Random Thoughts

by Dave Landry

Long story endless, last week, I was talking to a colleague, and she Googled me during our conversation. Since her results represented her browsing history, I decided to do the same in an "incognito" window (Who am I kidding? Now you know how I spend my Saturday nights!). I found the following republished (2006) from an article I wrote (likely long before 2006). I think it's just a relevant today. Below is the original text, followed by some random thoughts.

1. Trade in a conceptually correct manner

Trading because Mars lines up with Venus might work occasionally, but there is no real basis for trading in this manner. Patterns that you trade should make sense and have some sort of statistical edge.

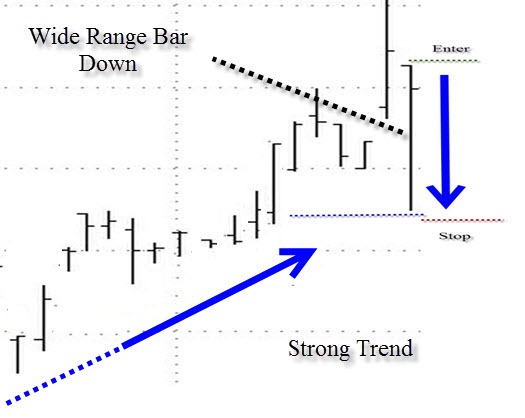

Random Thoughts: "Make sense" means that there is a psychological basis. Take the Trend Knockout (TKO), for instance. It helps to ensure that the "Johnny-come-latelies" are knocked out of the market, and some eager shorts are attracted. Should the trend resume and trigger an entry, there's a chance that you can take advantage of these trader's predicament--the shorts then rush to cover, and the Johnny-come-latelies get drawn back in.

2. Trade small

Any ONE trade should NOT have a material impact on your life. ANY one loss should be viewed as an “expense”—no different from what you do in any other business.

Random Thoughts: YouTube recommends a lot of get rich quick gurus to me. Last week, I couldn't resist the "clickbait" of a trader bragging that he had purchased $350,000 in SPY puts. So, if he is risking 2% (as per my money management system) on that trade, his account would have to be at least $17.5 million. Also, this position was put on before the mother-of-all rallies. So far, over half of this trade has evaporated.

3. Ignore the news

The news is irrelevant. It’s the reaction to the news that’s relevant.

Source: Facebook. Original Source: CNBC.

Random Thoughts: This one remains relevant. A report came out which said that 16 million Americans had lost their job in the last 3-weeks. Meanwhile, the Dow has its best week since 1938. As I preach, even if you get the news right-e.g., Brexit, Hillary, 16 million jobs lost, etc...-again, it's the reaction to the news that's relevant.

4. Forget about logic—Don’t worry about the “whys”

Stocks trade on emotions–period. There often is no logic as to why a stock rises or falls.

Random Thoughts: I'm seeing a lot of "theme" or "story" based investing now. Yes, logically, it makes a lot of sense. Which companies are making potential lifesaving drugs now, or toilet paper? What's logical often doesn't work. What you know, everyone likely knows. Technical analysis leads the way. Traders leave their footprints on the charts. For example, we now know that some people "in the know" sold stocks right before this whole mess got started. Sell signals (see my 2020 Bear Market Updates) reflected this and other selling.

If you have a setup that you really like-something that you've traded for years-and, there's also a story, fine. Take the setup!

5. Know YOUR Methodology

Each method will have its sweet spot.

Random Thoughts: Trend following works incredibly well until it doesn't. As discussed in the 04/09/20 Week In Charts, the easy part of this bear market might be over. We printed money on the first crack lower. Now, we are getting punished in the retrace rally. There's an old saying in the south: "The sun doesn't shine on the same dog's ass every day." I've seen some amazing things throughout my career-small accounts turned into large fortunes only to return to even smaller accounts. In two of these cases, I begged the traders to pay off their mortgage and sock some money away for income. That way, you have a place to live and some money for food. And, if you're such a good trader, take a small portion of your proceeds and do it again.

I'm not immune and certainly not holier than thou. Occasionally, I get a little too full of myself-which always happens right before I get my ass handed to me.

I once had a trader who told me that he followed me when I was hot and didn't when I was not. I asked him if he would tell me when "I'm not." He refused because that would "ruin his system." Since that day, especially when I'm getting whacked, I think, has something changed? Has volatility become insane (now) or dried up (summers)? Am I still "fighting the last war?" (i.e. has the trend turned).

6. Don’t deal in mediocrity

Pick the best and leave the rest.

Random Thoughts: We have a "time inconsistency" as human beings. We are tempted to do the wrong thing at the moment, even though it will likely be detrimental to us longer-term. In a word, Akrasia-a topic of many of my lectures. We feel the pressure to produce and confuse "intuition" with "into wishing" (Ed Sekoyta). There's also a deeper psychology involved with dealing in mediocrity. For years in article and webinars I asked: "Why do people with successful careers deal in mediocrity in the markets?" Then, one day, I got my answer:

“I think I can answer the question about why highly trained and skilled professionals can't seem to get the chart reading/trading thing. I am a physician who specializes in psychiatry. Doctors, lawyers, and mechanics are trained to take whatever train wreck comes along and fix it. We are expected to do something immediately regardless of the conditions and despite the possible negative outcomes of our action. As a physician if you dwell too much on the potential negative outcomes you will become a deer in the headlights and not be able to function so we tend to minimize the negative aspects of situations. Waiting for the ‘perfect pitch’ is not what we are trained to do. We have no training to prepare us for sitting on our hands and waiting…it is simply not part of the mindset.” Dr. J.

7. Do NOTHING unless there is something to do!

Your performance is based on the good trades less the bad trades. By avoiding the markets in less-than-ideal conditions, you’ll have fewer bad trades hence, better performance!

Random Thoughts: With #6 in mind, the more successful you are, the harder it is to do nothing. When I wait, and wait, and wait for great setups, I nearly always make money. On the flip side, when I try to force things to happen, I nearly always lose. The secret to trading is figuring out when not to trade. Write that down!

8. Stack the odds in your favor: Market/Sector/Stock

Your odds will greatly improve if you only trade when the market, sector, and stock are all trending in the same direction.

Random Thoughts: If all of the pieces don't fit, ask yourself: Self, do I have the mother-of-all setups? And, if you do, then take it! On anything less than an "F-yeah!," PASS!

9. Let things work

Results in trading are often skewed—most of the gains come from a few big winners. Therefore, it’s crucial to catch these occasional homeruns.

Random Thoughts: I'm not saying be obstinate and not honor your stop. If you're stopped, then you have to exit. My point is that you should not get bored with trades that aren't moving on your "microwave society" time frame as long as you're not stopped out. Many times I see people give up on trades right before they have the mother-of-all moves.

10. Money management

Trade small, use stops, take partial profits when offered, and trail stops.

Random Thoughts: Money management will cure a multitude of sins. If you are trading at a small size, then, psychologically, it's going to be much easier to follow your plan. If you're making big bets that can ruin your account and lifestyle, you're either going to exit at the first signs of adversity and miss a huge wining trade, or worse, hang on until you wipe out your account.

11. Money management

Trade small, use stops, take partial profits when offered, and trail stops.

12. Money management

Trade small, use stops, take partial profits when offered, and trail stops.

13. One To Grow On-The Battle Is Within.

When looking at charts, the plan of action is often quite obvious. Knowing what to do and doing it are worlds apart. Get to know yourself. The good news is often you'll know when you're doing the wrong thing, but do it anyway. This has been the topic of many of my blogs, articles (TRADERS Magazine), courses (member's area), and webinars (The Week In Charts).

May the trend be with you!

Dave Landry