If you haven't read the first ten 2022 resolutions, click here before continuing.

11. I will seek excitement and entertainment outside of the market.

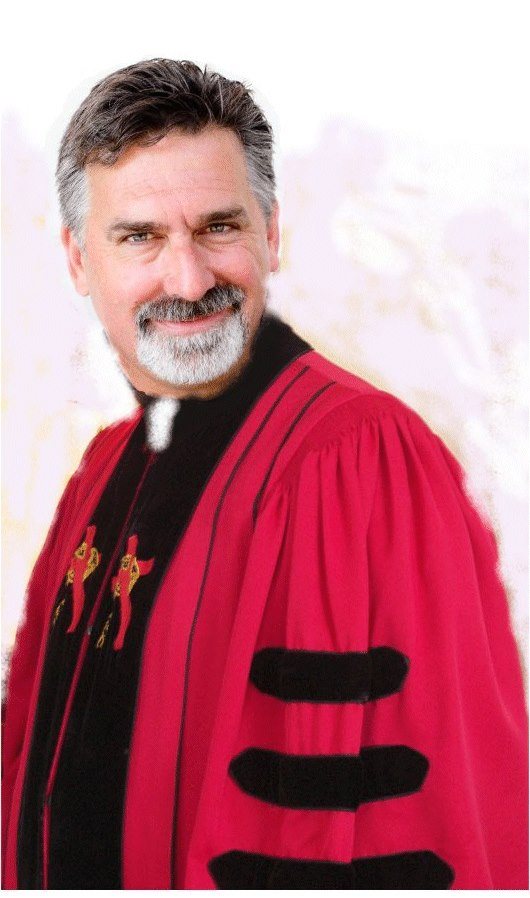

If you’re looking for action, the market is a very expensive place to look. As I preach, have an affair instead. That way, you only lose half of your money. All kidding aside, find something to do other than staring at a quote screen. I keep myself crazy busy. I’m often here before the sun comes up and long after it goes down. That doesn’t mean that I'm sitting here staring at a screen. I'm writing/working on content, answering emails, doing research/analysis, giving webinars, or planning the next leg of my Big Dave's Trend Following Moron World Tour. The more that you stare at a quote screen, the more likely that you’re going to put yourself into a “state of regret.” And, further, the more likely you will be to take unnecessary action. “Be as close to the market as you need to be but no closer.”

As I preach, busy traders make good traders. A client of mine who has had his struggles with trading told me that his trading has “gotten a lot better.” Did he discover some Holy Grail? Nope. One of his doctors quit, and he had to pick up her shift at the hospital. He no longer has time to deal with mediocrity in the markets. He has no choice but to only take the best and leave the rest. He also doesn't have time to micromanage himself out of perfectly good trades.

12. I Will Accept What The Market's Willing To Give.

I have the privilege of working with great doctors, engineers, entrepreneurs, and even a well-known dog trainer. These people are very successful, and their intelligence humbles me. I might not know you (yet?), but I’m willing to bet that you’re smart. How do I know? Trading attracts some of the brightest minds out there. Unfortunately, the same people who are attracted to trading often make the worst traders. One reason is control. You didn’t become successful in life without a high degree of control, yet in trading, you have none.

You’re either going to win, lose, or draw on a trade. You can’t control the outcome, but you can control yourself. Pick the best, leave the rest, and then let the chips fall where they may. The so-called serenity prayer comes to mind.

One more point here: Remember, all trades will eventually end badly. You flat out lose, you make a little then get stopped, or you make a lot but then give up a sizable portion of the profits in the end. Knowing ahead of time that there’s going to be some pain in ANY trade makes it a lot easier when, not if, it occurs.

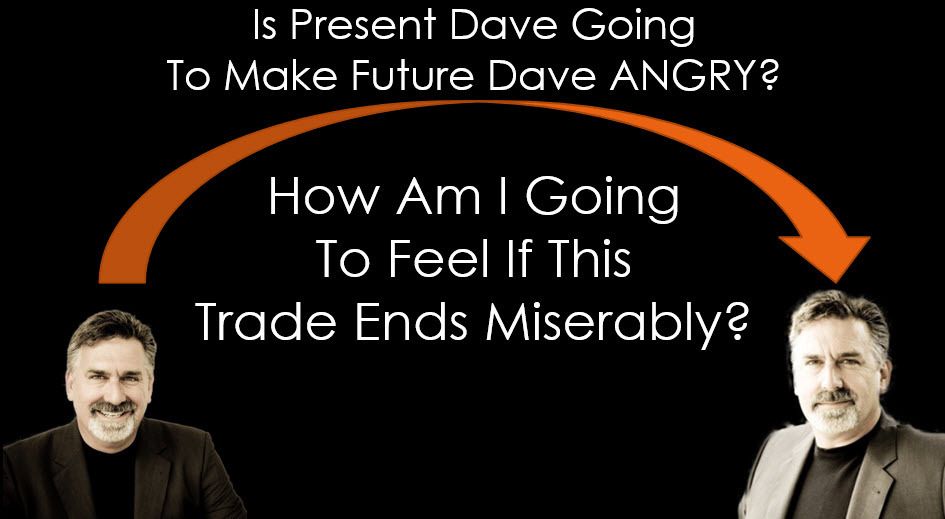

13. I will do an honest pre-mortem on every trade.

The main reason that trading can be so difficult is because often it's not like real life. For the most part, you'll have to go against human nature to be successful. This has been fodder for many presentations. However, there is one aspect where trading is just like life. Trading, like life, involves making decisions and living with them.

Making decisions is easy. Living with them is NOT!

You'll never avoid all regrets when it comes to trading. However, if you do a serious check of your emotions going into a trade, you'll have less regrets when all is said and done.

You must ask yourself if your current self is going to make your future self angry. Is this really a fantastic setup? If you don't take it, are you going to make your future self angry if it takes off without you? And, more importantly, if it fails miserably, other than dropping an F-bomb, could your live with yourself knowing that that eventually such great setups will really pay off? Conversely, if through your "time travel" you feel like you'd be mad at your current self for taking the mediocre-at-best-trade, then don't take it!

14. I will do an honest post-mortem on every trade.

YOU MUST do a brutally honest post mortem (not to be confused with Post Malone) on each and every trade. Years ago, one of my big epiphanies was finding myself saying, “What in the hell was I thinking!?!” when looking at trades of the past. The stock (or other market) was choppy, and there was no obvious discernible pattern. Regardless of the outcome*, go back to day one and ask yourself, was there an obvious or emerging trend? Was there overhead supply? And, were there all of the other things that I said to look for/avoid in the 14-hours of my Stock Selection Course. If you can't afford the course, make sure you at least watch the 1-hour video on that page. Many of the things to avoid are outlined there.

*Note: Good trades can have bad outcomes and bad trades can have good outcomes. If you figure out how to separate luck from skill, write me a letter! This leads us to our next point.

15. I will reward myself for following the proper process regardless of the outcome

“Outcomes are noisy.” (O'dean) You can do everything exactly right and still lose money. Conversely, you can wing it and often do quite well. Warning, dead horse beating follows: The market is often a bad teacher. Yes, you might have a string of success shooting from the hip, but longer-term, the only way that you’ll be successful is to follow the process.

16. I will hold myself accountable.

I have a very smart client that has an excellent grasp of the trading process. His stock selection is very good, and he “gets” my swing-to-intermediate-term hybrid approach to money management. He has periods of great success but then begins to abandon the plan through a host of bad behaviors. You name ‘em: taking less-than-ideal setups, trading “big-picture ideas,” etc… I asked him, would you be willing to get your wife involved with your trading to help you from deviating from the plan? "Oh no," he replied, “that would end our marriage.”

Okay, maybe your spouse isn’t the best person to get involved with your trading.* Do find someone willing to give you the tough love that you might need. I’ll be happy to help here (if you're following my trading service or a Gold Member in the Facebook Group). And, if you don’t want to get anyone else involved, just make sure that you at least hold yourself accountable. Because so many are “looking over my shoulder,” my accountability is that I must make sure (again) that I leave no stone unturned when it comes to looking for opportunities. This is especially true since many of my clients are good stock pickers. Every night I stress that a client might find something that I didn't, so I make sure that doesn't happen. Once opportunities are found, I know that I must stick to the plan. Yes, I’m human and tempted to micromanage and a host of other bad behaviors, but I know that I must stay true to form.. My educational business makes me a better trader because it forces me to practice what I preach.

*Although there was a study (by Montier) that showed performance improved for men who got their wives involved with their trading. Unfortunately, the trading worsened for the wives who got their husbands involved. I wrote about this and holding yourself accountable here.

17. I Will Embrace My Emotions.

I purposely used the word "embrace" and not "eliminate" because it has been proven that you can’t function properly as a human being without emotions (Damasio, Shull). Every decision, even what you are going to have for lunch, comes with some emotions and stress. To wrap your head around this, become cognizant of your emotions in both life and trading. Also, reduce the number of unnecessary decisions that you make by simply following the plan. Remember, less decisions, less stress.

18. I Will Keep A Journal of my Actions AND MY Feelings

By Source, Fair use, https://en.wikipedia.org/w/index.php?curid=23609342

Obviously, it's important to keep track of your trades (although nowadays, brokerages will do a great job of that for you). It's also vitally important that you keep a journal of your emotions. Note: This is the journal that I resolved to use in 2019. Why are you taking this trade? Was it something carefully planned ahead of time, or is it something that you're doing on the fly? How's your life going? As I preach, your life will spill over into your trading and your trading will spill over into your life. I can attest to this here. For some of the reasons previously mentioned (I don't want to be a Debbie Downer, let's just say I visited the funeral home twice, and three out of four of my family members spent time in the ER), 2018 presented its challenges to me on a personal level. I was glad to see it go! Even the positives 2018-19: we began the process of building a new house-created unnecessary trading temptations. It seemed that nearly every time I'd walk over from my office to visit my wife, she'd inform me of a new expense-e.g. the latest: an extra $4k for beams (which was somehow left out of the original bid). When I returned to my office, I found myself trying to make something happen to cover the latest expense.

Source: Amazon.com

LR Thomas

"Don't expect trading to fill a hole in your life that's missing"

In December of 2018, Charles Kirk had me as his guest of honor for his retreat in St. Lucia. One thing that came up was what to do with temptations that are outside of your normal methodology. For instance, day trading if you're normally a position trader, option trading if that's not your normal forte, etc. As I've said before, if you do feel such temptations, put aside a small portion of your account and do just that. Some of you have pointed out that this could be a little dangerous-I hear ya: you can't get a little bit pregnant. However, I think if you're going to do it anyway, then do it with a small portion of your account and do what you normally do with the vast majority. Anyway, Charlie discussed the same thing but took it one step further. He pointed out that at the end of the year, you should carefully analyze what you did (in a separate account!) outside of the norm to see if it all was really worthwhile.

At the aforementioned retreat, one of the attendees, Casey, suggested something quite brilliant. Keep a "confession journal" on your desk. When you do find yourself caught in the Siren call of doing something that you shouldn't-and believe me, if you've been trading for a little while, you KNOW what that is!- document it! So, in addition to your Emotional Journal, keep a Confession Journal too.

19. I will "believe in what I see and not in what I believe."

I've been developing a massive course in trading psychology on and off for years. As part of this project, I took a personality test. I scored a 0 in agreeableness. That explains a lot. Now I know why I get so frustrated when the market doesn't do what I think it should. This was an epiphany for me.

It's hard to work hard and not get the expected outcome. That's often trading. As I preach, unless you're Bill Clinton, what is, IS. There might not be any good reason why a market is headed higher or lower, but it is.

20. I Will Take A Kaizen Approach To My Trading-To Train And Trick My Brain

If you want to make a big change in your life, make a small change. As I wrote in this Random Thoughts column, your body will resist big changes. My pudgy friends make for a great example. They go on their tri-annual fad diets and do quite well for a few weeks until their body finally has enough. They fall back into their old habits, or worse. They then rinse and repeat.

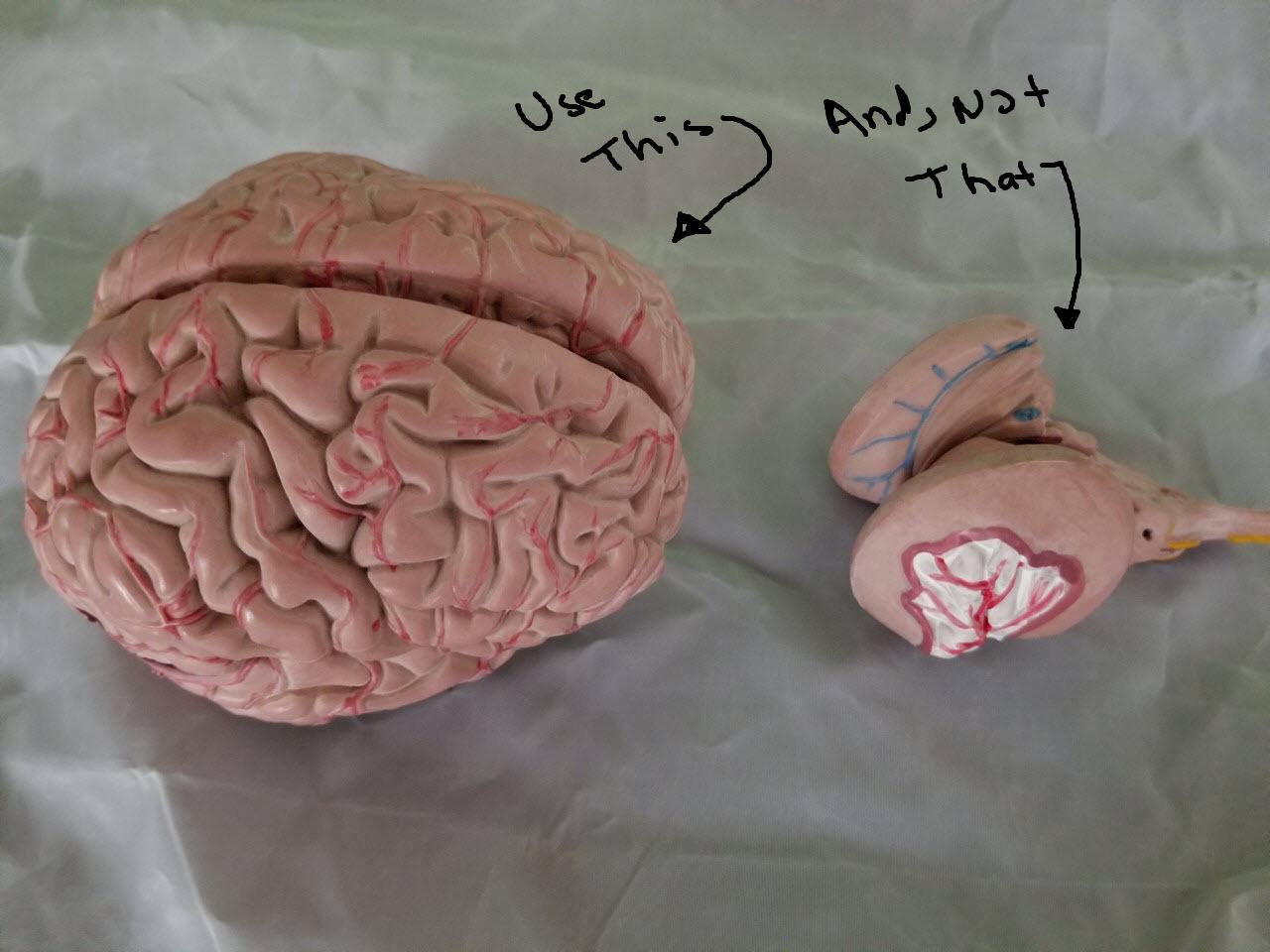

Your brain will resist big changes in life and in trading. You must take a Kaizen approach-make little changes to "tiptoe past the panic monster." I don't want to go all-freshman neurology on you, but if you can just take a few seconds to breathe before making that next trade, you'll be able to bypass the more primal emotional part of your brain to get to the rest of what's sloshing around up there. Don't trade with your "little brain."

What small changes can you make to vastly improve your trading? I'll go first. On my intra-day trading, I tend to get caught up looking at the "flickering ticks" of the 15-minute bars (which, BTW, used to be MUCH worse when I was looking at the 5-minute bars!). Before placing any trade, I make sure to look at the daily chart to see the forest for the trees. Many times, what looks like the mother-of-all rallys (or sell offs) doesn't look like much more than a blip on the daily charts (i.e., noise, narrow range "inside day" type trading). I also check the daily range to see where it is based on recent ranges (see my Trading Quick Clips for more on this). Sometimes, I feel compelled to jump into a market because it looks like it's taking off without me. I started forcing myself to use stop entries above the market. To my amazement, by using stop entries I've missed a ton of false moves. And, when the move really does take off, I'm in at a slightly higher price. Of course, I still occasionally buy the high tick, but not nearly as much as I used to. And, one more... I use to find myself firing off trades as soon as I walked into my office. I wasn't sure why I was doing this until I read about judges giving more lenient sentences after lunch (than before). Apparently, the judges were "hangry" before lunch and in a much better mood with a full belly. I realized that my as-soon-as I walk in the office trades that failed miserably were often just after breakfast or lunch. So now, when I return to the office, I write "W.I.TO." (or "walk in the office) followed by whatever I'm returning from. This forces me to think long and hard about the next potential trade. Do I want to trade because I feel good or is it the mother-of-all opportunities? I can go on and on, but you get the point. Make some small changes which will give yourself enough time to avoid the emotional part of your brain.

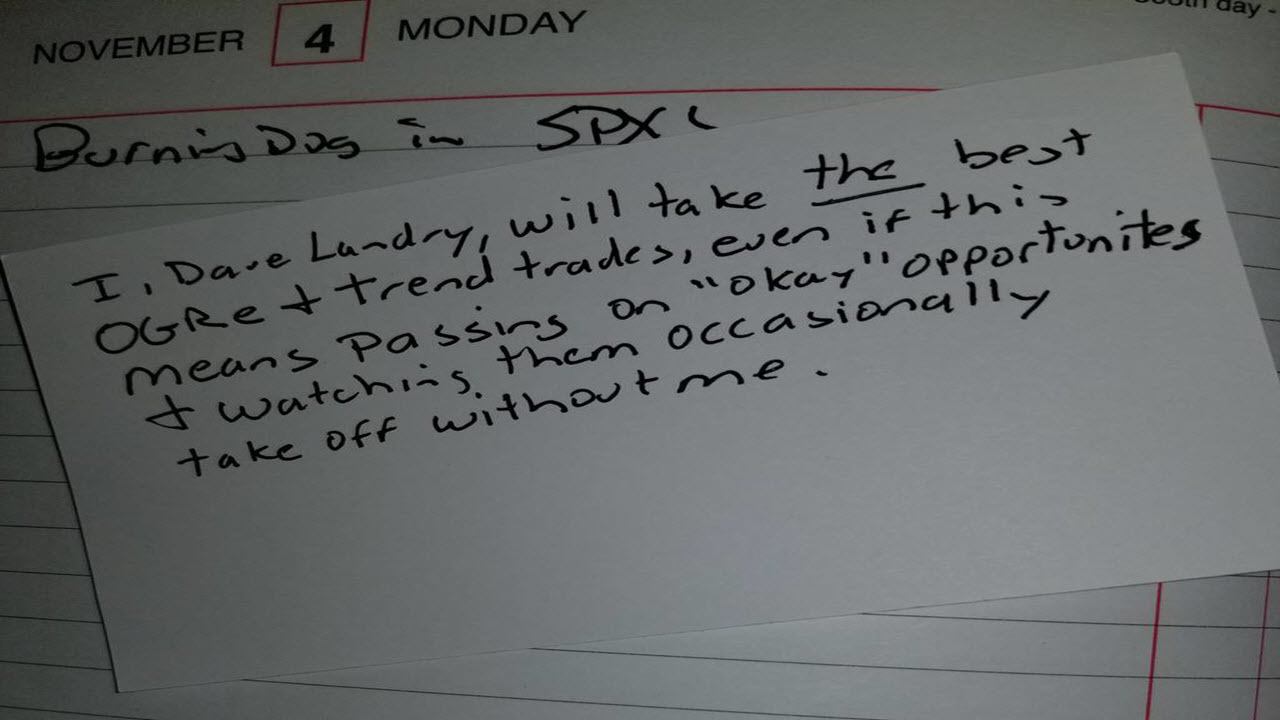

21. I Will Read My 3x5 Trading Card Before EACH AND EVERY TRADE!

One easy way for me to "tiptoe past the panic monster" is to read my 3x5 "bookmark" in my trader's journal before each and every trade. I might still do stupid and emotional things, but at least I get the whole brain involved with the decision.

22. I will print off this list and refer to it often in ’19 ;)

Seriously, as mentioned in the (free!) Getting Started Course, when you write something down and refer to it often, you're 10x more likely to do it! When I look back to prior personal goals, like reducing my girth, I notice that as long as I refer to my goals daily, I move in that direction. However, as soon as life gets in the way and those goals get buried on my desk, it becomes very easy to slide. Along these lines, this is why I have everyone in my Member's area set their trading goals. Then, each time they log in, they instantly know whether they are moving toward or away from their goals!

Below are my goals. Feel free to borrow them! On more than one occasion, I have been tempted to do the wrong thing. When I get that urge, I force myself to read my goals out loud.

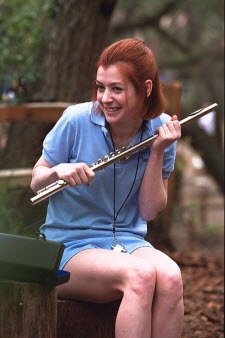

Source: IMDB.com

In addition to process goals like mine, goals can also be motivational in nature. Not to "last year at band camp" you, but last year in St. Lucia, I worked one-on-one with several traders. One of the "fixes" was for them to be cognizant of the trades outside of their normal trading. I told them to keep their longer-term goals in mind. For instance, some wanted to leave a legacy for their family. If they are trading outside of their wheelhouse or taking unnecessary trades, come back to the fact that that next trade is much bigger than you. That trade is taking away from their family's legacy-you're stealing from their future/your future self. So, review your goals and ask yourself if the next trade will help you move toward or away from your goal.

In Summary

So that's it! Aside from a minor tweak or two, the resolutions remain pretty much the same. Follow them, and I can all but guarantee a prosperous 2021!

After Thoughts

Whenever I do a column, I have the computer read it back to me to see if I come off pretentious or holier than thou. Believe me. I am not. This morning I woke up and started going through my 2019 Trading Journal. Here's a list of my sins:

I fired off unnecessary day trades.

I held PURE daytrades (e.g., Opening Gap Reversals) overnight.

I tried to force things to happen by trading mediocre setups. Said alternatively, I did not let the market come to me.

I bought some penny stocks.

I tried to "play both ends against the middle" (e.g., I ended up short stock and long calls).

I traded not because the opportunity was big, but the risk was small.

I forgot to check my own research and missed/got in late on some trades.

I ended up with a lot of correlated positions on OGRe trades (e.g., TVIX, SPXS, SOXS).

I took profits too soon on what would turn out to be the mother-of-all trend days.

I fat-fingered an order, ending up with 5X the intended position size.

I emotionally jumped in with market orders when a stop order, above the market, would not have triggered into the soon-to-be-a losing position.

I tried to make the market pay for things.

Here's what's humbling: I committed all of the above sins last January alone! As I skimmed the next few months, it appears that I did recognize that I was forcing things, and in my best Monty Python voice, "I got better." The epiphany for me here is that no matter how long you've been at this, you have to remain diligent. Bad habits are super easy to fall back into. Resolve to stick to your resolutions. Read them often to make sure that you're super cognizant of when you're breaking them.