12/05/18 Now With Dave Landry

By Dave Landry | Now With Dave Landry

Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Working On...

I'm continuing to add content to the Member's area. Over the past 2-weeks, I added two Q&A sessions. We covered a lot of ground including the importance of discretion-especially on the short side-and, the fact that more has been needed over the past few years, volatility, use/misuse of statistics, dealing with a crisis like a flash crash, pioneer vs. secondary signals-should you factor in a company's story, trading a larger account, using limit orders to enter thin stocks (or options), when not to use a limit order, do people make money trading options?, put options as a substitution for stock, using a VPN when traveling, plus much more. Check it out in the Member's Area.

What I'm Reading

Between the markets, member's area, and the Week In Charts, once again, I haven't had much time to read. With that said, my 2018 goal is to finish more books than I start, so I worked to finish "The Upside Of Irrationality-The Unexpected Benefits Of Defying Logic" by Dan Ariely. I'm going to put this one in the worth reading column. Again, the bottom line is that the more we understand our flawed thinking as human beings, the better equipped we are to deal with life and especially life in the markets. I'm sure you'll see more of this one in upcoming Dave Landry's The Week In Charts and in the member's area.

I also read some of the Pomodoro Technique. This is a book on time management--something we all need in this crazy busy world. I only read a little because I was happy to see that I was already implementing something similar-or at least trying to! I keep a 1/2 hour glass on my desk and when I embark on a project or my market analysis, I try to stay focused until the sand runs out. I then get up and stretch a bit, surf the net, or deal with any "fires" that cropped up while I was in focus mode. Get you a pomodoro timer or a 1/2 hour glass. You'd be shocked at how hard it is to stay focused on one thing for just 20-30 minutes. Initially, I started with a 10-minute sand timer--and that was tough!

See books to read for more trading and books on becoming better.

What I'm Thinking About

I've once again returned to thinking about the micro vs. the macro. And, I stumbled across this quote by Tim Ferris from Tribe Of Mentors (see books to read): "Excellence is in the next five minutes, improvement is in the next five minutes, happiness is in the next 5 minutes." With this in mind, I've been thinking about how I'm spending those "5 minutes." Is it something that's going to have a long lasting impact on my life-like moving my butt, or figuring out some automation for my website, some market related research, making sure my trades are planned ahead of time, etc. Taken one step further, it comes down to the minute too. Take a minute to place that stop (I'm human here! I have one that recently got away from me! keep reading), take those partial profits when blessed, and check your plan to see if any other action needs to be taken. Ever miss a big trade that was on your radar (I have more than I'm willing to admit!)? Well, it only would have taken a minute to check your plan and place that order.

I've been continuing to put some thought into what I'm going to bring to the Charles Kirk retreat in St. Lucia. In going through the his member's questions, yes, there are some fairly technical things that I'll have to cover. The other 98% of what has to be covered can be summed up in keeping things simple, the only way to profit from a trade is to capture a trend (period!), unless you're Bubba Clinton, what is, "is." Don't confuse the issue with facts. By forgetting about politics, fundamentals, news, and any other extraneous information you can get back to the business of what a market IS doing. Is the trend up? Down? Or, just plain sideways?

What I'm Trading

Again, my goal isn't to report every trade here on a blow-by-blow account, but to rather shed some light on recent lessons and current opportunities. With that said, I'm looking to buy deep-in-the money puts on some bigger cap issues that are still in the fairly early phases of rolling over. And, I'm managing my portfolio which, on the long side, has become mostly IPOs and very speculative issues-those that can trade contra to the overall market: UGP, LTHM, VAPO, GRTS, GH, and IIIV--that's the one I was referring to above--looks like the market is going to be a bad teacher on that one! A couple of those have banged out the profit target, which is nice, especially given current conditions.

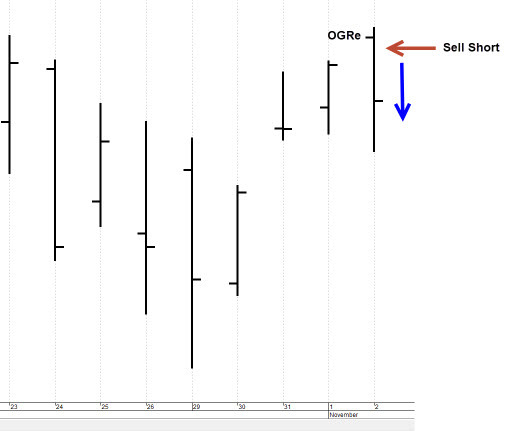

I'm still keeping an eye out for opening gap reversal (OGRe) in the indices. I caught a tiny-better-than-a-poke-in-the-eye one on Monday. Then, of course, the market implodes on Tuesday (see the aforementioned Q&A for more on this trade). This had me guilty of doing the mental math on how much money I missed, but I keep coming back to-Dave, index OGREs are for same day trades--you followed your plan. I know, easier said than done, but longer-term, you have to be willing to reward yourself for following your plan and not becoming obsessed with the shoulda, coulda, woulda's.

This Week's Content

Since it's been a while since the last Now, I have a several of Week In Charts posted. Check out the one where I equate investor's selling stocks to rats leaving a ship (now in the Free Member's area). I think this is very important to understand, given the nature of this market. Also, check out "Love The Trend That You're In." This is one I found from several years ago, but it's just as relevant today.

Around DaveLandry.com

Again, I continue to add to the Member's area. As mentioned previously, the ultimate goal is to enhance the user experience. So far, the feedback has been great! I've been filling in the missing pieces in the bi-weekly Q&A sessions. Some of this has worked its way into the courses.

The Holistic Trader

As mentioned before "holistic" means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

I haven't done very well in the diet and exercise department. I have started stretching a bit. I also received a Samsung Watch for my birthday. The stretching has me feeling much better and the watch has been reminding me to move my fat ass every now and then.

Upcoming Appearances

Since I'll be with Charlie Kirk in St. Lucia for the next week or so, other than my trading service, I won't be doing any publishing. So, you're on your own. Don't do anything stupid!

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.