Random Thoughts

Random ThoughtsLet’s just jump right into the charts.

The Ps sold off but were able to bounce off of their worst levels. Still, for the day, they lost a little over ¾%. Minor support here is its prior breakout levels, circa 1810. This is right about where its 50-day moving average is—often, technicals come together at the same levels.

The S&P futures are getting whacked pre-market so it’s likely that the Ps will test support—at least in early trading.

The Quack sold off hard but then rallied to make back nearly all of its intra-day losses. For the day, it ended down just over 1/2%.

The Quack looks much better than the Ps. So far, its move only appears to be a Technical Knockout-ish move–a probe lower to shake out weak hands followed by a reversal.

Although the Nasdaq still looks okay in spite of ending lower, one has to wonder if the additional weakness coming into today will put pressure on the index.

Let’s look at the sectors:

Some areas were hit especially hard and didn’t get back up. Chemicals, Banks, Insurance, and Manufacturing are examples here. It’s important for these areas to stabilize soon.

Recent weaker areas such as Media, Consumer Non-Durables, Restaurants, and Retail continued their slide.

The good news is many stronger areas such as Aluminum, Defense, Drugs (especially Biotech), Semis, Hardware, Software, and Transports, to name a few, ended lower but so far, they only appear to be pulling back.

Although off their best levels, Gold & Silver continued their rally off of what appears to be a major bottom. You’re welcome.

Overall, things still look okay but additional weakness would be cause for concern.

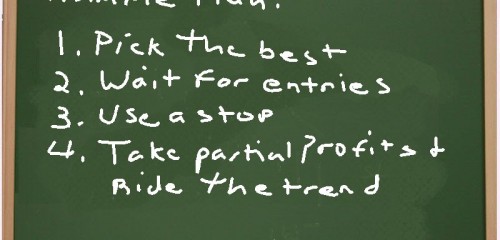

So what do we do? I’m still seeing a few setups on the long side, especially in stronger areas like Biotech. I’m also seeing transitional setups (e.g. Bowties) in Gold & Silver. On the short side, I wouldn’t get too aggressive just yet but if you like a setup in areas that appear to have already rolled over, then take it. It’s too early to go crazy bearish. And, again, you certainly don’t want to attempt to short any of the stronger areas. We don’t have to predict the markets. We just have to follow. Waiting for entries can help keep you out of new trouble. It could be an ebb and flow situation where the market adjusts out portfolio for us. For instance, we recently got triggers (entries) in Gold. And, that obviously did okay yesterday. We have a short or two leftover so that might help. We’re looking to buy more Gold so on a rally, that might trigger. On a continued slide, we might get knocked out of some longs and our shorts might pay off. Letting the market make these decisions for us takes the pressure off. It’s simple. First, pick the best setups to begin with. Second, wait for entries. Third, once triggered, use a stop just in case you are wrong. Forth, if you’re right, take partial profits and ride the trend via a trailing stop. It really is this simple. Notice I used the word “simple” and not easy.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....