TFM 10% Sell Signal Triggered As Of 10/27/23

By Dave Landry | Random Thoughts

Random Thoughts

by Dave Landry

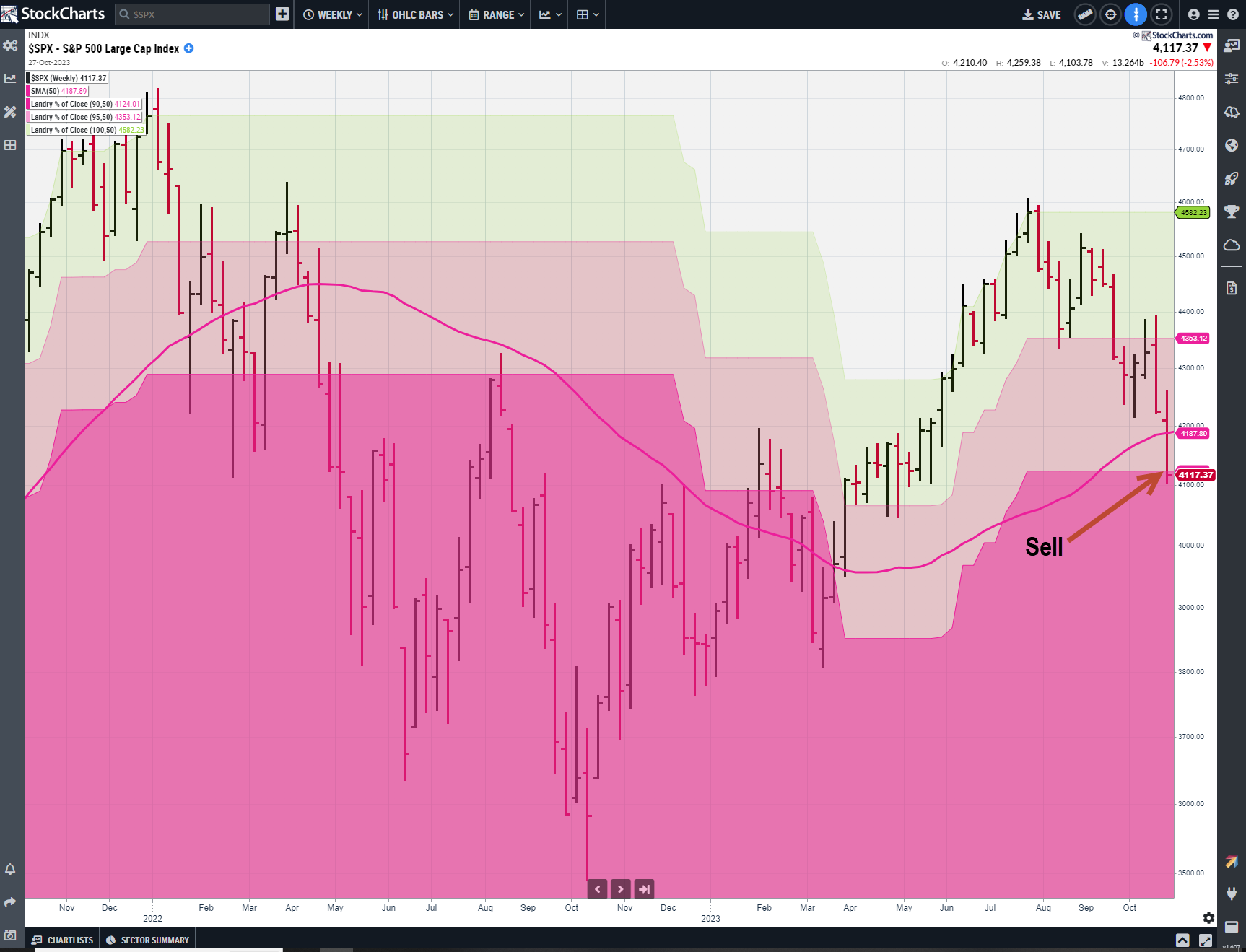

The TFM 10% Market Timing System triggered a sell signal on Friday 10/27/23. This occurs when the market closes 10% or more away from its 50-week closing high and below the 50-week simple moving average.

I view this as a MAJOR sell signal. Based on a Tweet about the system (and my subsequent forensics), there's nearly a 60% chance of an additional 10% further downside (or more).

Here's a video explaining the system:

So What Does This Mean?

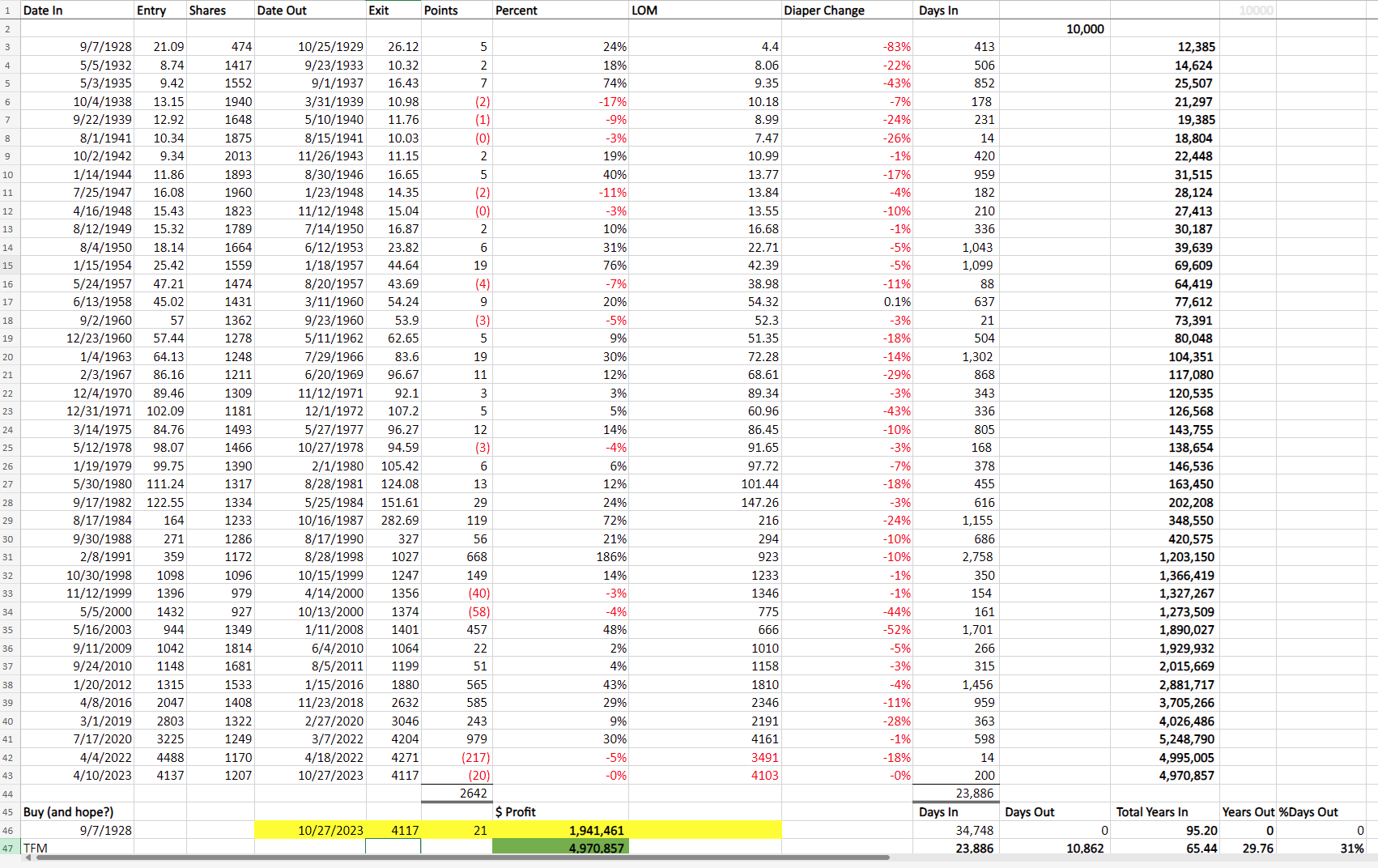

Market timing is less about beating the market and more about not letting the market beat you. The goal with this system (and ANY of my market timing) is to get out of the way when necessary. Borrowing a line from my brother-from-another-mother Ian McActivty (who I'm pretty sure is looking down on us laughing-and finally will be vindicated with his "Ya see, maybe you should own a little gold! mantra.), you want to avoid the "diaper change" moments. I see a diaper change as when the market drops 20,30,40,50, and yes possibly 70% or more-AFTER a sell signal. See below.

It's not the end of the world, but every bear market has begun with this signal (but not every signal turned into a bear market). It's usually better to get out of the way and then ask questions.

Sometimes, the markets come roaring back after a sell signal (and I hope it does!). Notice in the spreadsheet above that the market dropped nearly 30% after the "pandemic" signal. True, it did recover all of its losses, but as I preach, "buy and hold will work until it don't." And, it's a lot easier to sleep at night while the market continues to implode without having your hard earned capital in harm's way. As I preach, borrowing a line from my buddy Greg Morris: "Whipsaws are frustrating. Bear markets are devastating. You can survive frustration."

So What Do We Do? Should I Bail On All My Long-term Holdings?

That's up to you. I just call 'em as I see 'em. I am not a registered financial advisor. In fact, some people call me a Trend Following Moron (TFM)-hence the name of the system. Talk to your professional financial advisor. I'm sure he/she/they/them will tell you to just hang on. "It'll come back! We're in for the long haul! Markets go up on average 12% per year (which is based on an 81-year time horizon, but who's counting)." They all tend to drink the same Kool-aid made by HODL Corp.

The market might come roaring back-and I hope that it does. Again though, buy and hope will work until "it don't."

May the trend be with you!

Dave Landry