Random Thoughts

By Dave Landry

I’m a big Tim Ferriss fan. I love the way he seeks out success-whether it is financial, physical, or spiritual-and then works to deconstruct it. He poses the question: “What would it look like if it were easy?” Let’s apply this to trading.

Trading Is Not Nearly As Hard As You Make It

As I preach, trading isn’t easy, but it’s not nearly as difficult as many try to make it. So, when you find yourself plotting the 15th oscillator, wondering if it’s a 5th of a 3rd or 3rd of a 5th in your wave count, or trying to pinpoint some exact cyclical reversal, remember that a market can only exist in one of three states. It’s either going up, down, or sideways. Do some in-depth analysis if you must but always start with and come back to a blank chart and ask yourself up? down? or sideways?

Don’t Confuse The Issue With Facts

Markets are always emotional and often irrational. Just think about your behavior. When you look back on today, were you emotional or irrational at all? I can answer the question for you: you were. That’s physiology. You can’t make ANY decisions without emotions.* Therefore, if you decided to get out of bed, eat breakfast and so forth, you had some emotions. Some of these emotions may have caused you to behave irrationally. Being cognizant of your own emotions will help you embrace the fact that the market is made up of a lot of emotional “yous.”

"Markets can stay irrational a lot longer than you can stay solvent”

You Don’t Get Paid To Look Smart

I started trading Bitcoin just a few short months ago. During this time, I’ve found myself drawn into some heated debates about it being a bubble. Well, these people are probably right, but in the meantime, the crypto quadrupled. They’ve missed out on a trend follower’s dream. And, when the bubble bursts and we see a 50% or more drop, these people will be the first to brag about how right they were. Well, you can make a lot of money in an irrational market or you can sit on the sidelines and pontificate your brilliance.

I gave up trying to look smart in the 90s and started drawing big blue arrows in the direction of the trend. This earned me the title “Trend Following Moron.” I was hurt at the time because I admired the famous trader who called me that, especially since we had just become friends. He was impressed with my analysis. So, why did it get nasty? Well, he began fighting the exact trends that I was continuing to follow. He was right, but early—which has ruined many careers, but I digress. Anyway, I quickly got over my bruised ego and embraced the title. T-shirts and buttons soon followed.

I’m an extrovert but can get a little shy when I’m around financial greatness (but could pretty much care less when I see a celebrity in an airport). Anyway, I was once on my way to a party, sitting quietly on a bus next to a money manager who was running over 5 billion. My wife Marcy broke the ice, asking him about his trading. After he explained his methodology, Marcy turned to me and said, “Isn’t that what you do?” No, I replied, I’m not that smart. I just buy things that go up and sell things that go down. He turned, pointed a finger at me, and said: “He’s got the right idea!” A friendship then ensued.

Yes, I’ve learned a little about the markets over the last 30-years, but the bottom line is, in spite of all this knowledge, what is, is: up, down, or sideways. My trend first attitude has helped many of you to stop chasing rainbows and just follow along. It warms my heart when I receive emails from people who have dubbed themselves “fellow TFMs.”

So What Would It Look Like If It Were Easy?

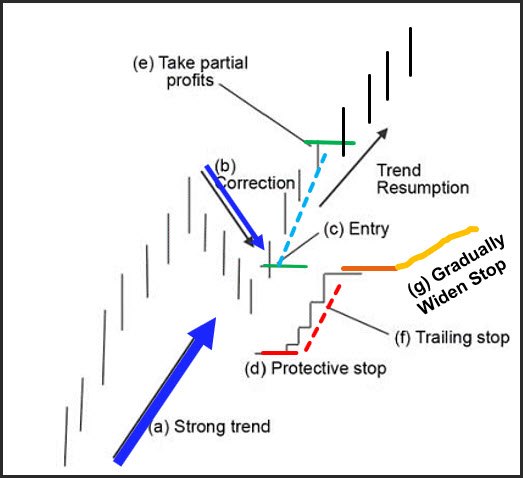

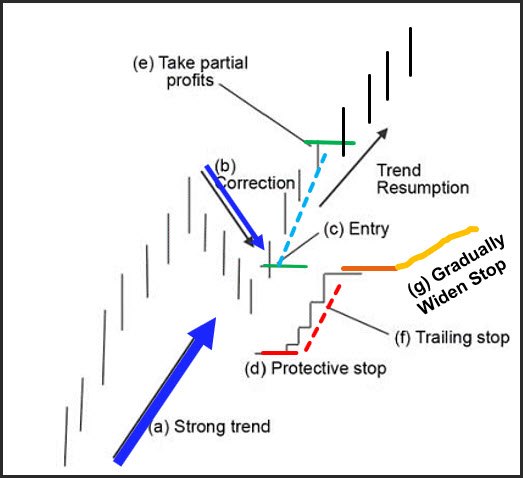

First, you would only trade obvious established trends. Once you build confidence in this, you could then venture into trend transitions (i.e., new/developing trends).

Years ago, I used to quote Linda Raschke by saying, “If you don’t know what direction a market is headed, then ask a 6-year old kid.” I stop quoting her because many began to give me credit for the quote. Linda’s right. A 6-year old doesn’t care about looking smart. He isn’t tempted to prognosticate an uptrend because he’s stuck in a downtrend—and, so on and so forth.

Next, you’d only trade when you had a setup. You’d then use a simple money & position management system to get you into the market if the trend appears to be resuming and keep you out entirely when it isn’t. Once in, the system would get you out when the trend eventually ends or worst case, out at a small loss if it never truly begins.

Easy Rule #1. Only trade markets in obvious trends

First and foremost, the trend is determined by the “net-net” price change aka the big blue arrow. Other simple metrics such as moving averages (e.g. daylight) could then be used for additional confirmation

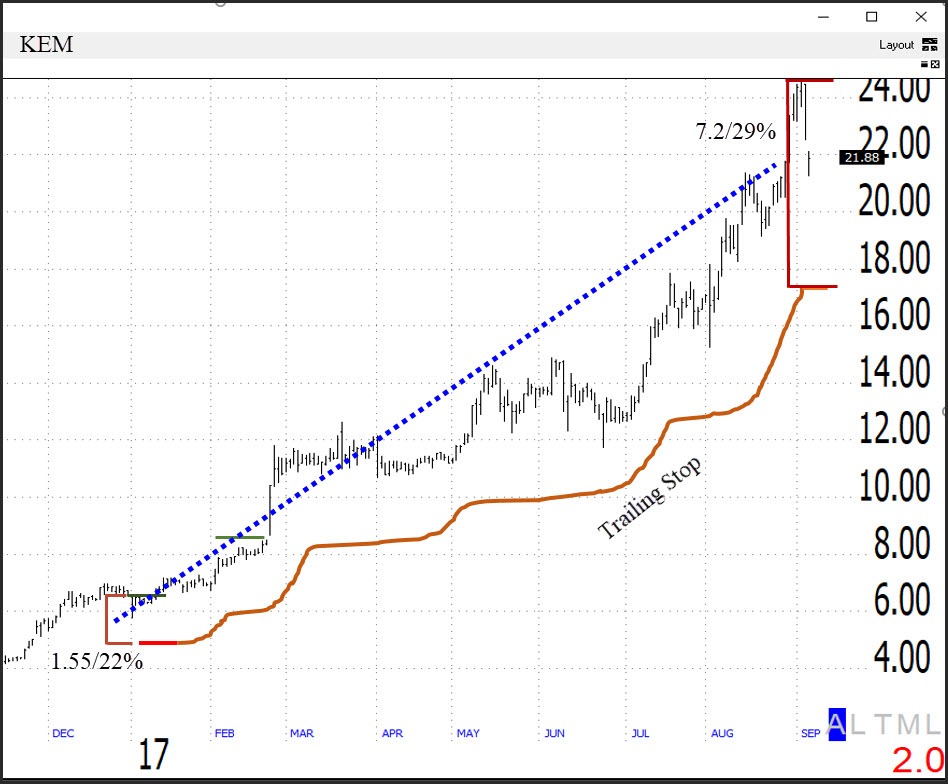

Notice the solid uptrend (aka the Big Blue Arrow) in Bitcoin before it set up as a TKO (read further)

Easy Rule #2: Use A Simple Setup

One the trend is identified, a simple, easy to identify setup should that suggests the market has the potential to resume its trend over the short-term. Trend Knockouts (TKOs), especially in persistent trends, are one of my favorites-watch the video below.

Easy Rule #3: Wait For Entries

Place your entry above the market at a level that’s high enough to ensure that the trend is beginning to resume (and not just a fake out), but not so far away that the entire short-term move would be giving up on a trigger.

"Easy" rules for trading. (a) Identify a strong trend (b) wait for a setup (in this case, a pullback) (c)wait for an entry (d) use a protective stop (e) Take partial profits (f) Trail stop higher (g) Allow stop to widen with trend

Easy Rule #5: Take Partial Profits

Take partial profits (half) when the market rallies at least 1x the original risk. System designers: don’t get your panties in a wad. The negative expectancy is beaten with the next rule.

Easy Rule #6: Gradually Widen Your Stop To Stick With The Trend

Trail the stop on somewhat less than a one-for-one basis. In other words, suppose a market rallies $1.23, you might only raise your stop $1. Or, on big rallies, say 3 points, you might only raise your stop 2 points. This will help you to adjust to the longer-term volatility of the market (which, btw, will be increasing if you caught an acceleration of trend) to hopefully, stay with that trend for a long, long time. This is where the real money is made. Short-term profits are nice, make you feel good, and help to keep the lights on. However, you must position yourself to capture the occasional homerun.

Easy Rule #7: Do Nothing Unless There Is Something To DO

Unless there are one of the aforementioned things to do, then there is nothing to do. Doing nothing is harder than it looks, especially for people of action-like you! This is why this is the hardest easiest rule of them all!

Watching every tick will not help a market to move. All that will do is temp to you to take unnecessary action. Put systems in place and then go about your life. Spend some time with your loved ones, save some lives if you’re a doctor, or just chill on your boat. The Ron Popeil “set it and forget it” watch-the-market-for-you-systems can be as easy as alerts to tell you when there might be action to be taken or something like hard stops/contingency orders. As I’ve said more than once, busy traders make good traders!

Obviously, there are a few more details to the above, but you get the gist: Keep it simple. Seek to buy markets that are going up and sell markets that are going down. Use a little money management and keep that simple too. Check your ego so that you have the proper mindset to avoid trying to outsmart the market. And, don’t do anything unless there is something to do.

May the trend be with you!

P.S. What do you think about this article? Scroll down and leave me a comment. I personally read ALL comments.