You Want To Trade Trends? Well, You Better Know These 13 Things

By Dave Landry | Random Thoughts

Random Thoughts

By Dave Landry

The only way to make money trading is to capture a trend-period. Therefore, if you want to make money trading, you better know these 13 things:

1. Markets Go Up And Markets Go Down

Yeah, I know, duh! Like Pinocchio being a bad motivational speaker and Kenny Rodgers being a pain in the ass to play cards with, "everyone knows that." That’s fine and dandy until the market goes down. I see it all the time. For instance, in my world travels, I have met many “traders” who have held onto stocks (past reasonable stops) in spite of their overall markets dropping 30% or more. And, if the market is down 30%, they're likely down 30%-or more! Once in a trade, people begin to reason why a market should not be going down or worse, why a bottom is near, and it’s “too late to sell.” This so-called "sunk cost" analysis is human nature. Unfortunately, unless you’re Bill Clinton, what is, is.

2. It’s Always Darkest Right Before It Gets "More Dark"

Speaking of being down like the market, never forget that trends can last much longer and go much farther than most are willing to believe. There’s no such thing as "value" because a market is low. The Nasdaq seemed pretty cheap back in 2001 when it was down over 50%, but it then dropped another 30% from those levels. There are stories of famous money managers selling puts after a market has been really beat up. And once, I was in an audience where the speaker was advocating doing the same. It wasn't easy for me to resist the temptation of blurting out "Yeah, that'll work until it don't!"

The reason reasoning and logic (e.g. the market is a value) often doesn’t work in markets is because you’re dealing with the fickle nature of the human psychology of the participants. Write that down. Never forget that people can sell for a variety of reasons that have nothing to do with the market. And sometimes, selling can beget more selling-even when it seems like a bargain. Sr. might decide that he better bail before Jr.’s Ivy League college fund turns into a community college fund, at best-nothing wrong with community college, just try explaining that to jr.

On the flip side, there may be no reason why a stock at high levels continues to go higher-but it is. Again, what is, is. Me drawing big blue arrows back in the late 90s is what earned me the title Trend Following Moron. I wasn’t very flattered at the time, but after a while it forced me to be cognizant of when I might be trying to outsmart the market instead of just following along. T-shirts and buttons soon followed and of course, a domain purchase. Yeah, TrendFollowingMoron.com is me.

Speaking of T-shirts and the guru thing, I have been there, done that, and got the T-shirt. When I first was asked to provide commentary on the Internet (in the late 90s), I felt pressure to predict every zig and zag. I quickly realized that I was chasing my own tail instead of just following along.

3. The Only Way To Profit Is To Capture A Trend

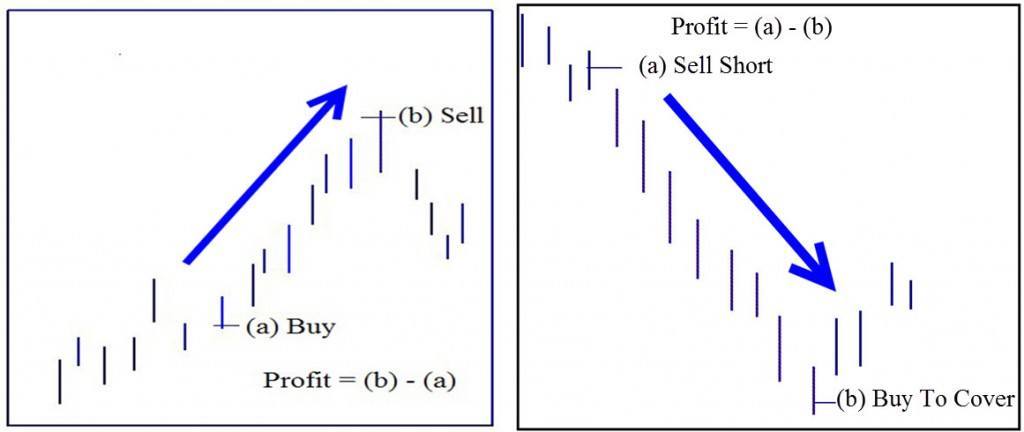

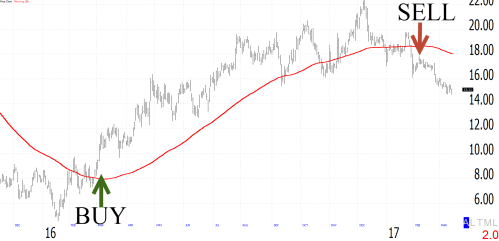

If you buy at (a) and sell at (b), then (b) must be higher than (a) to make money. Conversely, on the short side, if you short at (a) and cover at (b), then (b) must be lower than (a) to profit. I know, double duh!--another one of those Captain Obvious statements. However, you’d be surprised at how many people fight trends-even many who claim to be trend followers.

4. There’s A Beautiful Concrete Rule When It Comes To Technical Analysis-And NO OTHER METHODS

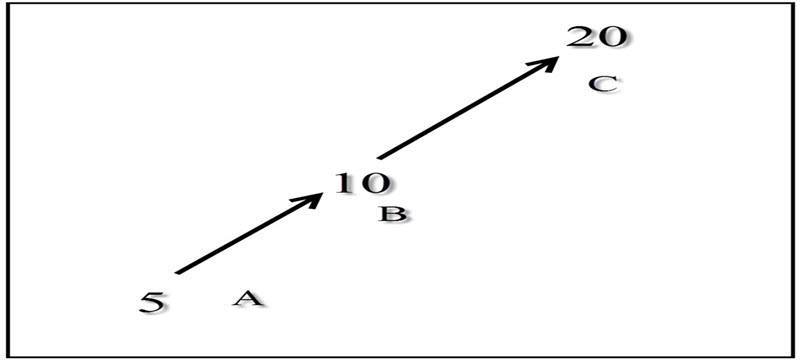

If a market is going from A to C, and B is in between, it must pass through “B” on its way to C. So, if a market is trading at 5 and is on its way to 20, it must pass through 10 along the way. There are no hard and fast rules when it comes to fundamentals. True, trading is a little more difficult than just buying at B*, but I can assure you that you’ll do much better looking to buy at B than fighting a trend. In fact, I once helped a student who was flunking his stock trading project in his finance course. I told him that he could only “buy” at new highs and when forced to “trade” (which the professor made them do randomly) he had to sell losing positions first. He went from last in class to finish in the top three. A couple of years later, I, I mean my daughter, kicked butt doing the exact same thing on her stock project.

(*although I do have an IPO strategy dubbed “Buy At B” that does just that with a few caveats)

5. Indicators Don’t Indicate Trend (Or, Anything), They Illustrate

Indicators are derived from price. Therefore, they are not predictive. They simply illustrate what’s already there in price. Hold on there Big Dave, don’t you use moving averages? Yes, I do occasionally use moving averages, mostly with my Landry Bowtie pattern (for more on the pattern, you can get my books free here). However, I always look at price first and foremost.

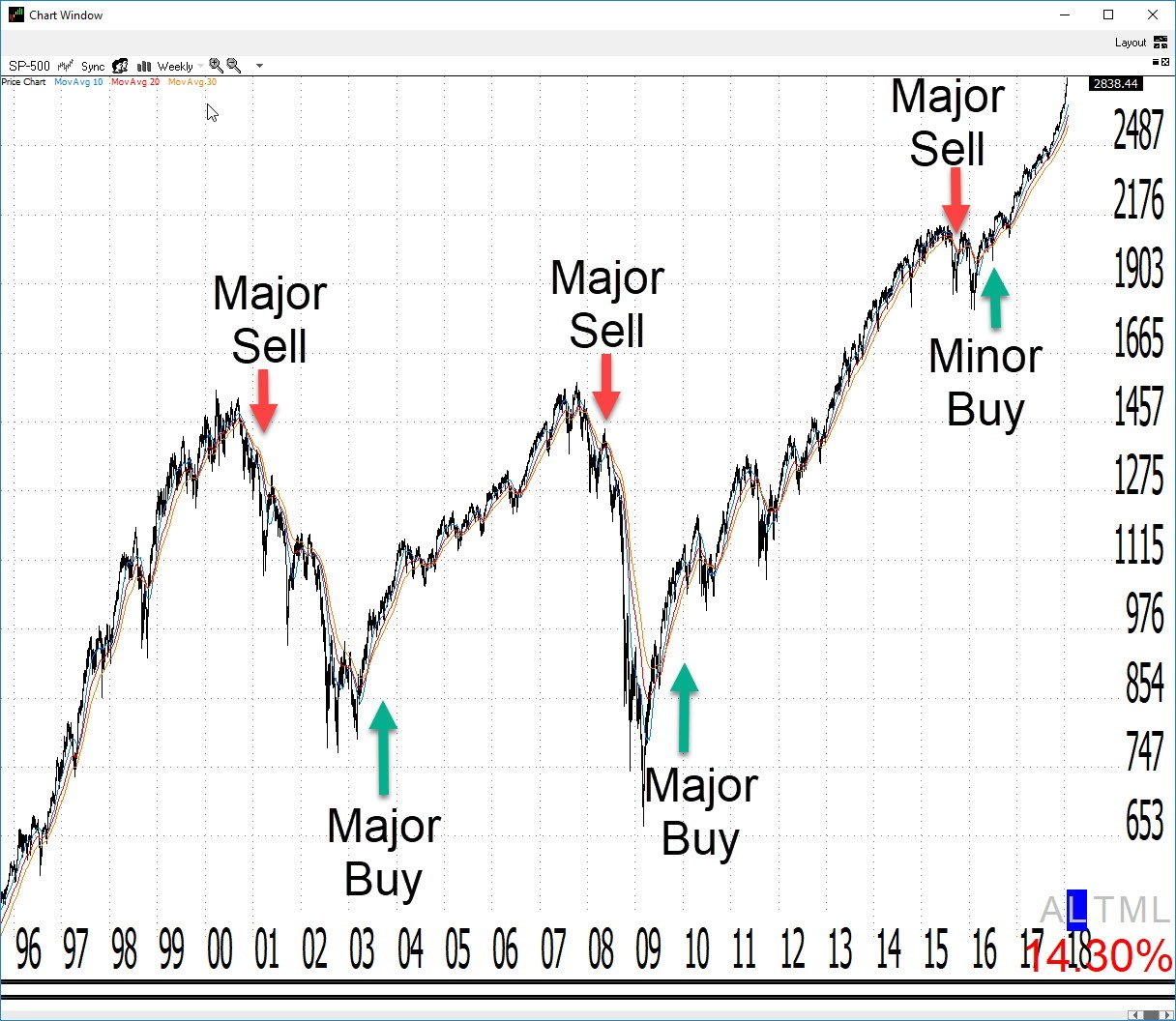

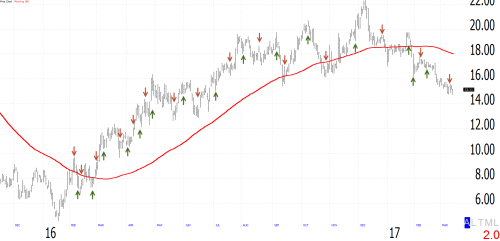

The great thing about Bowtie moving averages is they can often alert you to the fact that a longer-term trend might be losing steam or actually changing direction. Again though, they are just helping to illustrate what’s already in price. Notice that in the major signals below (signals after multi-year highs/lows) that the price had already turned significantly. This brings us to our next point, where is, and where was price?

6. You Must Always Start With (or come back to) Net Net

I have a brother-in-law named Andy. I love ‘em to death, but when Andy asks your opinion, he’s already formulated what your proper reply should be. Should you not agree with him, he will begin to-albeit very convincingly-argue his case. I have dubbed this “Andy-ing.”

Many feel compelled to share with me their latest and greatest indicators. Don’t get me wrong; I’m flattered that they would like me to opine. However, 99.97% of the time, they really don’t care what I have to say. They’re just Andy-ing me—looking for confirmation that they have discovered the Holy Grail. Channeling Saul Bellow: "When they seek advice, they are looking for an accomplice." The bottom line is that when you strip away all those indicators, all you’re left with is price. And, price doesn’t lie. The market is either higher, lower, or about the same as it was. Therefore, never forget about the “net net” change when it comes to markets.

7. Surprises Tend To Happen In The Direction Of The Trend

The last time the market became dubious, way back in early 2016, we were good little trend followers and shorted (okay you 8th grade humorist, it's spelled with an "o" not an "a"). Assurant (AIZ), a stock that we were short in the model portfolio "missed" on their earnings. Nearly all the other stocks we were short then also had negative surprises. Of course, things don’t always work out so well, but in general, surprises do tend to happen in the direction of the trend.

8. Trends Are Not Like A Bus

The secret to trading is patience. Write that down. Great trends don’t come along every day. You have to grind it out, day after day, waiting for the next trend(s). I often spend hours of research that produces absolutely nothing. Like Steve Edmunson, "I spend a lot of time researching things we ultimately don’t do.” That's okay. as I wrote in The Layman's Guide To Trading Stocks: “you must be present to win.” I know that the treasure hunting will eventually get me to the "print money" phase. Unfortunately, that's usually short lived. You then go back to grinding it out all too soon.

Source: ForexLive, Original source: WSJ.com

Steve Edmunson

" I spend a lot of time researching things we ultimately don’t do."

The point is that trends are streaky. My friend Peter Mauthe criticized me after a speech once (which he arranged) for using that word. He told me that "You’re making it sound too elusive." Well, it is. And, I just like to tell it like it is. Believe me; I’d make a lot more money in my trader's education business if I told you that you could make money every day and all day.

Many give up, usually right before the next trend occurs. This is the African Queen Syndrome that I often talk about (see this Week In Charts). Again, “you must be present to win.”

For those who or patient or happen to start at just the right time, you can't let it go to your head when you're in a great trend. I’ve seen people do some really stupid things during the “print money” phase. They think that they “get it.” They begin getting careless. The God-like complex causes them to over leverage, begin taking less-than-ideal setups, and generally trying to beat the system by getting in early. And, in severe cases, their ego begins to take control of their personal life. "The pride goeth before the fall." They tell the boss to f-off or abandon a great business that they spent years building.

Hey Big Dave, are you holier than thou? Nope. “I’m fairly local, I’ve been around. I’ve seen the streets you’re walking down.” (21 Pilots) And, of course, got the T-shirt (the aforementioned guru one, not 21 Pilots). Back in '99 I was a little cocky, borderline "douchy." '00 cured me of that. Now I know that I don't know. I just follow along.

You have to be consistent and patient in your approach. During less-than-ideal conditions, you need to trade less. This doesn’t mean taking smaller-than-normal positions. It means that you are picky in your stock picking. If the market is acting dubiously, at best, then wait. Or, at the least make sure you have either the mother-of-all setups or one that can trade contra to the overall market.

9. Trends Are Hard To Ride

Covel once equated riding a trend to riding a bouncing bronco. In fact, this analogy caught on so much that he changed the cover of the later editions of his book to a cowboy riding a bronco. Big contra-trend moves often occur to shake you out and then the trend promptly resumes. We can actually use this propensity to our advantage. If fact, this is the basis of my Trend Knockout pattern (see this video). Shorts are an even better example of the bronco analogy. They sell off nicely making you think that this shorting thing is a piece of cake and then BAMN! short covering and bargain hunters drive the price of the stock straight up. The buying quickly exhaust itself after, of course, shaking you out first. Again, we can actually use this propensity to our advantage. Sharp retraces are the basis of my Witch Hat (see 10 Best) setup.

10. You Can't Predict Trends, But You Can Follow Them Forever

The future is uncertain. We don’t know when there will be a trend. We wait. Once we identify one, we can then seek to get onboard. We don’t know if the trend will end tomorrow, the day after, or years from now. Therefore, if blessed with a quick profit, we pocket half and then hopefully, enjoy the ride on the remainder for a long long time. Whenever I speak someone usually asks me my holding period. I always reply, “10 years, hopefully much longer.” Obviously, I get taken out much sooner than that but my ultimate goal is to ride a portion of that trade forever-at least until the market tells me otherwise.

KEMET (KEM), which triggered an entry way back in February 2017, provides a good example. I had no idea that it would turn into the biggest winner of the year. I simply saw a setup I liked and then applied a little money & position management.

11. In Order To Follow A Trend, You Must First Have A Trend to FOLLOW

Follow is the key word in trend following. You must first wait until there is a trend before you can follow it. You will be a little late to the party. And, when it ends, you will have over stayed your welcome (see #12 below). That's okay! Embrace and accept this. Check your ego at the door. You don't get paid to look smart. You get paid by catching trends. And, again, that's the only way to get paid.

12. The Trend Is Your Friend But Not In The End

All trend trades eventually end badly. In the end, what appears to be just another correction will turn into a bona fide reversal. That's okay. If you played your cards right, you've captured the majority of the move. You can focus on what you made and not what you "lost" in the end. Then, pat yourself on the back and shout "NEXT!" Easier said that done, but get your attitude right and trading will become much easier.

13. Simple Trend Following Methods Can Work-Even Better Than More Complex Ones

Keep it simple. As mentioned above, first start by asking yourself is the market higher or lower than it was. Then, proceed from there. As I preach, many times I'll see presentations where they show a system with dozens of buy and sell signals. Usually, by default, there's a moving average plotted. I always find it interesting that more often than not, just following something as simple as a moving average would have gotten you in and kept you in the trend-sans a lot of slippage and commissions.

I once had the opportunity to visit a trader who had developed quite a few fairly complex systems. I noticed that we were long and/or watching a lot of the same stocks. I told him, if I didn't know better, I'd think that you were just buying new highs. He smiled.

So, again, keep it simple! If you do find yourself tempted by the complex or arcane, just make sure you are paying attention to the big blue arrows first and foremost. And, never forget, everything works better with trend. So, again, start there.

In Summary...

You want to trade trends? Well as long as you understand and adhere to the 13 things mentioned above, you should do just fine!

May the trend be with you!

Dave Landry

P.S. Leave a comment below to let me know what you think. I personally read them all and often reply.