Unhappy Endings

Dealing With The Fact That ALL Trend Trades End Badly

Random Thoughts

By Dave Landry

All trend trades eventually end badly-even excellent ones. Living with this is tough, but it comes with the territory. We must embrace, accept, and then willfully pursue the next soon-to-be-awesome trade with no loss in enthusiasm (my second favorite "asm" btw, my first? sarcasm!). Unfortunately, that next trade will eventually end badly too. Let's explore the psychology of "unhappy endings" and what we can do about them further.

Open Profit Drawdowns And House Selling-Good Problems

We sold our house, and the buyers were able to close several weeks early. This was a good problem to have, but a problem nonetheless. My wife Marcy and I have been scrambling to pack & move, toss, or donate 20-something years of stuff-which included a car that I've been working on for just 12-years (and every other hobby from "hobby boy" over the last 30-something years-see something you want? let me know!). We also had to deal with a few repairs in our "spare time." Marcy sensed-through overhearing F-bombs and my cantankerous nature-that my trading was adding stress to our already stressful situation. To my chagrin, she began to spout some Dave Landry teachings to me: "You know, you tell your people not to trade around major life events." Arrrg! And, admittedly, I was trying to force a few things to happen to cover all these new expenses. However, my main frustration was the big drawdowns to open profits in existing trades that have been on for weeks and even months.

All Trend Trades Eventually End Badly

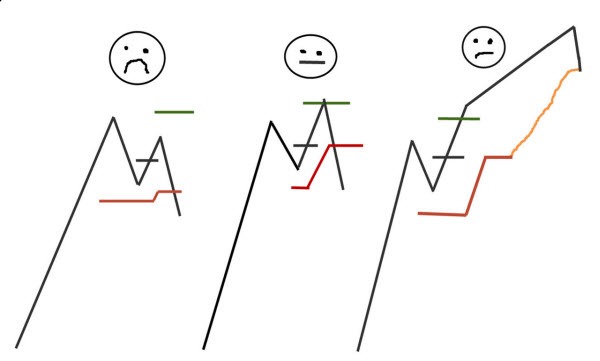

As I often preach, trading is like buying a pet, “it’s going to end badly.” (Carlin) ALL trend trades eventually end badly. And, by the way, the only way to make money on a trade is to capture a trend! Anyway, either you’re going to get stopped out at a flat out loss, or you’re going to give up some open profits along the way.

Even fantastic trend trades end badly. If you're using an ever widening trailing stop like a good little trend follower1, one of the corrections along the way will turn into a bona fide reversal.

So, Knowing The Above, Why Was I Upset?

Well, first, I'm still human! As I preach, your trading will spill over into your life, and your life will spill over into your trading. So, there was some stress working back and forth. Further, a loss, even though it was on gains, is still a loss. Also, there's a little neurology at work here. A loss has twice the emotion as a gain. Even though six out of seven of my positions have hit the initial profit target and I was in longer-term trend following mode, seeing some profits evaporate still registers quite high on the F-bomb scale. This is especially true given all my new expenses and stress of getting out of bed (and then having to move that bed!).

Everything that was happening was perfectly normal, and I'd be thrilled if my portfolio always looked this good! Trust me; often it does not! Also, I'm not immune to the unhappy ending effect.

Here's The Video Format Inspired By This Column (from Dave Landry's The Week In Charts)

We Tend To Let The Ending Define Our Experience

In Dollars and Sense: How We Misthink Money and How To Spend Smarter, Dan Ariely and Jeff Kreisler, the authors describe how things end tend to define the entire experience. They give examples of great vacations being defined by mediocre endings and vice versa.

I get it. Never say never, but I'll probably never go on another cruise. At the time, we had lots of fun, met some cool people, the food was pretty good, and we had a blast in Mexico. When we got back, we were presented with our bar tab--I guess it slipped our minds after a few cocktails that drinks were not part of the "all inclusive." We then begin to think back. The food really wasn't that good, the boat was a little rocky. And, by accident we got separated from our ladies in Mexico-they ended up in a separate car. Maybe I've watched Taken too much, but in hindsight, I guess it was a little scary. Also, our new friends weren't really that cool. We reached out to them afterward and they would have nothing to do with us! Judging by the amount of alcohol they drank, maybe they sobered up and realized that we weren't that cool either!

The end of a trade, like a colonoscopy, is a pain in the arse. Ariely and Kreisler, referencing the work of Kahneman (and others), discussed the colonoscopy experiment. To summarize, those patients who had the extended procedure with the less painful ending, tended to view the whole experience as better, even though the procedure took longer than the standard one.

Open Profit Losses Are Perfectly Normal

According to Curtis Faith2, Richard Dennis treated the Turtles' drawdowns to open profits differently. He wasn't concerned with them because they came with the territory. Like death, taxes, and in more recent times, kale, you can't avoid it! If you're trend following, then you're going to have to give up some profits along the way. It reminds me of a presentation given by Mike Moody to the American Association Of Professional Technical Analysts a few years back. Mike was giving an excellent speech on relative strength. I raised my hand and said, "Mike, my experience with momentum and relative strength is that it always ends badly. And, if I could cure for that, you'd never see my fat ass again! Thoughts?" In a calm, soothing voice, Mike said, "Daaave, if you're going to have a baby, you're going to have a lot of baby poop. Baby's are neat and cool, but you're going to have a lot of baby poop." Even still, I think trading momentum is the only path to wearing gold plated diapers.

Emotional Accounting

Mentally monetizing trades can often temp you to micromanage yourself out of perfectly good trades. Equating the profits to a credit card payoff, a mortgage/rent payment, or something much more fun can put you into a lose-lose situation. If you lock in the profits, the market will continue without you. And, if you don't, the market will promptly reverse to spark those "shouldas" and "couldas."

Resisting the tantalizing call of mentally monetizing is tough. Since the emotions run high, mentally monetizing can better be described as "emotional accounting3."

How do we overcome?

It's cliche to say just plan your trade and trade your plan. However, it's just that. Ask yourself, are open drawdowns normal? Am I following my plan by sticking with the trade even though I'm not stopped out? If yes, then find something else to worry about. And, if you're still mad, go have no fun somewhere else! (I'm half kidding)

Learn To Think In Terms Of The Net-Net

If you planed the traded, traded the plan, stopped out, and made money, then congratulations! You have the makings of a successful trader! Feel good about what you made-not bad about what you gave up in the end. Look at the net net-where you bought (or shorted) and where you sold (or covered). People often bitch about the profits they gave up at the end of my recommended trades. I tell them that if the troublesome cash is bothering them, then keep enough out for a massage and send the rest to me. That way, you'll center yourself, and it'll be like it never happened! Not once, in my 20-something years of public commentary, has a frustrated-from-profits check showed up in my mailbox. Just in case though, you can send it here: Sentive Trading, LLC c/o Dave Landry, P.O. Box 298, Abita Springs, LA 70420.

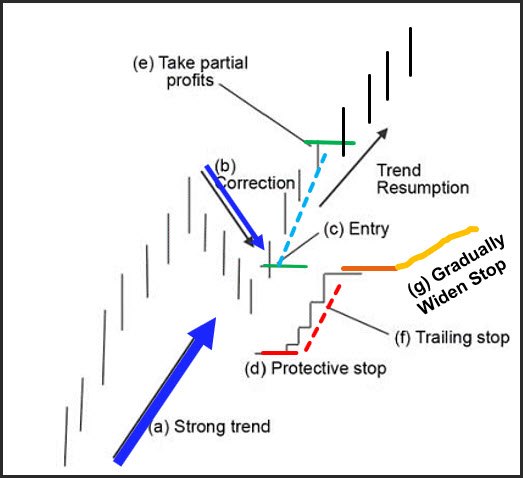

Take Partial Profits Along The Way

When everything is going swimmingly, I get emails asking me why do we bother taking partial profits? Wouldn't we make far much more just holding onto the whole position? Yes, you would, unless the position reverses after just a swing trade to stop you out of the full position-which statistically, does happen quite often. In these cases, taking half puts some money in your pocket (vs. nothing!). You're not going to get rich when this happens, but at least you make something to help keep the lights on. And, annualized-I know, there's a danger when you have "fun with statistics"-a short-term gain can be quite impressive! Taking partial profits also reduces your drawdown steepness for when, not if!, positions begin to turn. There's a beautiful ebb and flow with scaling and trailing. It reminds me of my buddy Greg Morris' saying "dancing with the trend."

Don't Hedge

Source: Wikipedia; Original Source: Baseball Digest

As the great Yogi once said, "In theory, theory and practice are the same. In practice, they are not. Well, hedging is one of those "in theory" things. It looks great on paper! However, if you hedge properly-which isn't very easy btw-then your hedge makes money when your positions go against you. Yaaah! Unfortunately, your hedge loses money when the positions move in your favor. Boo! Further, they'll have to be reset both in time and price which cost money. Without digging myself too much further into the complex hedging hole, just realize that longer-term, hedges are a drain on a portfolio.

One more point here: You're a person of action and motivated. That's great for life but not so much in trading. This propensity might tempt you to try to do something to stop the bleeding. And, yes, I've been that and got that T-shirt too-piling into 3x inverse shares or buying put options to stop the carnage.

Emotionally Account To The Stop

If you do feel yourself "emotionally accounting," (and let's face it we ALL do!) then "account" to the stop. For instance, let's say you're that up $2,000 on the trade. If stopped, you'll make $1,500 on the trade (baring overnight gaps, of course). Therefore, emotionally account for a $1,500 gain.

What Would Ron Popeil Do?

Source: http://www.ronpopeil.com/

Like Ron Popeil's Showtime Rotisserie 4000, can you just "set it and forget it?" Well, the quick answer is yes. If after allowing the stock to open and the stock is a ways away from where your mental stop is (i.e., no discretion is required), then place a hard stop and move on. Watching the screen instead will lead to the Siren call of an unnecessary trade which I can all but guarantee! Or, at the least, it will more-than-likely put you into a state of regret.

In Summary

Accept the fact that all trend trades eventually end badly. And, since the only way to make money on a trade is to capture a trend, this is what we signed up for. Take partial profits along the way to reduce the severity of the "bad ending." Don't try to hedge. Make fewer observations and if you ever find yourself emotionally accounting, then account to the stop. If the unhappy ending results in more money post-trade than pre-trade, then thank the trading gods and shout next!

May the trend be with you!

Dave Landry

Notes and References

1. See the money management course under the Member's area.

2. The Way Of The Turtle-See Books to read.

3. Dollars and Sense: How We Misthink Money And How To Spend Smarter, Dan Ariely and Jeff Kreisler