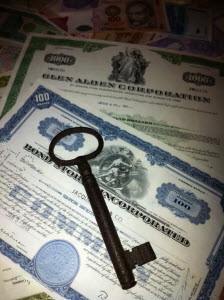

Still The Key To The Markets

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

The rally went back to the big caps on Thursday. The Dow, Ps, Quack, and Rusty gained ¾%, ½%, ¼%, and 0% respectively.

With the broad based Rusty (IWM) flat, internally things were a little mixed on an individual issue basis.

Overall though with the major indices near all-time or major highs, you certainly can’t complain.

Most sectors remain at or near new highs.

Even most of the weaker sectors have pockets of strength. For instance, Major Oils made multi-year highs even though the Energies which have been looking questionable as of late.

Ditto for metals. Steel & Iron closed at multi-year highs.

Speaking of Metals and Mining, Gold and Silver looks a little sold out in here. The stocks look like they might be in the process of bottoming. “Process” is the key word in that sentence. There’s no need to be a hero just yet but they might be worth watching—wait for signals such as a First Thrust or a Bow Tie. Along these lines, I’m keeping an eye on Uranium for a possible major bottom.

Overall, again, things are looking pretty good. 25 out of the 31 major sector groups that I follow are within 1% of multi-year highs.

So far, so good—the market continues to follow through. And, as I preach, follow through is key.

As I wrote yesterday, at this juncture, it’s important to watch on an individual sector basis to see if old trends die out while new ones emerge. Waiting for entries on new positions and honoring your stop on existing ones can often take you out of old trends and put you into new ones. Write that down. It’s profound.

So what do we do? I think the game plan remains essentially the same: When a market is making new highs, us pullback players don’t get much new action. If it follows through and pulls back, then we look to ride the next wave. In the meantime, honor your stops on existing positions. And, enjoy the ride-take partial profits as offered and trail your stops higher. Build your momentum list and pay attention to the sector action for new leaders.

Best of luck with your trading today!

Dave