Picking Great Stocks-What To Look For And What To Avoid

By Dave Landry | Daily Commentary , Random Thoughts

Random Thoughts

Random Thoughts

As I often preach, when a market is just shy of new highs, one or two big up days can make all the difference in the world. With that said, the Quack had a great day. It tacked on nearly 1 1/4% to close at 13 year highs. As a trend dude, I’m certainly not going to argue with that.

The Ps weren’t quite as impressive but still managed to close up over ¾% nonetheless. This action has them nearing the recently mentioned 1700 inflection point. Again, it is not a line in the sand but if the market crawled back above it, it would suggest that it has stabilized. Ideally, you know me, I’d like to see the market blast to new highs (>1725) and not look back for a while. This would negate May/August/September peaks.

Internally, the market looked pretty good. Lots of tech such as Drugs, Biotech, Internet, and the Semis broke out to new highs. I suppose this isn’t a shocker since the Quack reached its highest level in over a decade. Outside of tech, there were quite a few areas that rallied nicely to hit or approach new highs. This included Shipping, Mortgage Investment, Regional Banks (selected), Selected Manufacturing, Gaming, and Media to name a few.

Tuesday was a good day. Now, we deal with Wednesday. As I preach, markets, like life, have to be taken one day at a time. The futures are very weak pre-market so it doesn’t look like it is going to be a route higher.

Check out my latest review on Amazon.com: “It must be said from a design perspective, the cover is hilarious. It reads a bit more like a table of contents than a book cover. But, that is actually the first sign of just how much useful information is in this book. There’s so much good stuff….”read more and the other 115 reviews.

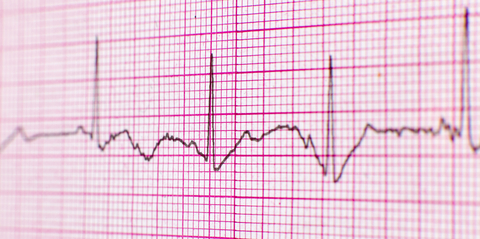

So what do we do? Even with the weak futures, in light of the new strength, I would avoid any new shorts. On the long side, I’d focus mostly on tech. If the Ps and other areas continue to follow through, then I would look to diversify out. It is still not a market where you can throw darts. You have to pick your spots very carefully. Make sure your stock is in a solid uptrend or making a serious transition to an uptrend. Ideally, the trend should be a persistent and accelerating one. The stock should trade cleanly. If it looks like an electrocardiogram then fuggetaboutit. Once the trend/transition in trend is identified, make sure you have a setup. Right now I’m seeing a few Trend Knockouts (TKOs)—email me if you need the pattern. Above all, wait for entries. As I preach, that in and of itself can often keep you out of trouble. We have had numerous stocks lately on the radar fail but also fail to trigger. Dodging as many bullets as possible is a crucial part of successful trend trading. I’ll flesh this out yet again in Thursday’s show. Above all, honor your stops on new and existing positions just in case the market fails to follow through.

For the nimble and aggressive, watch for a possible opening gap reversal trade (OGRe) in the index shares.

Best of luck with your trading today!

Dave