Here’s THE System That You Should Follow

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

I’ve told the following story a thousand times and I’m going to keep telling it until you people get it. Way back when the earth was still cooling, my wife Marcy asked me “How many trading systems do you really need?” after I showed her my latest system (likely systems) de jour. You just need one babe, the one that you will follow. In the last column, inspired by my recent trip to Germany, I talked about how to follow the system once you find it. I suppose we need to back up a bit and discuss how to find that viable system in the first place.

Do You Believe?

The first thing you need to ask yourself is do you really believe in the system? Trust me, if you have an ounce of doubt in what you’re doing indecision will haunt you as soon as real dollars are on the line. As I wrote in Layman’s, “I’ve never met an unsuccessful paper trader.”

So how do you believe? Well, you study the charts over and over. You not only look for how great the system is but you also have to play devil’s advocate and pick it apart. Someone emailed me a back tested system, bragging about the results. When I pointed out to them that the nearly 50% drawdown is a little steep, they said, “Well, the system actually ended positive for that year!”—yep, yet another successful paper trader. Could you really lose over half of your money and then keep following the system? And, without digressing too far, never forget that with back testing, your largest drawdown is always in front of you—so, I’d expect a little more than 50%.

Does The System Fit Your Lifestyle?

pics-about-space.com

Do you really want to be in and out all day, glued to a screen? Many years ago I found myself with a bucket with some Lysol in it under my trading desk-just in case. What’s next? Astronaut diapers? I quickly came to my senses and thought, do I really want to be found dead like this? In more recent times I was working with a doctor who carried a laptop from exam room to exam room, daytrading while treating patients. I’m not saying that doctors can’t be good daytraders but you can’t be a good daytrader and a good doctor at the same time.

Know The Nuances

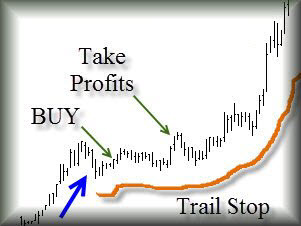

Do you know the nuances and more importantly, can you accept them, good, bad, and indifferent? Can you trade a system day after day that makes a tiny amount and then get whacked and lose 6 month’s (or more) worth of hard work, rinse and repeat? On the flip side, can you trade a much longer-term trend following system and be wrong for over 75% of the time and survive abysmal drawdowns? As mentioned in the last episode of Dave Landry’s The Week In Charts, a famous trader was criticized for losing a fortune. His point is that he never what have made the fortune in the first place without his mindset to follow the system.

Do you know the nuances and more importantly, can you accept them, good, bad, and indifferent? Can you trade a system day after day that makes a tiny amount and then get whacked and lose 6 month’s (or more) worth of hard work, rinse and repeat? On the flip side, can you trade a much longer-term trend following system and be wrong for over 75% of the time and survive abysmal drawdowns? As mentioned in the last episode of Dave Landry’s The Week In Charts, a famous trader was criticized for losing a fortune. His point is that he never what have made the fortune in the first place without his mindset to follow the system.

On the good side, will it go to your head when the system begins to print money? I’ve seen people do some really stupid things with their life simple because they just so

Guy Who Lives In Van Down By The River. SNL

happen hit it just right. Unfortunately, as we say in the south “The sun doesn’t shine on the same dog’s ass every day.” I’ve seen people go from sport cars and boats to “living in a van down by the river.” And, some of these people have decided to check out early. Whoa, Chief Orman, you’re beginning to bum me out. Sorry, didn’t mean to “Karen you*” right before breakfast but I’ve seen most everything and sometimes good problems are still problems nonetheless.

Good, Bad, AND Indifferent

They’ll also be the indifferent times where you just have to grind it out. You’ll wonder if you’ll ever make any real money. Quoting Brian Gelber:

“This is my view of a year in the life of a trader: Four out of twelve months you are hot. You are so excited that you can’t sleep at night. You can’t wait to get to work the next day; you’re just rolling. Two months out of the year, you are cold. You are so cold, you are miserable. You can’t sleep at night. You can’t figure out where the next trade is going to come from. The other six months out of the year, you make and lose, make and lose.” Brian Gelber

So, You Think You Have Something?

So, You Think You Have Something?

When you do think you have something, make sure it’s fairly simple. I would seriously toss out any system that you couldn’t explain to me on a cocktail napkin. My eyes tend to glaze over once the 3rd oscillator is mentioned. Trust me, it’ll be much easier to follow a simple system in real markets than something more complex.

So never forget, while imperfect, simple systems can work quite well longer-term. Longer-term is the key word in that sentence. I was asked in Germany why I would tell them exactly what I’m doing? Well, from experience, I know that people won’t follow it. In great conditions they’ll try to beat the system but getting in early, overleveraging, and a host of other sloppy behavior. In less than ideal conditions they’ll invent trades* or worse, join the church of what’s happening now (instead of just remaining a member of The Church Of Trend Following.com.

To The Markets

It’s interesting that somehow the bull/bear switch magically got flipped late last week. Don’t get me wrong, as a certified TFM, I promise you I’m not going to fight it. I’m just going to remain a little skeptical as long as the internals are somewhat dubious.

It’s interesting that somehow the bull/bear switch magically got flipped late last week. Don’t get me wrong, as a certified TFM, I promise you I’m not going to fight it. I’m just going to remain a little skeptical as long as the internals are somewhat dubious.

Most sectors are still shy of their old highs. You know the routine though, if more and more begin to improve then I’m all in.

Although they don’t look bad, even the indices aren’t quite there yet. Yes, Friday was a good day with the Ps (S&P 500) and Quack up over 2%. You know markets. It’s “What have you done for me lately” Janet. Unfortunately, the market, especially the Ps and Rusty, haven’t made a lot of progress on a net net basis in a long long time. You know the routine though, take things one day at a time.

So What Do We Do?

Click “2” below to continue reading….