05/03/19 Now With Dave Landry-Fortune’s Formula?, Trades, And A Bunch Of Other Stuff

By Dave Landry | Now With Dave Landry

Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Reading

I finished Fortune's Formula-The Untold Story Of The Scientific Betting System That Beat The Casinos And Wall Street by William Poundstone-a book recommended to me by Linda Raschke.

As mentioned in the last NOW, my beef with the Kelly Formula is that markets aren't normally distributed and you never know what your "defined edge" really is. The book touts the fact that you can never go broke with the Kelly Formula. Like the old folks in the Alexa Silver ad, "I don't know about that." I suppose, like the frog jumping half the room with each jump, you might not get there, but you'll eventually come pretty darn close.

The Kelly Formula states that if you have a "sure thing," then you should bet 100% of your bankroll, and possibly lever that up. My thinking is that there is no such thing as a sure thing when it comes to markets. And, later in the book, Poundstone mentioned poor (literally) MIT students who bet everything "Kelly style" on a sure thing warrant. The writers of the warrant decided to change the rules and decimated their accounts. The leveraged "that'll work until it don't" got me thinking about Long Term Capital Management (LTCM). The brainiacs here thought they had a sure thing, so they used 30x leverage. Ironically, Poundstone discusses LTCM later in the book and mentions how they would not have lost everything if they were using the Kelly Formula. Again, I don't know about that!

Since I often don't have time to read for pleasure, I tend to view books through the lens of a trader. And, this one did get me thinking. I even fired up a computer and did some backtesting. Although this failed miserably, it was good to learn "yet, another way not to make a light bulb."

Also, in a Larry Williams fashion (see the last NOW), it would be fun to try to parlay a small account.

Anyway, for a book I seen a little mixed on, I sure have written a lot about it! So, The bottom line that it is worth reading. Just tread lightly when it comes to the Kelly Formula.

What I'm Listening To

Long story endless, a few weeks back I had the privilege of visiting with my cousin-in-law, John Paul. He's studying philosophy so I decided to pick his brain a bit. Ever since I read the quote from G.C. Selden: “The Socratic method applied to the average speculator would produce amusing results,” I've been enthralled with the Socratic type of reasoning. I seriously think that if you're willing to admit that "you don't know that you don't know," you'll do fine as a trader. Anyway, John Paul recommended that I read Socratic Logic by Kreef.

While searching for the book, I came across A More Beautiful Question: The Power Of Inquiry To Spark Breakthrough Ideas by Warren Berger. I know that this is Amazon's way of tricking me into buying something extra, but I'm also am open to ideas, especially about ideas! Once you start exploring, If you have an open mind (and a few dollars in your wallet), you're never really sure where it will take you. Sure, you have a few dead ends, that's okay! One or two good ideas pays for it all.

I'm a huge fan of if you want answers, ask questions! Most of what I've built here at davelandry.com has come from asking "How can I do that?" and quite a few "What abouts?" Inspired by Berger, I started a questions notebook for business and trading.

What I've Been Doing

Last week, my wife Marcy got a wild hair and thought that it would be fun to visit the Fruth's in Houston. And, it was. To those who don't know Richard "Dick" Fruth, he's a good friend of mine that I met through the American Association of Professional Technical Analyst (AAPTA). Dick runs several hundred million dollars and is the author of the excellent book Discovering Growth Stocks and Anticipating Parabolic Moves.

In the course of our conversations, we began talking about Linda's book Trading Sardines and how much we both enjoyed it. One of my takeaways was Linda's brutal honesty about how hard trading really is. Dick agreed. This really struck a chord with me. Here's a man who's been in business for 40-something years and readily admits that trading isn't easy.

One of my other takeaways from the trip was to remember to see the forest for the trees occasionally. Dick is a lot more longer-term oriented that I am. True, when I enter a position hope to be in it for a very long time. However, my money management often takes me out fairly quickly (I do have a couple that have been open for a few months). When Dick takes on a position, he intends on staying with it for a long, long time. While going through some of his holdings that he's held for years, I noticed that something like a 50-week and even 50-month moving average using something simple like LandryLight could keep you in positions "forever." Notice below that Denny's (DENN) has stayed above its 50-month moving average for over a decade. Now, I'm not going to rush out and become a super long-term trader (ironically, I had a trade yesterday that lasted five minutes), but it did get me thinking. Sometimes, I should stop to look at the forest for the trees.

See books to read for more trading and books on becoming better.

What I'm Working On...

I'm continuing to add content to the Member's area. We had a great Q&A session if I say so myself. We covered money management before the IPT is hit, the Phoenix strategy in IPOs, potential trades, and what to do in an oversold environment like now.

Speaking of content, based on the questions received, I thought it would be a good idea to do an update on the TFM 10% System-a simple system to keep you on the right side of the market. I covered this in a lot of detail in the latest Week In Charts. Check it out below. I'm a little biased, but I think you'll be pretty impressed. And, BTW, after crunching some more numbers, buy and hold did not win!

I'm continuing to play with Finviz*Elite. I've been like a kid in a candy store here. I've been running IPO screens (See the last NOW for an example) to show me any potential action that needs to be taken on the close and for potential setups for the next day. I've also been running scans to show me a tradable universe and using my mouse's scroll feature to display the charts. I've been doing this in part due to my injuries from too much repetitive computer work. I'm sure I'll have a lot more to say about this over time. I'm halfway thinking about doing a "tools of the trade" type of webinar. Anyway, so far, my elite account is paid for itself 10 times over. Check it out below.

What I'm Thinking About

Inspired by The Artist Way by Julia Cameron, I have been keeping up with my "morning pages" religiously. Every morning I wake up and write three handwritten pages. I try to do this in a stream of consciousness fashion and not worry about the content or grammar. With my recent downtime from my surgery, I spent some time taking notes on all that I had written over the past several months. This made me may realize the value of doing this. Some days, not much comes from it other than an ever-growing "to do" list and other days I have business and trading ideas. Even little things like noticing that much of what I was worried about never came true has been a godsend. Channeling Twain: "I have had many troubles in my life, most of which have never happened." Anyway, I encourage you to start your own "morning pages."

What I'm Trading*

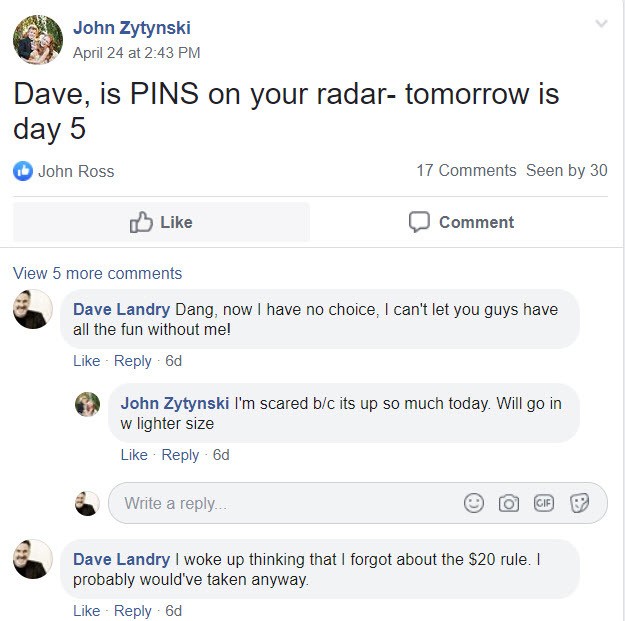

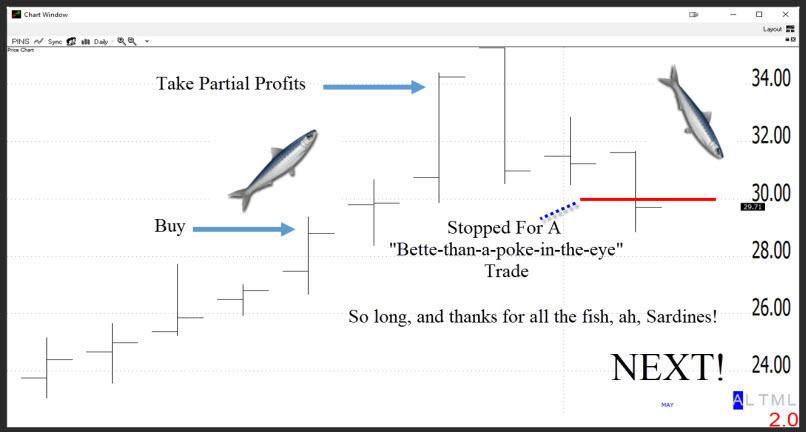

I'm continuing to trade my IPO "Buy At B" set up. As mentioned, I love these "pioneer" setups that get you into hot IPOs early, but often keep you out of stinkers (e.g., LYFT, APRN, SNAP, etc.). Pinterest (PINS) provided the latest setup here. Special thanks to John Zytynski in my Facebook group for reminding me to look at it. As crazy as my life has been lately, I could've easily missed it! Although it didn't turn into the mother of all trades, like recently mentioned TIGR, it did well, especially if you play the "annualized game." As you can see, money management is crucial.

Source: YouTube, Original Source: HBO

Speaking of money management, I can't beat the dead horse here enough. I've recently seen people lose money on good trades because they failed to use proper money and position management. Shame!

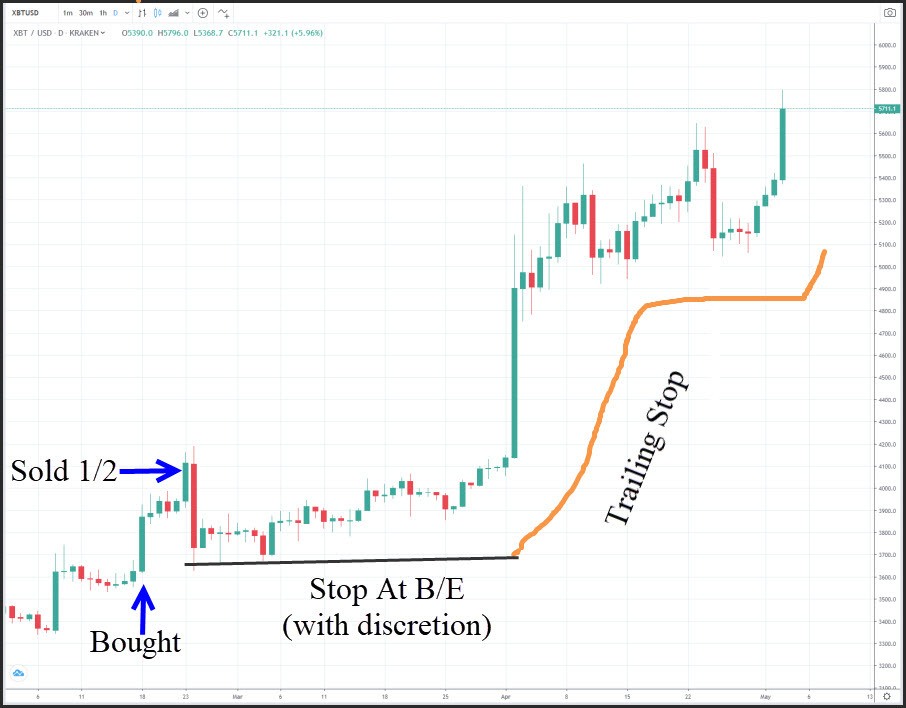

After a long hiatus, I've been back into Crypto over the past few months. Why? Because as a trend follower (ing moron), I like to go with the money is. And, as long as the trend continues, I'm going to keep trading Crypto. Below is the Bitcoin trade. I still have some "residuals" leftover in Litecoin and Ethereium. See this NOW for a lot more on this.

I'm now playing the "see how long I can hold on to the trade game-" one of my favorite games to play.

In FOREX, I'm still playing to catch major trend change on the hourly charts. And, as often happens, I'm questioning my sanity in this. I got stopped out of two EUR/USD positions for small gains and the AUD/USD for a loss. Net net, the trades have lost overall. See Methodology under the Member's area for more on trading FOREX.

I found it interesting that with trailing stops and profit taking, I'm now 90% out of equities. I don't know if this is a sign, but I find it interesting that a trend follower like me is mostly in cash with the market hovering around all time highs-just a random thought.

The Holistic Trader

The Holistic trader means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

I now have a pretty nasty scar on my elbow due to the use and abuse on my keyboard and mouse over the years. I know that if I don't slow down, I'll be facing three more potential surgeries. The reason I'm sharing this is just so that you know that you can abuse your body for a long time, but eventually, it will catch up to you.

I have been working on my ergonomics. As much as it pains me, I've been using the new and improved version of Dragon Naturally Speaking for a lot of my typing (admittedly, the new expensive version does seem to work better than anything I've ever tried to past). If you notice my emails or columns seem a little mentally challenged this might be why. Read them phonically and go easy on me for the grammar. Also, I recently noticed a Facebook post which was transcribed from a conversation that I was having with my wife-quite accurately, I might add. I guess that I need to be more careful now that I have one more device in my house listening in on my conversations. For mousing, I think I have found a solution. After trying at least a half-dozen mice, I've been really happy with the 3M Ergonomic Mouse. It looks like a joystick, but it's really just a "vertical" mouse (i.e., you actually move the whole mouse around).

I also bought a second Stream Deck programmable macro thing (the first I use for video editing and absolutely love it). These aren't exactly cheap, but for me, it's been worth every penny. For instance, notice in the photo I have my Crypto screen. If I want to see charts, balances, or trade, I just hit a button. I also have other screens programmed with websites, my Facebook group, etc. I'm hoping that saving a keystroke here and a keystroke there will keep the surgeon away for a while longer. And so far, I seem to be noticing an uptick in productivity.

As previously mentioned: My carpal tunnel (and other stuff), in part, has me moving more and more to the one-to-many business model for my educational business. I simply can't continue as I have for the last 20-something years. I think more of you will benefit from this. I eluded to this in the Start course (free).

Upcoming Appearances

There's not much to report here. I'm still open to restarting my international travel. So far, that process seems to be pretty slow. I may be doing some online international work soon (Italy), so maybe that'll help to get the ball rolling. I will be playing the role of Dave Landry in Dave Landry's The Week In Charts.

May the trend be with you! (and if it's Saturday 05/04 when you read this "May the fourth be with you!"

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.

*My goal here isn't to report every trade here on a blow-by-blow account, but to rather shed some light on recent lessons, screw-ups, and current opportunities.