dave Landry

References and additional reading:

- 1The "ABC" concrete rule is a reoccurring theme here at DaveLandry.com. Watch the first four videos (free) of Trading Full Circle.

- 2Again, watch the first four Trading Full Circle videos for a lot more on why Technical Analysis and only Technical Analysis.

- 3Read: 13 Things That You Must Know About Trend

- 4I'm hinting at "anthill" type strategies such as reversion to the mean trading and selling naked options. These methods can work for long periods of time. Unfortunately, though, I can all but guarantee that they it will end badly. And, yes, I've "been there, done that, and got the T-shirt!"

- 5See Trading Full Circle. Come to the Weekly Chart Shows.

- 6See Trading Full Circle.

- 7Again, this is covered in detail in Trading Full Circle.

- 8See the Stock Selection Course. Right now (until 07/6/18), I'm including one year free to my Core Trading Service so you can learn the theory and then see it in practice. Also, I'm including 1-year to the new member's area (from the launch date) and immediate "sneak peek" access.

- 9Repeatably is a reoccurring theme here at DaveLandry.com. Yes, your guru might have done something impressive at some point. Quoting Janet, just ask them "What have you done for me lately?"

- 10See the Trading Psychology Micro Course (a sub-set of Trading Full Circle). Embracing, not eliminating, emotions comes from the research of Shull and Damasio.