TA 101-The Implications Of Thursday’s Breakdown

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

The Ps lost close to 1 ½% of their value. This action has them breaking down out of their sideways range.

The Quack was hit even harder. It lost nearly 1 ¾% of its value. This action has it breaking down out of its short-term sideways range–all the way to the bottom of its previous range.

The selling was nearly across the board as suggested by the broad based Rusty. It lost close to 2%. Like the other indices, it too broke down out of its range.

One thing that I have been concerned about lately is the fact that previously strong sectors have been losing momentum. This really played out on Thursday. It is a case of, “the bigger they are, the harder they fall”–Biotech, Retail, Health Services to name a few. And, there’s plenty more. As mentioned recently, we could see shorting in these previous high fliers. This is especially true now that they have begun to crack.

Bonds banged out new lows. Stop me if you heard this before: it’s not the absolute rate that bothers me, it’s the delta in rates. They need to stabilize-and soon. When Bonds can’t get a bid when the market is tanking, it suggests a liquidation type of market. Someone needs to raise cash soon, selling even bonds.

About the only thing that glimmered was Gold. Well, Silver and Gold and some other Metals and Mining. It has been tough to jump aboard these stocks lately due to their recent fake out. The good news is that if this is the real deal, we should have plenty of opportunities along the way.

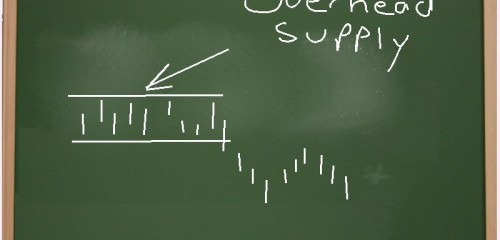

So what do we do? With the market breaking down out of its sideways range, it’s starting to look a little ominous. Those who bought in the range in anticipation of higher prices are now faced with a loss. This is known as overhead supply. If the market goes straight back up, then they will breathe a collective sigh of relief and keep on holding. On the flip side, the longer and further the market stays below the range, the more inclined these individuals will be to sell. And, this selling can beget even more selling. In light of all of the above, I’d certainly avoid the long side for now with the exception of areas waking up such as the Metals & Mining. Although things look a little ominous, I wouldn’t run out and short just yet. As a pullback player, the market-or, at least individual areas–will have to bounce a bit to create setups. So, get ready to get ready on the short side just in case. Aforementioned previous high fliers could provide some wonderful opportunities soon.

Best of luck with your trading today!

Dave

P.S. We had a GREAT chart show yesterday if I say so myself! I covered things to look for in setups and when to make exceptions. This led to rants on money and position management. I then took your questions on individual stocks and trading and general. And, of course, I spent a lot of time discussing the current developing market situation. Click Here to acquire a download (nominal fee applies).