“Why Is It So Difficult To Be A Consistent And Successful Trader?”

By Dave Landry | Daily Commentary , Random Thoughts

Random Thoughts

by Dave Landry

Recently, while looking at everyone complaining on Facebook-whatever happened to “look at me, I’m traveling the world while you’re busy working,” pictures of cute kittens and ugly baby grandchildren?-I received a pop-up chat from a chap in Brazil. He’s writing a piece on why there aren’t more profitable and consistent traders and was looking for my take. The short answer is that the real world and the trading world are two different worlds. And, quite frankly, we’re not made to trade. Let’s explore this further.

I once asked my wife Marcy to check out my latest column. She said, "You say a lot of the same $h*t." Well, that's true. So, longer-term readers will notice that this column “beats the dead horse.” I’m glad that you noticed. And, I’m going to keep beating that dead horse until everyone gets it. Judging by my inbox, I’m going to keep up with the SSDD for a long time—God willing.

Don't Confuse The Issue With Facts

We must apply a high degree of logic in our daily lives to survive and prosper. Yet, in trading, there often isn’t any. People buy and sell markets for a variety of reasons. If you’ve been reading this column for more than a day, then you’ll know that I often quote Marian McClellan (the late mother of Tom McClellan):

“People buy and sell stocks for a variety of reasons. Some people buy when they have money. Some people sell when they need money. And, others use far more sophisticated methods.”

The point is that many times their often illogical reasoning-which has nothing to do with the markets-helps to move markets. This is why it is more difficult for more intelligent people to become successful traders. They think there has to be some sort of logic, but often there is none. This is not to say that trends and reoccurring tradable patterns do not exist. They do. It’s just that sometimes markets will do illogical things.

One way I wrap my head around all this is to monitor my own emotions and mistakes. Am I dropping F-bombs? Did I do something stupid? Or, am I tempted to (confession, I literally almost just jumped the gun on a signal but resisted and forged ahead with this column)? I also have an unfair advantage because my educational business allows me to often see the mistakes of many others. This serves as a constant reminder of what not to do. It also reminds me that there is a lot of emotionally charged trading out there.

Control, Or Lack Thereof

In the real world, you must have a high degree of control to be successful. However, in trading, you have no control over what the emotional market participants will do next. You can only control your reaction to it.

Being Right Vs. Making Money

In the real world, you can’t be wrong very much. You can’t be an engineer and have half (or even one) of your bridges collapse. If you’re a doctor, you can’t kill over half of your patients. However, in trading, you can and will be wrong quite often. In fact, with a trend following methodology, you can be wrong more than half of the time* and still do exceptionally well. And, by the way, the only way to profit from a trade is to capture a trend.

Ready, Set, Action?

In the real world, you must take action. Unless you’re a toll taker, you're not going to get paid to sit on your ass. Yet, in trading, often the best new action is no new action. You must only trade when conditions are conducive to your methodology. Trading in less-than-ideal conditions will all but guarantee you a loss. Sometimes, you just have to wait. This goes against human nature, at least for the motivated like you.

In the real world, provided that you work hard, you receive a steady paycheck. However, in the markets, you can work hard and do everything right but still lose money. It’s an odds game at best. Provided that you have a conceptually correct and viable methodology, then you must follow the process and not be “end goal” oriented. Learning to accept losses even when you did everything correctly is difficult. Many soon get frustrated and begin seeking out new methodologies. Occasionally, they will have some brief success but will go right back to “Grail hunting” as soon as they hit the inevitable string of losses. This is why you don’t see many consistently profitable traders longer-term. They give up and end up perpetually out of phase, bouncing from one methodology to the next.

Get Paid To Trade?

This is not to say that hard work does not pay off longer-term in trading. You must work hard to find the best opportunities and follow your methodology. You must work hard to be process oriented and reward yourself for following the process regardless of the outcome. You might want to write that down.

Buy Low?

In the real world, we seek bargains. To run a business, you must seek out the lowest prices possible. Quite simply, keeping cost in check might be the only thing that makes you successful. This is especially true if you’re in a low margin business. However, in the trading world, as a trend follower (and again, the only way to profit from a trade is to catch a trend), you must avoid seeking bargains. A market that appears to be “low” will often go much lower. As I preach, "it’s always darkest right before it gets 'more dark.'" The Nasdaq might have seemed cheap in ’01 when it was down over 50%, but it went on to lose another 34%. To make money as a trend follower you must wait for a market to rise both over the somewhat longer-term to establish a trend and over the short-term to trigger the buy.

You want a bargain? Save over 50% on Trading Full Circle. Use the promo code "tfc50" (no spaces or quotes, all lower case). I'll also give you 3-months access to the learning management system (i.e, Member's area, keep reading). 100% money back guarantee within 30-days if not completely satisfied. Offer ends 11/07/19.

Bad Teacher

In the real world, experience is the best teacher. You learn from your success and mistakes. In the trading world experience is also important, but, unfortunately, the market can be a bad teacher. Sometimes you'll do something stupid and make a lot of money. It’s human nature to attribute this to skill. And, sometimes you'll do everything right and lose money.

The market often “teaches” you not to use stops. Just last weekend, I was at a cocktail party where a gentleman told me that he "no longer uses stops because 'they' are out to get him." The longer-term bull market has kept him alive. Unfortunately, as I preach, "that'll work until it don't." The market will also teach you to take small profits, to pick tops/bottoms, and to trade in less-than-ideal conditions. I can go on and on, but I don't want to bore you (too late?). The point is that you’re often being taught by a bad teacher.

Stay Out Of The Church Of What's Happening Now (and don't tell the boss to f-off)

Now, suppose that you are prudent. You follow your system and make a lot of money. You can’t let this go to your head. As I have said ad naseaum, I've seen people do really stupid things like abandon profitable businesses that took years to build or tell the boss to F-off. The market has convinced you that you've found the key. Maybe current conditions were just conducive to your methodology. Channeling Linda Raschke, whenever you think that you found the key to the markets, they change the lock.

On the flip side, no methodology works all the time (if it did, you never see my fat ass again) There will be blood. Surviving the bad times and resisting the urge to join the “Church of What’s Happening Now” is key. I realize that I've already made this point about "Grail hunting," but I think it bears repeating. This is especially true since I've met many who remain perpetually out of phase for years, even decades.

Insane In The Membrane

Source: CypressHill.com

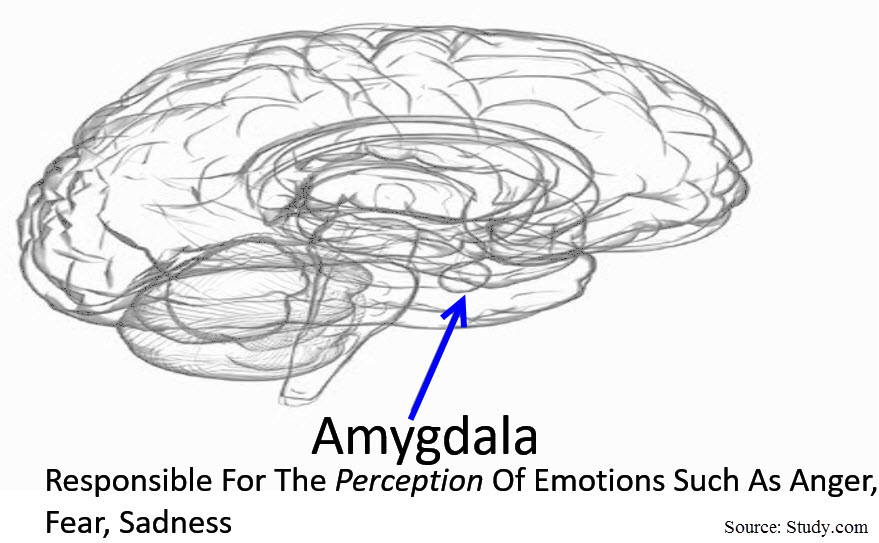

In addition to psychology working against us, we also have some physiology hindering us as a Homo Sapien trying to trade. Volumes can be written here, so let me see if I can cover neurology in a nutshell:

We physically aren't made to trade. The tiny emotional part of our brain that is designed to keep us alive often works against us by keeping us from using the rest I of what's sloshing around up there.

A negative emotion has twice the impact as a positive one. This is what causes addicted gamblers to keep "chasing the high." As a trader, you're going to be wrong a lot. Even on great trades, more often than not, they will be going against you.** If you don't guard against this negative neurology, you could easily end up in a downward spiral.

Problems Without Solutions

I hate when someone presents problems, but no solutions. Anyone can do that. As I re-edit this article for republication, I realize that maybe I'm guilty. As I grapple to give you some solutions, the reality is there are no quick fixes for not being made to trade. Please forgive me if this comes across as soft selling, but this is why I spent an entire year putting together a learning management system based on 20-something years of my own research backed with trials and tribulations. You can get a sneak peak at this by becoming a free member (below) and taking the intro course.

Although I haven't provided you with much in line of solutions, Channeling Kettering, "A problem well stated is a problem half-solved." Embracing and accepting our not-made -to-trade psychology and physiology is 50% of the battle. The other 90%(Yogi) is up to you.***

so, why aren’t There More profitable and consistent traders?

Quite simply, we are not made to trade. Trying to apply logic, attempting to control the situation, bargain hunting, and seeking constant action keeps many from becoming a consistent and successful trader. Embrace this and accept this you'll beat the odds!

May the trend be with you!

Dave Landry

After Thoughts....

This column was originally written over 3-years ago (May, 2016). I find it interesting that a lot of the concepts discussed-outcome biases, being process oriented, attributing good luck to skill and a bad process to bad luck were covered in detail in Annie Duke's Thinking In Bets (2018). See recommended reading for more on this.

Notes and References

*Statistically, a pure longer-term trend following methodology is only right about 28% of the time. This is why I have taken a hybrid approach-trading for both short-term and longer-term gains-in attempt to beat those odds. See Member's Money Management for a lot more on this.

**According to Greg Morris, a market only makes new highs 4% of the time.

***Take the next step by taking the Member's Course on Trading Psychology.