Dave Landry Called The 2016 Bear Market Long Before Stanley Druckenmiller—Both Are Right But Early

By Dave Landry | Random Thoughts

Random Thoughts

The financial world is abuzz because Stanley Druckenmiller recently said "the bull market is exhausting itself.” Like “shotgun!,” I called it first. Both of us are right, just early because “A market can stay irrational a lot longer than you can stay solvent.” (Keynes)

Dave Landry Called The Bear Market First (sort of)

Major signals should not be taken lightly. As my buddy Greg Morris says, “We treat all signals as if they will become the big one…Whipsaws are frustrating. Bear markets are devastating…You can survive frustration..”

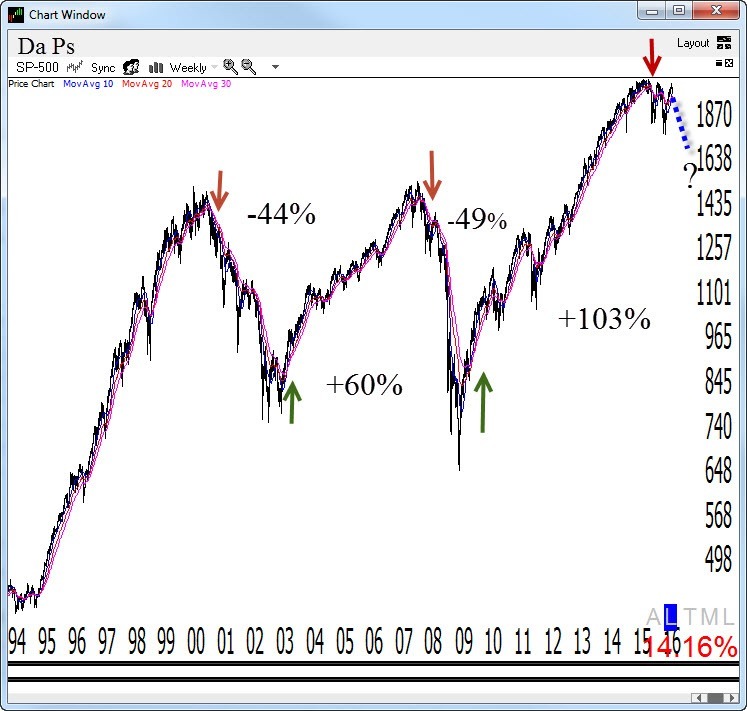

I define a “major signal” as a First Thrust or Bowtie coming off of all-time highs (lows for buys) or at least 5-10 year highs (lows for buys). To keep it simple, let’s just focus on the Major weekly Bowties over the last 20 years. Notice that significant bull and bear market cycles have followed ALL of the major buys and sells. This doesn’t guarantee a bear market is imminent but again, all signals should be taken seriously.

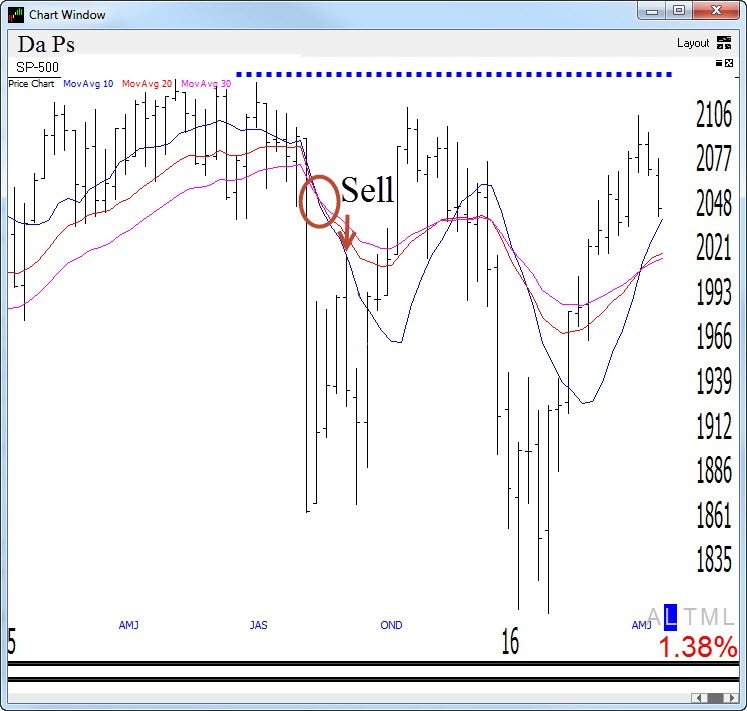

The latest major Bowtie sell signal in the Ps (S&P 500) triggered in September of 2015. And, this signal will remain in effect until and unless the old highs of 2135 are taken out decisively.

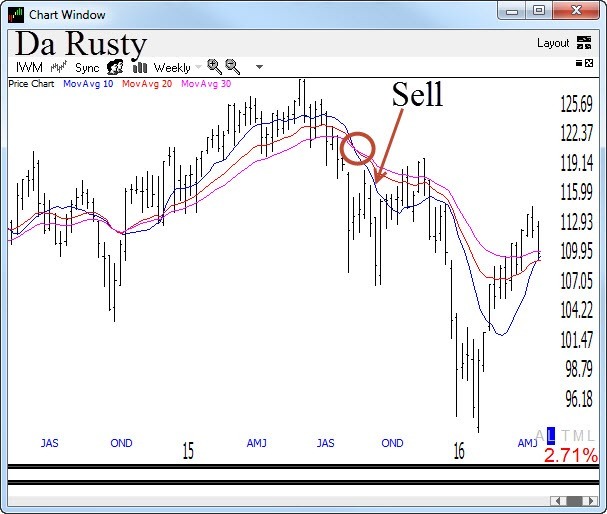

The signal has been a little bit more impressive in the Rusty (Russell 2000). The index dropped nearly 16% after the trigger before retracing. Like the Ps, the signal remains in effect here until and unless the old highs (130 in the IWM) are taken out decisively. BTW, on a closing basis, the Rusty has dropped over 25% since the 2015 peak. For reference, the media defines a bear market at 20%.

Right But Early

If you haven’t seen “The Big Short” you must. Just watch it with someone who understands markets like you otherwise you’ll spend 2 hours of your life explaining what’s happening—either that or come off as a know it all. Anyway, one of my favorite lines in the movie is when Michael Burry is being questioned about his massive losing position by Lawrence Fields.

Michael: “I’m not wrong, just early.”

Lawrence: “THAT’S THE SAME THING MICHAEL!”

Lawrence is right. It is the same thing. Again, as Keynes once said, “A market can stay irrational a lot longer than you can stay solvent.” Drukenmiller, like me, is right, but early. You can’t confuse the issue with facts. Yes, our financial policy is abysmal and quoting Drukenmiller “has no end game.” Yes, there is a situation in China (and Nigeria?).

So Are You Short With Both Fist?

Well, no. Right now the portfolio is filled with just longs. We have some Energy and Metals & Mining stocks along with a speculative Medical Appliance IPO stock (and a Biotech on the radar). Initially, we did have a plethora of shorts but we got taken out of those via stops/trailing stops. See yesterday’s Dave Landry’s The Week In Charts for more on this. You play the hand that’s dealt within context of the bigger picture. As the market was rolling over, the database was providing us with a plethora of shorts. On the sharp retrace back up, those shorts got taken out and longs began setting up. Now, within context of the bigger picture sell signal and other issues such as the overhead supply (see recent columns/webinars/Market In A Minute), to quote Jules, the potential long side setups would have to be “one charming pig.” In other words, we have been selective.

The fact that commodities can trade independently of the indices gave them a plus one. Super speculative issues that wouldn’t know a fundamental if it hit them in the ass (my favorite!) often don’t care about the indices or the GDP (or the situation in Nigeria.)

Follow Is The Key Word In Trend Following

If you know me, you know that I try to avoid all news at all costs but I do get some through osmosis (including, obviously, Stanley Drukenmiller’s prognostication). What information you choose to give credence to is up to you. Just frame it within price. Price doesn’t lie. Is the market going up, down, or just plain sideways? I think this market is irrational. Again though, a market can do whatever it wants.

To The Markets

Shorter-term the Ps (S&P 500) have been in a bit of a slide. Add in this morning’s weakness (05/06/16) and they are at 6-week plus lows. As they continue to slide, the overhead supply becomes more and more important.

The Quack (Nasdaq) is also stalling and reversing at resistance. It’s now banging out multi-month lows and has a mountain of overhead to overcome.

The Rusty (IWM) has now turned back down too. Like some other indices and many sectors, so far, the rally from the February lows was just a retrace within a bigger picture downtrend.

Most sectors are either stalling in their retraces like the Rusty, stalling well short of their prior highs like the Quack, or have just made it to new highs but can’t seem to get any further.

The only standout remains the commodities. Unfortunately, they too are now beginning to correct. Hopefully, oops, did I say “hope?”, its’ just that-a correction.

So What Do We Do?

Keep looking to position in the commodities but wait for entries in light of the recent weakness. On the short side, wait and watch. Next to 2007, this is the slowest bear market turn that I’ve ever seen. Do start keeping an eye out for short side setups just don’t bet the farm just yet. If you’re like me, Michael, and Stanley, we’re right, just early.

May the trend be with you!

Dave Landry

P.S. Did you like this article? Then please post to Facebook, Tweet it, and swipe left because the more popular it is, the more free content I'm able to offer. Didn't like it? Well, go have no fun somewhere else!

Well, If You Really Did Like This Column, You'll Enjoy These Related Columns:

Sources: