This Simple Technique Might Just Keep You Out Of Trouble

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

The Ps only ended up a smidge but that was enough to keep them at all-time highs.

So far, they still have a wedge look to them.

The Quack fell out of its wedge, losing over ½%.

The dichotomy between the S&P and the Nasdaq is interesting. If you did a little deeper, you’ll see that stocks are beginning to correct on an individual basis. This “pullback” action is creating a few setups.

Once you find a setup, in an ideal world, you also want the sector, other stocks within the sector, and the market itself to also be set up.

At this juncture, things are not ideal. The S&P remains overbought and so far is just drifting—i.e. (again) wedging.

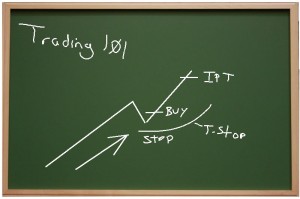

So what do we do? The overall market remains overbought. As I preach, trading overbought environments can be damned if you do and damned if you don’t. If you don’t, they take off without you to become super duper overbought. And, if you do, they correct and take you out with them. The aforementioned mixed market action is beginning to create some setups. When conditions aren’t ideal, my litmus test is that I really really have to like a setup. And, I am beginning to find a few. So, look to take the best setups but if, and only if, they trigger. Should the overall correction come sooner rather than later, it’s possibly this simply technique will keep you out of trouble.

Futures are flat pre-market.

Best of luck with your trading today!

Dave