Still A Game Of Clues

By Dave Landry | Daily Commentary , Random Thoughts

Random Thoughts

Random Thoughts

After all was said and done, a lot more was said than done on Monday. The indices ended in flatsville. The Ps did end up a smidge which is enough to keep them at all-time highs nonetheless-better than a poke in the eye I suppose.

I hate to read too much into a flat day. Essentially, it’s more of the same:

Most areas remain at or near new highs. See yesterday’s column for a lengthy list.

The Transports ended only slightly higher but that was enough to keep them at all-time highs.

Foreign shares (EFA) were flat. They still remain in a solid uptrend.

All wasn’t great in the world though. There was still a debacle de jour or two. SOHU was one of the latest victims.

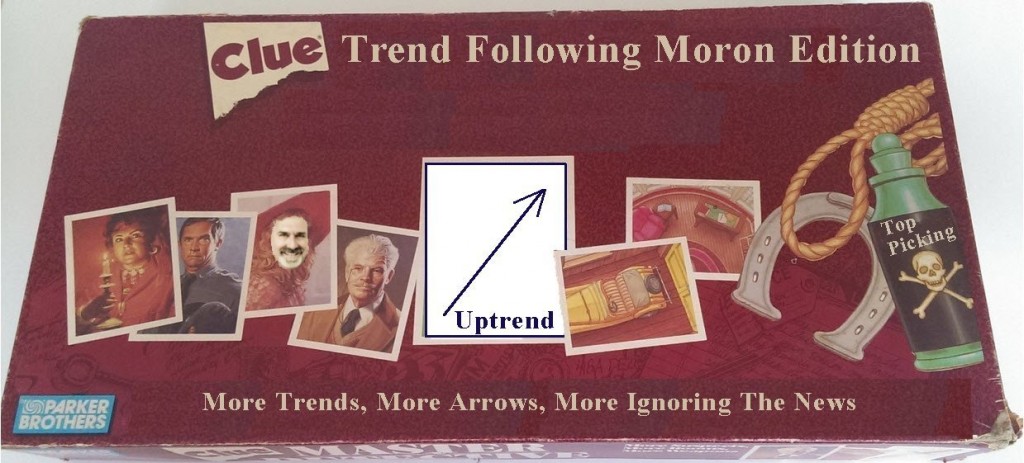

With a flat day, not much really changes. Overall, in spite of some pockets of weakness, things still look pretty good. As mentioned recently, predicting markets is a game of clues. You have to weigh all the evidence and build you case. So far so good but it is important for us to watch to see that additional weakness does not develop.

Again, I’m still not going to argue with a market that’s at or near new highs.

So what do we do? Not much has changed just yet: I’m still seeing some setups in trending stocks that have pulled back. These include areas such as Solar/Alternate Energies, Energy-Oil, Metals & Mining, Internet, Hardware, and Drugs. Therefore, continue to look to add/add back on the long side. As usual, make sure you wait for entries. As I preach, this, in and of itself, can often keep you out of new trouble. Continue putting together your momentum watch lists (or pay me to do it for you). Once again, as long as the market remains near new highs, I would avoid the short side for now. Regardless of what you do, make sure you honor your stops once triggered

Futures are flat pre-market.

Best of luck with your trading today!

Dave