I woke up with an epiphany on Thursday—why not show a bunch of charts in Dave Landry’s The Week In Charts. Before we get into that, I got ripped a new one not too long ago:

“You have been pounding the table the past month saying that the market is in a lot of trouble. Have you ever thought about picking another line of work?”

Yeah, I think about another line of work every time I get my ass handed to me, when I get stopped out to the tick and then watch the market take off without me, when the market is trendless, when I hit buy instead of sell, and, of course, when I wake up and find a turd like yours in my inbox.

I’ve given up trying to look smart many years ago and now just follow along. This has earned me the badge Trend Following Moron. Although initially offended, I’ve since taken that ball and ran with it. I’ve acquired the domain, put arrows on the back of my business cards, and it also inspired me to trademark Trading Simplified.

Gary Kaltbaum was one once kind enough to say that although I’m not right all the time-and will admit when I’m wrong—but I’m right over time. And, like the hokey pokey, that’s what trend following is all about—being right over time.

When the market is in a rip roaring trend, then it’s okay to be “all in.” With anything less you have to be from Missouri-“Show me.” My motto is “Primum non noncere”-First, do no harm. I think there’s nothing wrong with being prudent, especially given the nature of this market.

When the market was in a serious slide a few months ago, someone asked me where exactly I’d become bullish again. My answer was I dunno, I suppose if the market started making new highs and stayed there as a card carrying TFM, I’d have to start following along. The next question was “what about between ‘here’ (1900-ish in the S&P 500) to ‘there’ (2100)?” My answer was so what. Let everyone else fight it out. You have to have a framework in place. I use the word framework because exactly doesn’t really work in this business. You have to take a Justice Potter Stewart approach: “You’ll know it when you see it.” And, BTW, not that a magical switch will be flipped at 2100 but we’re still “not there yet.”

When the market was in a serious slide a few months ago, someone asked me where exactly I’d become bullish again. My answer was I dunno, I suppose if the market started making new highs and stayed there as a card carrying TFM, I’d have to start following along. The next question was “what about between ‘here’ (1900-ish in the S&P 500) to ‘there’ (2100)?” My answer was so what. Let everyone else fight it out. You have to have a framework in place. I use the word framework because exactly doesn’t really work in this business. You have to take a Justice Potter Stewart approach: “You’ll know it when you see it.” And, BTW, not that a magical switch will be flipped at 2100 but we’re still “not there yet.”

Vacation, the new one, not the old one. Warner Brothers

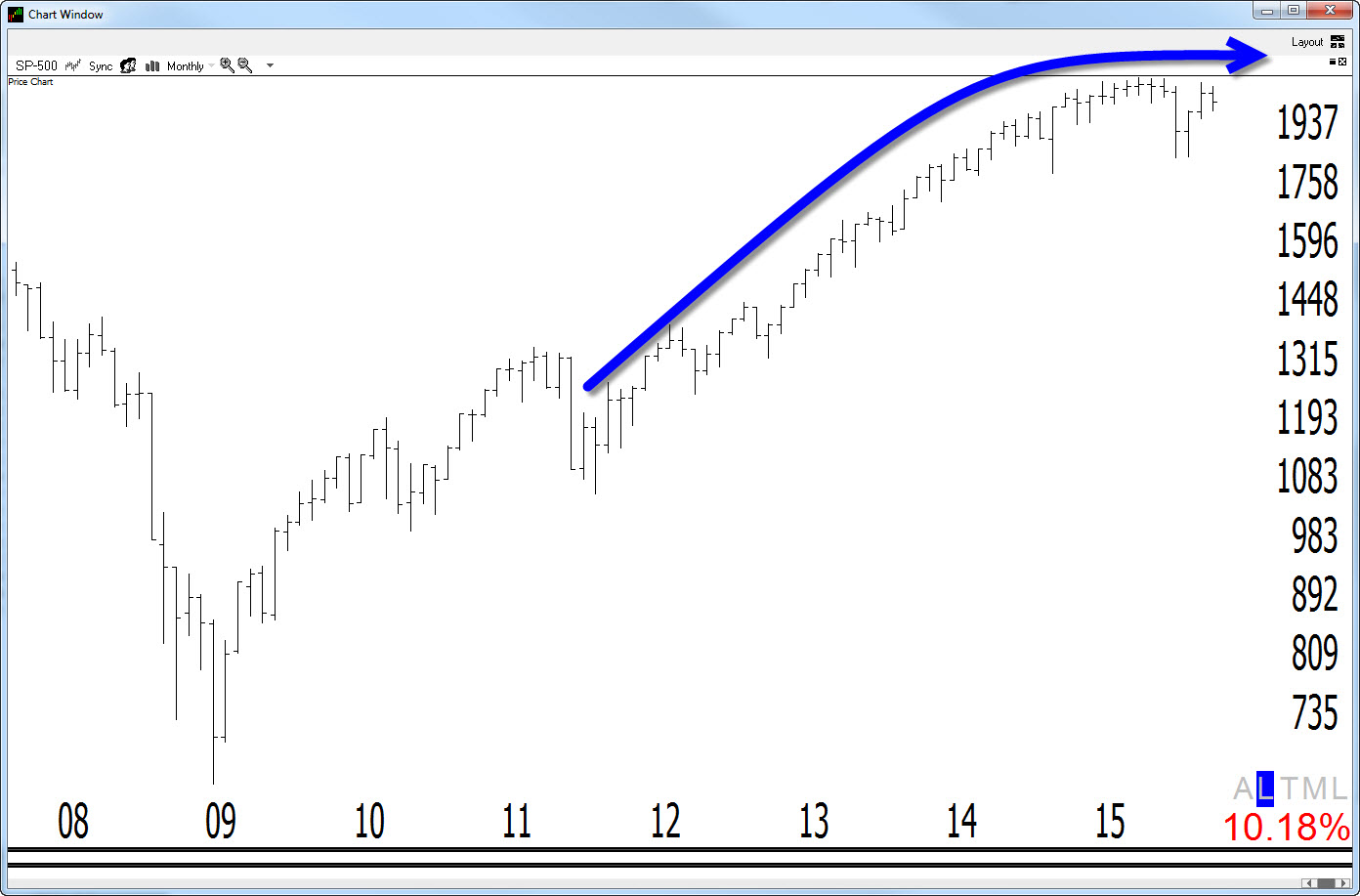

Hey Big Dave, I thought you were going to talk about charts. Oh yeah, in putting together the charts for the chart show, I was amazed at how some of the longer-term charts looked. Let’s take a look at the monthly Ps. You can argue that the great bull market since ’09 remains intact (and I hope it is!) but you certainly can’t deny that momentum has slowed. Count back about 12 bars (1-year) and you can see that the market sure hasn’t made much forward progress in quite a while. I’m hoping-I know hope in one hand and….-that this is just the mother-of-all consolidations but for now I have to believe in what I see and not what I want to would like to believe.

Redd Foxx as Fred Sanford, Source: Youtube, original source: NBC

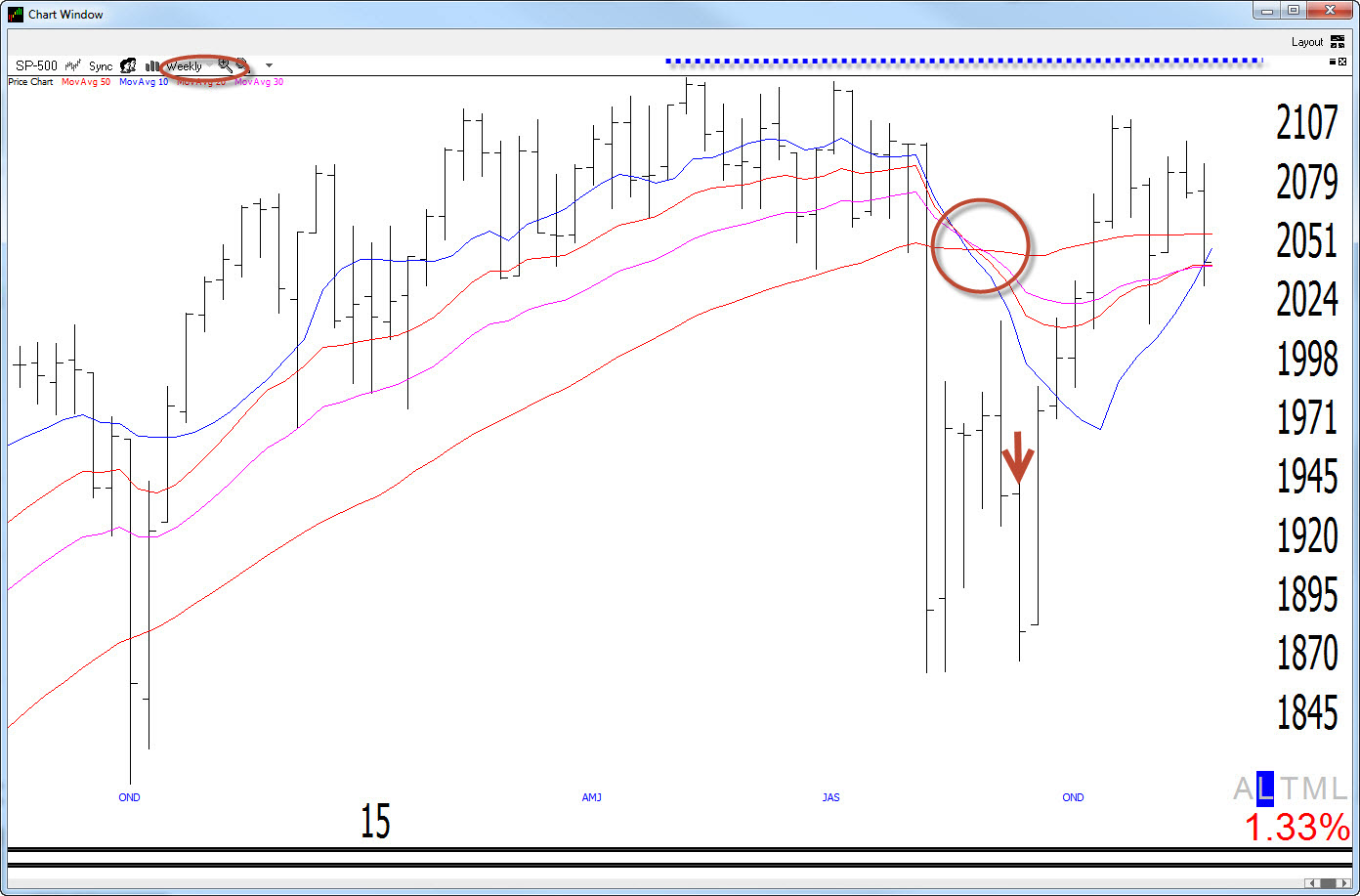

Backing up to the weekly, we see the Bowtie sell signal from all-time highs which triggered in late September. This was one of main reasons that I was so concerned about the market. Not every sell will turn into the mother-of-all tops but every top will have a Bowtie (or other emerging trend signal). Write that down. You’re welcome! This simple pattern has done a wonderful job of keeping you on the right side of the market for the last 20-30 years. Maybe it won’t work this time but as my good friend Greg Morris says, we treat all signals as if they will become the big one (Elizabeth implied).

When we get the daily we see that the so called and over hyped “Death Cross” is still in effect-the 50 simple moving average is still below the 200-day simple moving average. My point here (in Thursday’s show) was that you didn’t want to trade it mechanically but it-or any trend indicator for that matter-can help to keep you on the right side of the market. And, historically, the market has dropped as much as 50 and even 80% after signals. Ironically, when I was checking my inbox after the chart show I noticed that my good friend and fellow AAPTA member Ian Naismith had written about the Death Cross in his How I See It contribution to Pro Active Advisor magazine. He did a great job! He echoed my thoughts that you don’t want to trade the signals mechanically (although as Ian pointed out there is a slight edge) but they can keep you out of a lot of trouble. FWIW, here is my latest contribution to the magazine.

Everything works better with trend is my mantra. I’m proud of the fact that my weekly Bowtie signals (see free reports) have caught every major bull and bear market for the last 20-something years but something as simple as the slope of a 50-week moving average can also do a great job of keeping you on the right side of the market. Yes, the Death Cross has to be taken with a grain of salt but you don’t want to completely ignore any potential change in trend indicator-including the Big Blue Arrows.

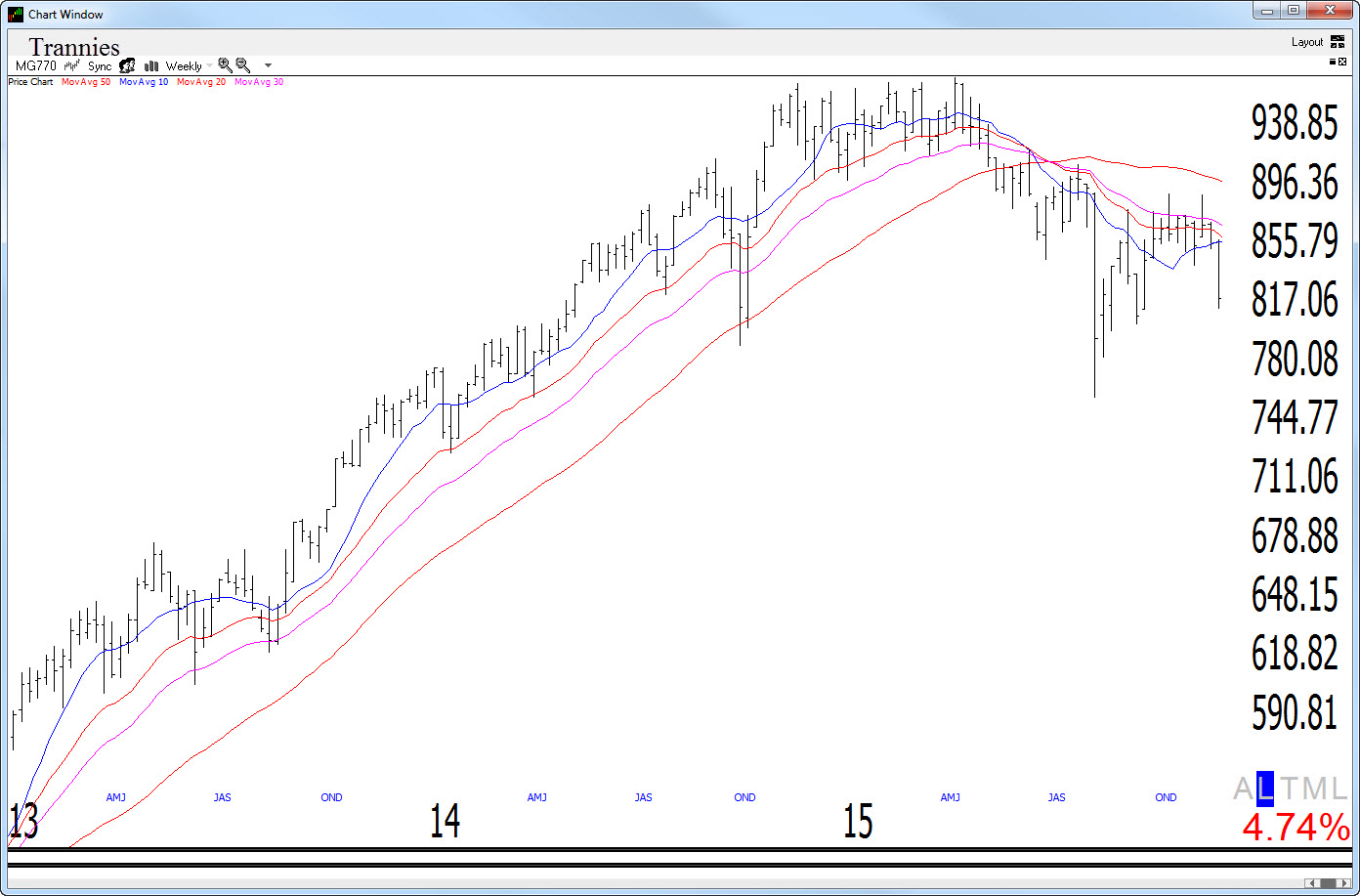

In the sectors, the action hasn’t been very impressive. Notice that the Trannies (BTW, I refuse to say Caitlyn, I prefer Bruce-Ann!), sure look like they are in a heap of trouble. Notice that they have sold off fairly hard since the last major weekly Bowtie signal.

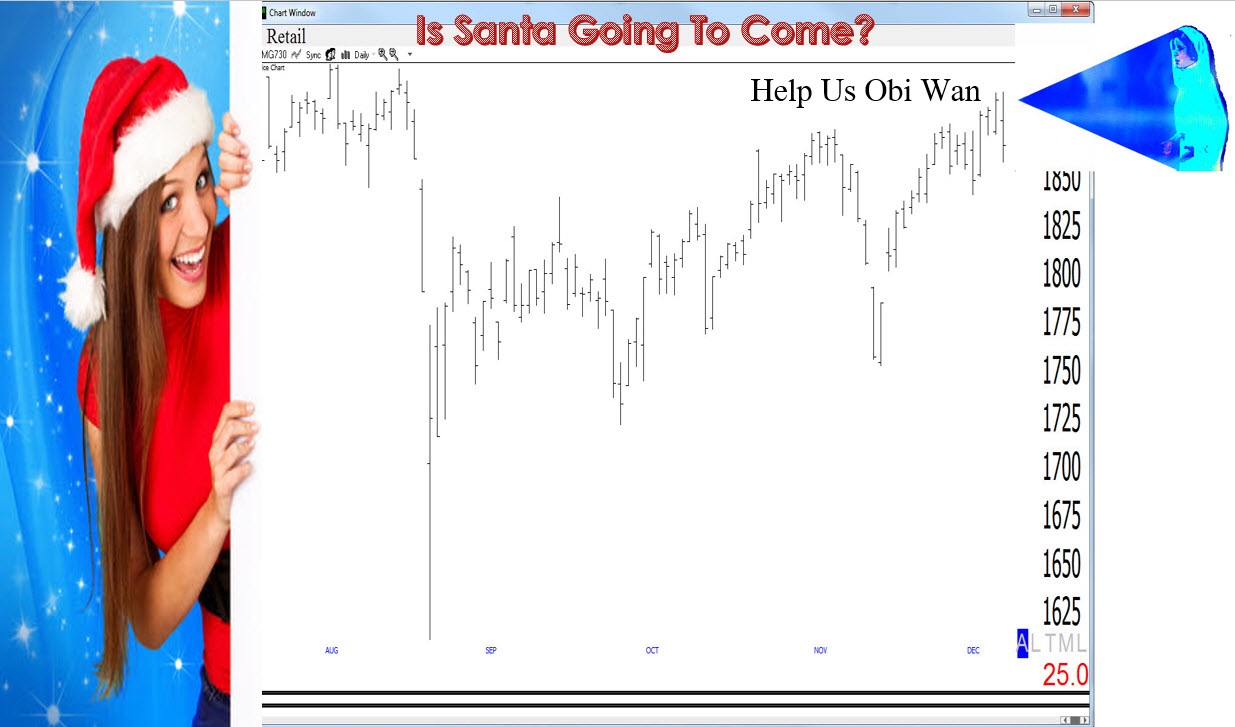

See Big Dave’s The Week In Charts for the action in many other sectors and the Rusty (IWM) and Quack (Nasdaq). I did want to emphasize what’s happening in Retail. Retail was about the only area that was waking up recently. It seemed like our Obi Wan-you’re our only hope! Could this be the start of the so called Santa Claus rally? Well, you know me, show me. And, so far, it has some right back in. So, is Santa coming? I wouldn’t get your hopes up just yet.

So What Do We Do?

I think being prudent in this market is key. I think it’s still in trouble. The database isn’t producing much right now and that’s probably good thing. I’d love to impress you with some dazzling recommendations but for now, I think I’m forced to sit on my hands. I might not be right this time but I’ll be right over time.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....