Moron The ABCS Of Technical Analysis

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

The market continues to hang in there.

The Quack and Rusty eked out small gains, enough to keep them at multi-year highs and all-time highs respectively.

The Ps were a little soft.

On a net net basis, the Ps haven’t made any forward progress yet this year. They do still remain just below all-time highs so I wouldn’t get too concern just yet.

Internally, things are still looking pretty good. This is especially true for technology, as you would expect with the Quack at new highs. Drugs, Hardware, and Software closed at new highs.

Other stronger tech areas like the Semis only appear to be taking a little breather.

Aluminum had a solid day. It is just shy of multi-year highs.

Uranium continues to rally off of its bottom.

All isn’t rosy in the world though. Retail continues to break down. Consumer Non-durable is also breaking down.

I think the good far outweighs the bad though. Most areas remain strong.

I would like to see the Ps break out to all-time highs decisively but I guess you can’t have it all—and if you did, where would you put it? (Wright)

For now, especially with the indices and most sectors at or near new highs, you want to err on the side of the trend.

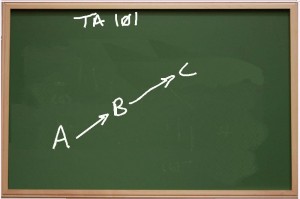

As mentioned on Thursday, if A < B and B < C, then a market will have to pass through B on its way to C. If a market is in an uptrend, it will have to make new highs. Therefore, with the indices and most sectors at or near new highs, you want to err on the side of the trend. As I preach, don’t try to outsmart it. Remain a Trend Following Moron.

So what do we do? Considering the above, continue to focus on the long side. I’m not seeing a lot of setups but this is normal for a pullback based methodology when the market/sectors are (mostly) at new highs. Therefore, wait for setups but make sure, as usual, you wait for entries. And of course, on existing positions take partial profits/trail your stops as offered and honor your stops. Do this just in case this uptrend doesn’t last forever.

Best of luck with your trading today!

Dave