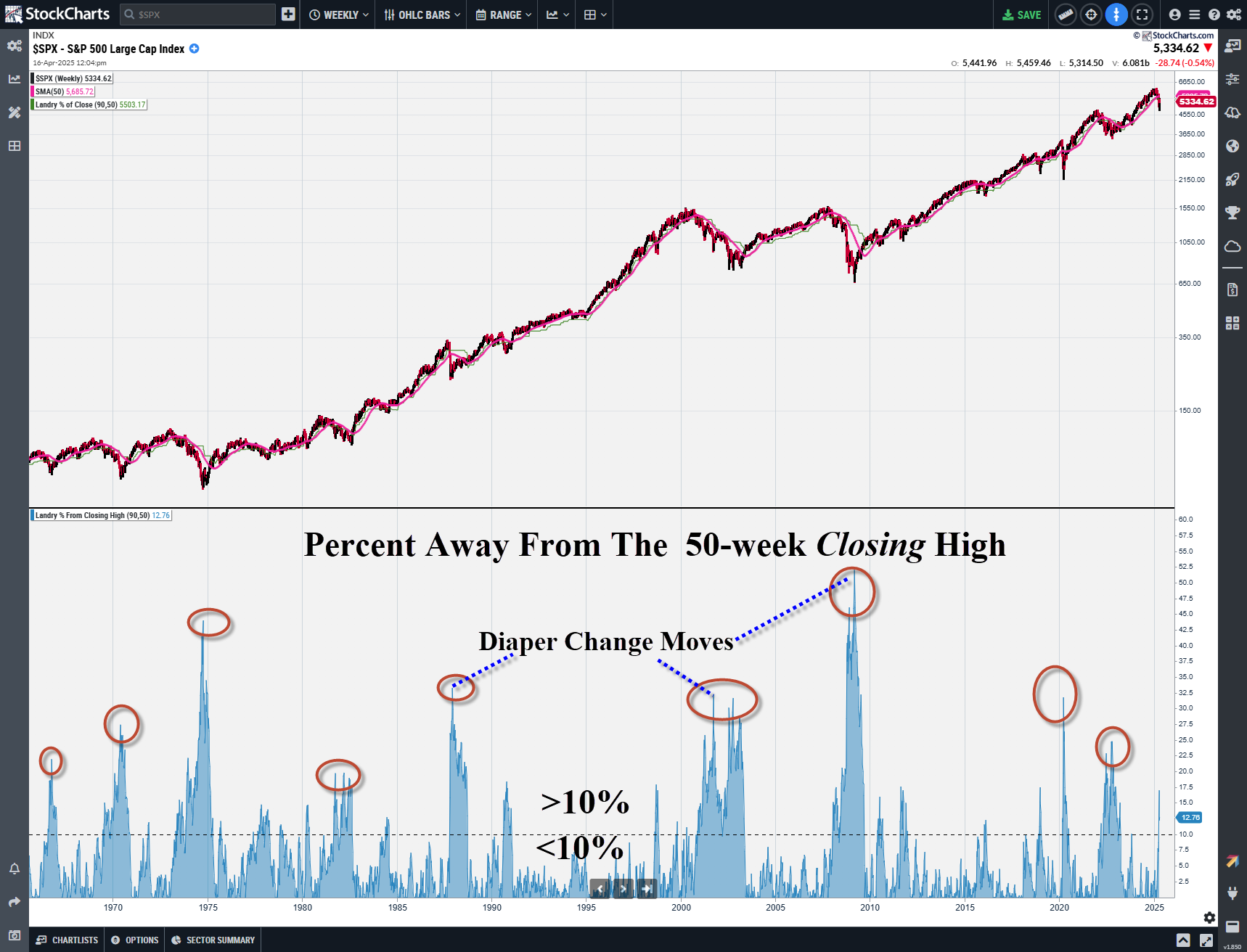

Designer's Intent: To Avoid Diaper Change Moments

The TFM 10% System is a simple market timing system for the S&P 500 (and potentially other indices). The "designer's intent" was to help avoid the occasional "diaper change moment.*" My thinking is that if the Ps are going to lose half or more of their value (as they occasionally do!), they're going to lose 10% first. Therefore, we need to think seriously about exiting when it drops 10% or more from its 50-week closing high.

Notice the number of diaper change moments (circled below). Decades ago, I was shocked at how often a market loses at least 50% of its value. And, BTW it's not just stocks. "All asset classes will lose at least half of their value at some point in your lifetime." Further, given the amount of leverage in the system and the speed at which information moves (related: What Keeps You Up At Night?), the frequency of these ugly moves will continue to increase.

Look no further than this chart for those who do not believe in the importance of market timing.

Reducing Whipsaw

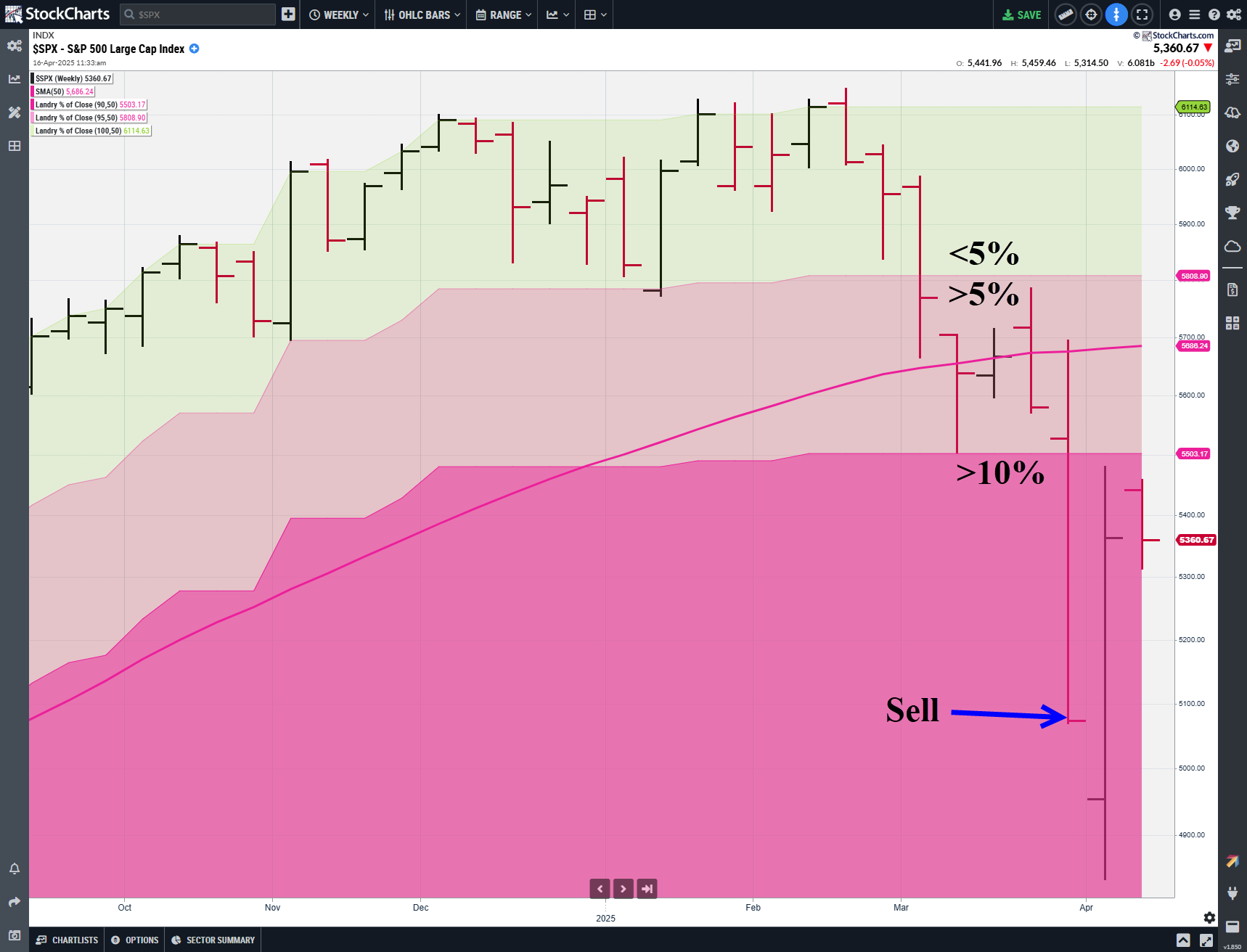

Since the market occasionally drops 10% and subsequently recovers, I added a whipsaw filter to reduce the number of "ins and outs."

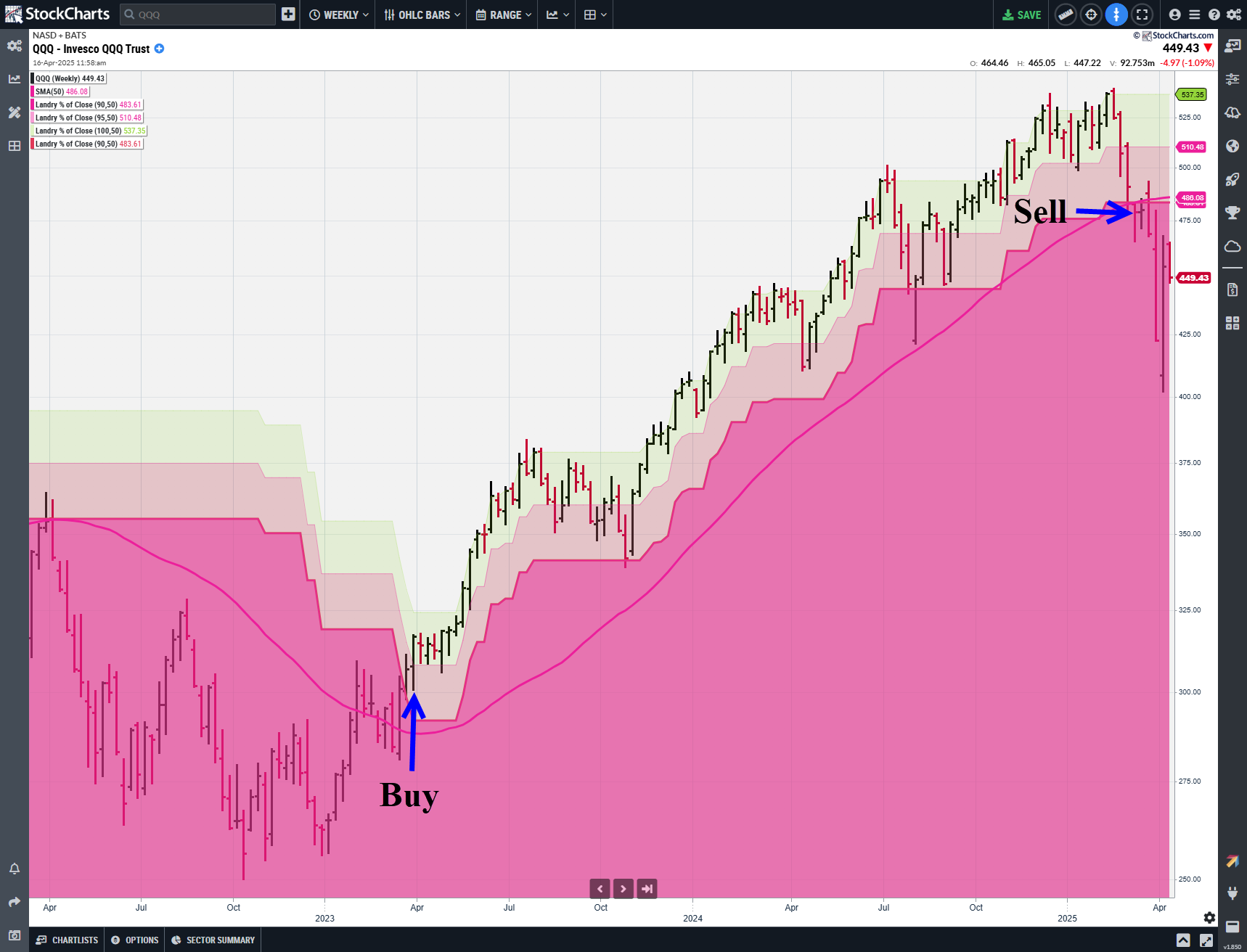

For buys, the weekly S&P 500 must have 2-bars of upside 50-week SMA Landry Light (lows > the 50-week) and be within 10% of the 50-week closing high. An example of this is shown below (coming out of the pandemic bear market). Notice that there are 2-bars of lows > 50-week moving average (Landry Light) and the close (3) is within 10% of the 50-week closing high (the green line on the chart).

Since they "slide faster than they glide," the rules for sells are less stringent: Exit the market when the S&P closes 10% or more below the 50-week closing high and is also below its 50-week moving average. The pandemic sell signal is shown below.

Jeff, a client, pointed out that he becomes very cautious when the market drops below more than 5% (from the 50-week closing high). This inspired me to add zones to the chart. Jeff's right! You should be cautious whenever the market has lost more than 5% of its value from the 50-week closing high. On the flip side, as long as it is within 5% of the 50-week closing high (the green zone), you can relax (I know ha ha!).

Notice the recent sell signal above. My intent was not to lose more than 10% on market exits. However, my original research was done (inadvertently) on a "calendar" chart (Friday to Friday). Therefore, since the sell signals can only trigger on Fridays, there's the chance that you could lose more than 10% intra-week. On the flip side, there will be times when the market recovers by Friday after a 10% dip during the week. There's always a trade-off in system development. You'll have worse losses when a market drops and stays well below 10%, but you're less likely to get whipsawed out. In this case, the loss was much worse than the designer's intent.

Why not exit intra-week? Well, I did contemplate that. However, I could hear Greg Morris' voice in my head: "The worst time to change a system is during the heat of battle." (paraphrasing)

Fortunately, in the Qs, a trade that I took, the exit was more inline with my intent.

By The Numbers

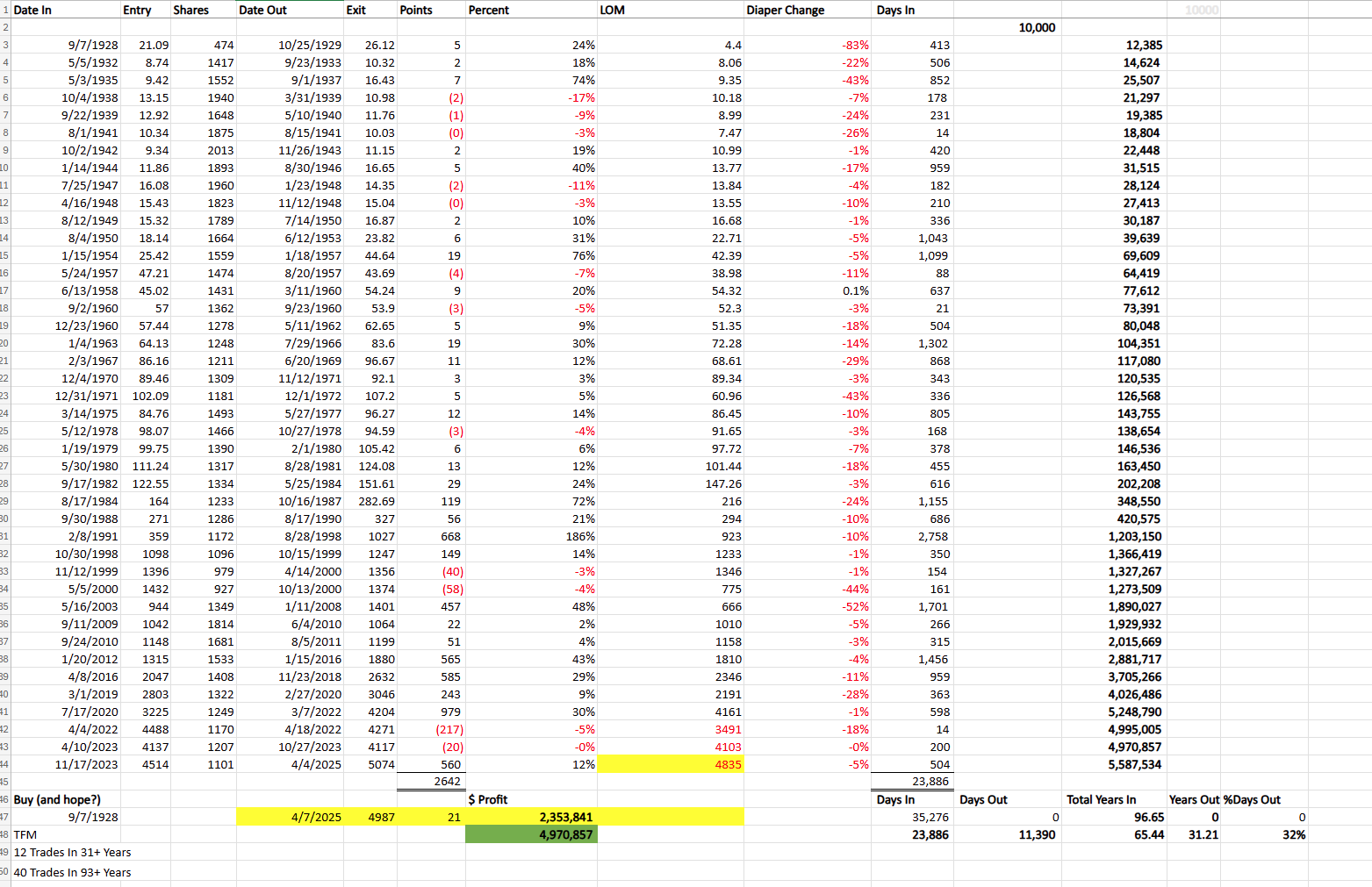

Below are the results starting with 10k going back over 100 years. Buy and hope (oops, I mean hold!) would have grown to over 2 million dollars. The TFM 10% would have grown to nearly 5 million dollars. Although the results aren't staggering, that's not the whole story. The TFM 10% would have kept you out of the market over a third of the time (30+ years), avoiding every bear market (and diaper change!). What makes a market timing system work is avoiding big bear market drawdowns. With every subsequent bear market-which, again, we could see more frequently-the results will become better and better.

Closing Thoughts

I can't guarantee much in this business, but I can guarantee that there will be future "diaper change moments." And, unfortunately, their frequency will likely increase. Therefore, market timing is crucial. It doesn't have to be (and should not be!) super complex. A simple system like the TFM 10% can help keep you out of trouble.

May the trend be with you!

Dave Landry

*"Diaper change" refers to when a market makes a sharp adverse move against you. I borrowed this term from Ian McActvity. RIP my brother from another mother!