It Really Is This Simple (I Never Said Easy)

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

The market bounced.

Let’s look at the scoreboard. The Ps, Quack, Rusty gained 1.24%, 1.14%, and .79% respectively.

So far though, it only appears to be just that, a bounce.

It looks like the damage is done. The Quack has formed a Bowtie down from multi-year highs. The rest of the major indices have formed Bowties down from all-time highs. It pays to pay attention when you see a transitional pattern. Not every one will turn into a major top but every major top will have one.

It’s not the end of the world nor can you see it from here. It is a daily signal. A weekly signal would be much more ominous. Unfortunately, since they slide faster than they glide (see Wall Street Truth #1 on pg. 18 of Layman’s), we can’t sit around and wait to see of that occurs.

Now is the time to pay attention. Since things are looking a little dicey, you certainly don’t want to buy anything unless you really think your stock can defy gravity, walk on water, or (insert your favorite metaphor here).

As I preached in Thursday’s chart show, you don’t want to rush out and dump all your longs either. Rather, let the market make that decision for you by honoring your stops. Let the ebb and flow control your portfolio. Keeping “results not typical”, “your results may vary”, and all other disclaimers in mind: the model portfolio actually went up during the recent slide and that was mostly on the long side!

I’m not telling you this to brag (well, maybe a little) but to show you that even if you knew the market was going to slide, dumping all of your longs isn’t always the thing to do. Letting the market tell you want to do is. Write that down.

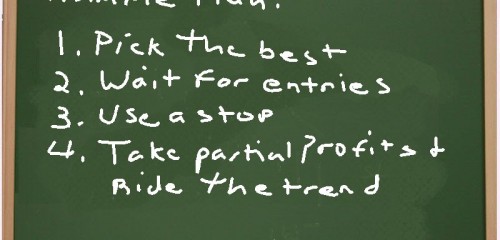

All you have to do is pick the best stocks to begin with—as I preach, a good offense is your best defense. Obsess before you get into a trade, not after. One you have picked the best of the best, wait for entries. That, in and of itself, will often keep you out of new trouble. Once triggered, focus on the defense: honor your stops, and take partial profits and trail the stops higher as offered. It’s that simple. I never said easy.

Looking to the sectors, Gold stocks still remain about the only that still glimmers. And, I’m even beginning to wonder a little there. As I have been saying, it appears to be more than a process than an event. Make sure you wait for entries.

Most other sectors look like the market itself. They have sold off hard and are now bouncing. This action is forming First Thrusts, Bowties, and other transitional sell signals.

Start putting together your list of possible shorts. Banks, Financials, Manufacturing, and other areas rolling over from all-time highs appear to be your best candidates so far. The bigger they are, the harder they will fall.

So what do we do? Again, Gold stocks are about the only thing out there that might appear to have potential on the long side. And again, just make sure you wait for entries in light of the lackluster (no pun intended) performance recently. On the short side, start putting together your list of candidates forming transitional patterns. Focus on the aforementioned sectors. As usual, no matter what you do, wait for entries, honor your stops, trail stops/take partial profits as offered. Stop me if you’ve heard that before.

Futures were firm but are now weak pre-market.

Best of luck with your trading today!

Dave