02/08/19 Now With Dave Landry-Don’t Be “Swayed” To Do The Wrong Thing!

By Dave Landry | Now With Dave Landry

Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Reading

I started reading Sway-The Irresistible Pull Of Irrational Behavior by Ori Brafman and Rom Brafman. I've really been enjoying this one. Yes, it's yet another one of those "we're pretty messed up as humans book," but it's certainly worth the read. So far, it has reaffirmed my recent conquering the micro to get to the macro quest. He gives chilling examples of how short-term loss aversion inspired bad decisions can lead to great tragedies-costing hundreds of lives! A lot of this dovetails nicely with our often bad trading decisions.

See books to read for more trading and books on becoming better.

What I'm Listening To

I finished listening to Extreme Ownership-How U.S. Navy Seals Lead and Win by Joco Willink and Leif Babin. The battlefield stories were quite thrilling. I found myself staying late "at work" a few nights to finish chapters. After setting the stage in the battlefield, Willink and Babin take the lessons learned and show how they applied them to solve business problems. The underlying theme of the book is that if you do the hard thing, your life will be easy, but if you do the easy thing, your life will be hard (e.g., the mantras of Les Brown, Jerzy Gregorek, and many others). I did find myself motivated to do some difficult things that I've been procrastinating. Through the process I discovered, that a) in reality it wasn't as bad as I feared and b) afterward, things did become easier. I wouldn't recommend this book as a trading book per se, but the "do the right thing, even if it is hard" lessons certainly apply. And, the title itself, "Extreme Ownership" is what we have to do as traders. We have to take responsibility for our actions. There is no one to blame but ourselves. And, we have to follow our well-thought plan, even though, more-often-than-not, that's the hard thing to do.

What I'm Working On...

I'm continuing to add content to the Member's area. Most recently, I added the last (01/30/19) live Q&A session to the archives. In this one, I discussed at length things that you really need to think about and do when contemplating taking your trading venture full time. I then covered using oscillators (or not) and other ways to gauge overbought/oversold. Finally, I went on to cover entering a trade-even though it was tough for a client to do. This one, so far (knock on wood!), has turned into a nice winner. Keep reading. Check out the Q&A in the Member's Area. I'm also working on a presentation to dig deeper into the akrasia effect and other things that tempt us to do the wrong thing over the short-term. Keep an eye out for this in an upcoming Week In Charts.

What I'm Thinking About

In reading the aforementioned Sway, I began to wonder if all this reading about how screwed up we are is a net negative? After some thought, I think not. While working on a presentation, by accident, I found this quote in the intro of The Upside of Irrationality-The Unexpected Benefits Of Defying Logic (another worthwhile read) by Dan Ariely: "...once you understand the way our human nature truly operates, you can decide how to apply that knowledge to your professional and personal life."

Dan Ariely

"...once you understand the way our human nature truly operates, you can decide how to apply that knowledge to your professional and personal life."

I'm also still thinking about the importance of the micro vs. the macro and how the micro can have long-lasting effects on the macro.

By continuing to peel the trading psychology onion, with my continued studies into human fallibility, I understand more and more why I have such strong short-term temptations to do the wrong thing. As mentioned recently, I do think that "a problem well defined is a problem half solved." (Kettering) The other 90% (Yogi) is up to you: do the hard thing!

Dan Ariely

The positive perspective…is... If we do understand when we go wrong….If we understand the deep mechanisms of why we fail and where we fail, we can actually hope to fix things. (TED Talk)

In the back of my mind, I've been thinking about some longer-term asset allocation strategies using things such as ETFs and simple systems such as weekly Bowties and my TFM 10% Timing System (see the free Market Timing course). The inspiration for this has come from several of you along with friends & relatives who have been freaking out about their 401Ks starting to look more and more like 201ks. It's going to be hard for the trader in me to do these things-maybe in my next life. I guess It's never too early to start thinking about them.

With my core trading methodology, my goal is to hang out as long as possible, hopefully at least 10 years! (I know, I said hope!) However, when the short-to-intermediate-term trend begins to turn in earnest and takes my stop out, I'm out. So, using my hybrid money management approach, I usually get taken out before 10-years-although I do have one position that I put on way back in October 2018; check back in October of 2028 :). I'm just not sure if I could ride out the longer-term drawdowns. I suppose the main reason is that I also still firmly believe that inefficient markets-(e.g., for the most part, more volatile issues) offer the best opportunities. And, I like keeping as much powder dry as possible for when those opportunities present themselves. Markets are markets and patterns are fractal though. So, the empirical knowledge that I've accumulated in the last 20-something years (DANG, Linkedin shows my LLC, Sentive Trading, as nearly 25-years old!) can have more than one use.

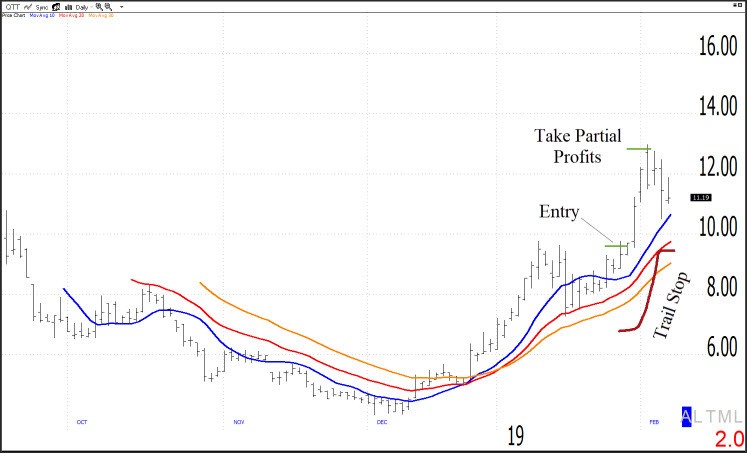

What I'm Trading

As mentioned ad nauseam, my goal here isn't to report every trade here on a blow-by-blow account, but to rather shed some light on recent lessons and current opportunities. With that said, my recent "smoke 'em if you got 'em" (take partial profits) and following the plan example is QTT. One client took the trade but immediately questioned his actions. Admittedly, I did the same: After a brief instant euphoric moment of profit, dropped an F-bomb as the traded promptly reversed. This is yet another lesson of how a market will tempt you to do anything-anything but following the plan.

Recent Content

It's been a while since the last Now, so quite a bit has been posted: simple ways to determine trends (x2), embracing cognitive biases, the one word that often stands between you and your success, plus more. As always, you can see the last six things I posted here. Just register below (scroll down) or once there sign up for a log on.

The Holistic Trader

As mentioned before "holistic" means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

As mentioned often, your life will spill into your trading and your trading will spill into your life. My house is now under contract-pending inspections (finger's crossed). So soon, I'll likely be forking over some cash for repairs, I'll have to pay some rent while the new house is being built, and deal with all those "for just another $5k" things that seem to be cropping up with my new residence and the future world headquarters of TFM Inc. The stress of all this has me a little crotchety and often tempted to figure out ways to replace the cash that I seem to be bleeding. I have to constantly remind myself that the market doesn't care about me or my time frame to deal with expenses!

Upcoming Appearances

Dealing with issues in my personal life has tapped the brakes on my travel for a bit. I am starting to get out there a little bit with a web appearance or two. I recently hosted a Crowd Forecast News show (the recording is on YouTube) and I did a presentation on IPOs last week for London Investment Week's Round The Clock Trader. I'm still waiting for my invitation to present in person-hint, hint!

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.