The Key To The Markets

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

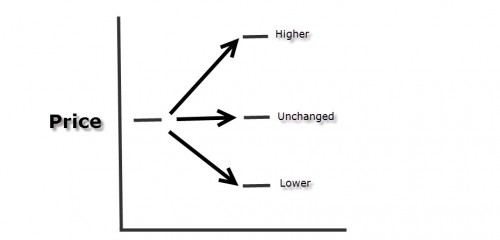

As trend followers, we need something to follow (duh implied). Follow through is key.

Unfortunately, on Tuesday we didn’t get any.

The S&P gave up most of Monday’s gains. This action has it sitting right at support-its prior breakout levels. Thanks to the “drop off” effect (Google it), the 50-day moving average is quickly catching up to the price, confirming this support area—see Monday’s Column for more on da fidy. Not much follow through intermediate-term here. Net Net, the Ps remain relatively unchanged since late October.

The Rusty ended off its worst levels but in the minus column nonetheless. It too hasn’t followed through much on a net net basis since October.

Although the Quack only ended down slightly, it also failed to follow through. Like the other indices, it hasn’t made much forward progress as of late. It remains just above minor support, circa 4,000. Somewhat major support would be 3,950 which is also its 50-day moving average.

The sector action confirms what’s happening in the indices. For the most part, they remain mixed (see recent columns for more details, or better yet check out my Trading Service for a lengthy up-to-date discussion).

Even if you didn’t know a thing about technical analysis, you could look at where a market is and where a market was.

Where is the market today? Where was it yesterday? Last Week? Last Month? And, so on….

Again, follow through is key.

So what do we do? With the market not following through, there’s not much to do. As mentioned ad nauseam, when the market is sideways make sure you really like a setup before looking to take new action. There’s not much out there but I am still seeing a few speculative longs setting up. These high volatility (or what some would call Beta) stocks can often trade contra to the overall market. For instance, one on the radar for Monday jumped 20% on Monday. I’ll walk you through this watchlist on Thursday in the chart show. Again, be super selective in your stock picking. Unless you think you have the mother-of-all opportunities, walk away and wait for follow through-that’s key.

Futures are firm pre-market.

Best of luck with your trading today!

Dave