Take These Simple Steps To Overcome Your Trading Temptations

By Dave Landry | Random Thoughts

Random Thoughts

By Dave Landry

Below, I explore some of my more recent discoveries into trading psychology with a focus on the importance of resisting short-term temptations-why the micro is so much more important than the macro. I explain how this applies to you (and me!). And, most importantly, what we can do about it.

I vacillate between deep dives into trading psychology and even a little neurology back to the Nike philosophy of “Just do it:” all you have to do is follow the well-thought plan-even though that often feels unnatural. You might not know why it’s so hard, but you have to do the hard thing now. The enlightenment will come later, possibly much later.

We all tend to go through a methodology Grail Hunt early in our trading careers. After discovering that there is none, my Grail hunt in more recent years has shifted to simplifying trading (hence the "Trading Simplified" trademark) and figuring out why something that appears so easy-"just do it"-can often be so difficult and elusive. I often wonder, why is it, after 20-something years in the markets, do I still have struggles?

Discovering trading psychology is like peeling an onion. As each layer unfolds, you begin to understand why you often feel the way you do when trading. You become wise to the “whys?”

Before we dig deeper, keep in mind that I'm not immune to the psychological urges of trading. Just because I decided to trade doesn't mean that I no longer have a pulse. I cuss, and I fuss. In fact, due to this propensity, my new office will be insulated with Roxul.

Whys To Wise

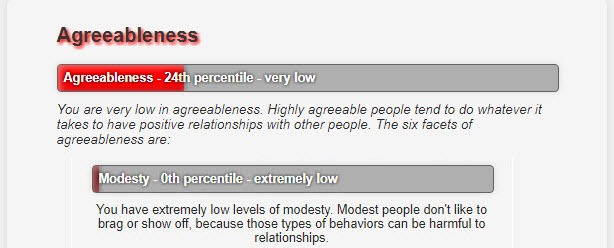

One of my “whys to wise,” 20-something years into this process, was taking a personality test. I scored very low in agreeableness. When I mentioned this to my wife and kids, they looked at me like I pooed my pants--pretty much the same look that I got when I walked into a Starbucks a few years ago and said: “I’d like a cup of coffee please” (before I had my teenager explain to me the complex ordering phraseology). I don't get out much, and usually, when I do, it's someplace where there isn't a Starbucks, or the coffee is much better elsewhere.

Not agreeable? Seriously? I thought I was the most agreeable guy on the planet. Just ask anyone (except the unenlightened idiots that don't fully agree with me..I'm half kidding!). Well, of course, I didn’t agree with the test until I noticed that my extroversion was off the charts-I am a ham and can often be found flossing (the dance, not dental) at parties. Yeah, I've been there and got the T-shirt. I also scored low, or more accurately, didn’t score at all in modesty.

No Room For Ego

I suppose my low score and no score in agreeableness and modesty respectively hints of a slight ego problem. Ya think? Now I know why I get so angry when my positions go against me-and they often will (keep reading). My big ego and little agreeableness often keep me in a state of frustration. That’s a harsh reality to face because there is no room for ego in this business.

Big Dave

"If you ever meet someone in this business that isn’t humble, they either don’t know what they are doing, or they are delusional. Run, don’t walk away from them!"

Do You Ever Find Trading Unnatural And Difficult?

That is not a Matchbox car. Now you know why they call me "Big Dave."

If you ever find trading unnatural and difficult, that’s good. You’re normal! The market often humbles even the best traders. Good traders respect the market. The recent batch of scumbags claiming that trading is easy are doing the novice trader a huge disservice-and quite frankly, aggravating the sh*t out of me! True, trading isn't nearly as difficult as many try to make it, but it's far from easy. I have friends who run 100s of millions and even billions of dollars (well, one, since retired). In all the years that I've known them not once have I ever heard them brag about how great they are. Good traders are humble. They don't brag about how much money they made and “it's not even noon,” they don't post their P&L 's, and they don't post pictures of themselves standing in front of Lambos. Pressfield said it the best: "The counterfeit innovator is wildly self-confident. The real one is scared to death." See the "War Of Art" and other recommended books under books to read.

Steve Pressfield

"The counterfeit innovator is wildly self-confident. The real one is scared to death."

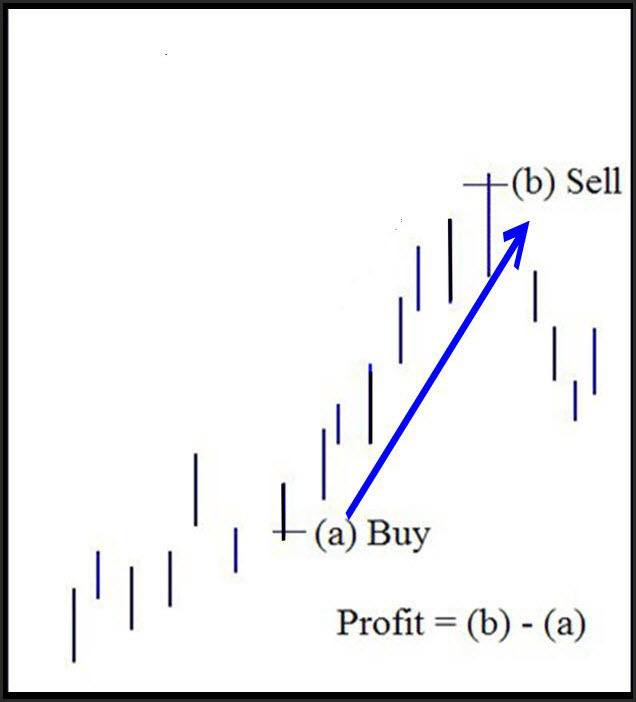

Let's Talk About Trends, Baby!

The only way to make money trading is to capture a trend. Period. Unfortunately, with trend following, you're going to be wrong-a lot. In fact, from a pure longer-term basis, statistically, there's only about a 22% chance of catching a trend. I have worked tirelessly and diligently throughout the years to improve upon those numbers by picking the best markets and creating a hybrid money management approach. Alas, the bottom line is that even with Big Dave’s superior methodology (don't you agree?), I’m still going to be wrong a lot. In fact, often during my most profitable periods, the majority of my portfolio is negative, but one or two big winners makes up all the difference-and then some.

"Someday" Is Now

Lately, I've been focusing on the extreme importance of the micro versus the macro. We all hope and dream of a bright future someday. The reality is that “someday” is now. Little things that you do today can have big, long-lasting impacts. Don’t believe me? Always answer your wife honestly when she asks you what you think about her new hairdo or outfit. Anyway, where was I? Oh, resisting the psychological urges that we internalize based on the market’s action isn’t easy. However, if we can focus on the now, truly focus on the now, then we can overcome these urges.

Not following through on "what you set out to do?"

In my peeling the trading psychology onion, I discovered there's a name for straying from the longer-term shorter-term. These short-term urges which take away from our longer-term goals are known as akrasia.

“Akrasia is the state of acting against your better judgment. It is when you do one thing even though you know you should do something else…..Akrasia is what prevents you from following through on what you set out to do.” (Clear)

James Clear

"Akrasia is the state of acting against your better judgment. It is when you do one thing even though you know you should do something else……. Akrasia is what prevents you from following through on what you set out to do."

Is Time Inconsistency Getting In Your Way?

Psychologically, we have a time inconsistency. A time inconsistency is our propensity to choose immediate gratification versus a longer-term goal. The example quite often given by behavioral scientists is that an overwhelming number of people will choose $500 today over $505 tomorrow. However, if the choice is between $500 a year from now or $505 in 366 days, most will opt for the $505. The payout is the same-five extra dollars for one additional day.

The short-term temptations can often be tangible and rewarding but longer-term, they come with a cost.

Society and false prophets (or more accurately "false profits") are two of your biggest enemies when it comes to giving in to the short-term temptations. The so-called microwave society and the aforementioned get-rich-before-noon “gurus” support our propensity for time inconsistency. Channeling Queen, “We want it all, and we want it now." I know I do!

Feeling Like Paul?

A few years back, a client emailed me to say that she "felt like Paul:”

“Dave…..You know that passage from Paul? I know not to do, but I keep doing it?.....” This later became fodder for an article in TRADERS Magazine, blogs, webinars, and videos. What’s interesting is, while researching Akrasia, Paul’s words became a reoccurring theme.

So Houston, We Have A Problem; Now What?

Great Big Dave, yet another diatribe on how we’re not made to trade. How do we go about fixing that? Well, channeling Kettering, “A problem well stated is a problem half-solved.” Taking the following simple steps will help you to overcome the remaining “90%” (Yogi). Become fully cognizant that the short-term does affect the long term.

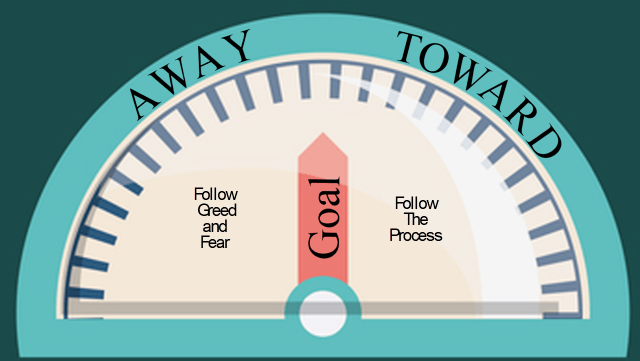

You Know That You Know

I've written extensively about the fact that, like Paul and the aforementioned client, you know when you're doing the wrong thing. Like the old "doctor doctor" joke, just don't do that. Seriously, being cognizant will get you halfway there. On every action, ask yourself: Is this helping me move toward or away from my goal. Which way will it move the needle? Again, the micro is more important than the macro.

Overcoming Akrasia

Overcoming akrasia all comes down to commitment. After a little digging, I found the definition in my library that is best suited for trading:

“..whatever it is that makes a person engage or continue a course of action when difficulties or positive alternatives influence the person to abandon the action..”

Encyclopedia of Psychology, quoting Philip Brinkman

Commit To Commitment Devices

As I often preach, Pogo got it right: "We have met the enemy and he is us." We must protect ourselves from ourselves. We must put so-called commitment devices into place to protect us from us. These do not have to be complex or costly. It's actually better if they aren't.

What a position trader feels like watching a 5-minute chart. Source: PaintingandFraming.com

In literature, Ulysses chained himself to the mast and put wax in his crew’s ears so that he wouldn’t become a victim of the Siren’s song. In the writing of literature, Victor Hugo procrastinated finishing the Hunchback of Notre Dame so long that he was facing a seemingly impossible deadline. He had all his clothes locked away and left himself only a shawl to wear. This way, he was forced to stay inside and finish the novel. And, allegedly, Herman Melville had his wife chain him to his desk so that he could finish Moby Dick.

Now, your commitment devices don’t have to be so dramatic. In fact, again, it’s better if they aren't. Our psychology and neurology make us resistant to big change. Homeostasis keeps us alive-e.g., just a few degrees variation in our body temperature can be deadly. Homeostasis is necessary for survival, but it is your worst enemy when it comes to making long-lasting changes. We have to make gradual changes to trick our brains. For instance, a few of my friends have recently gone on their annual fad diets. Like clockwork, their bodies will resist, and they’ll likely end up fatter in the future. Smaller is better when it comes to commitment devices. We have to make small, measurable changes. The Kaizen Way (Maurer) comes to mind (One Small Step Can Change Your Life).

James Clear

"Recognize that the future is now. … We have to make bad habits difficult in the present.” (James Clear, Atomic Habits)

According to James Clear, "Success is less about making good habits easy and more about making bad habits difficult." What's interesting is, like Maurer, in Atomic Habits he focuses on small, measurable changes (vs. drastic ones).

Make It Easy

Making bad habits difficult doesn’t always have to be a negative. A few weeks back, I found myself hunched over a screen, contemplating a day trade in a triple leveraged ETF (and no, it wasn't a money-lying-in-the-corner OGRe!). I knew that it was a bad idea, but the Siren call was drawing me like a moth into the screen. Just then, my bride popped her head into my office, waking me with the most beautiful word that I've heard all day: "lunch?" This snapped me out of my stupor. "Yes, please!" I replied. (I'm a big fan of lunch, hence the name "Big Dave"). I then said, "you know what babe, I can stand here all day staring at this screen and make unnecessary trades, or I can take you to lunch." So, when you do find yourself staring at the screen tempted to do something outside of your core methodology, take your wife or significant other to lunch (just not both at the same time).

Take A Walk

I often feel the urge to micromanage myself out of positions because they are going against me-even though the stop is still far away. And, on many times, I have to force my self to literally walk away. Not every time, but often, by the time that I get back to the office, the positions have turned around.

If you don’t have time for lunch or a walk, just turn your screens off. I have a screen saver on my trade station that kicks in after 5 minutes. I’ve thought about changing it to 30, but that would likely have me watching the screen more, which inevitably will lead to unnecessary trades. BTW, notice the black swan greeting card, which serves as a constant reminder not to do something stupid.

Just Breathe

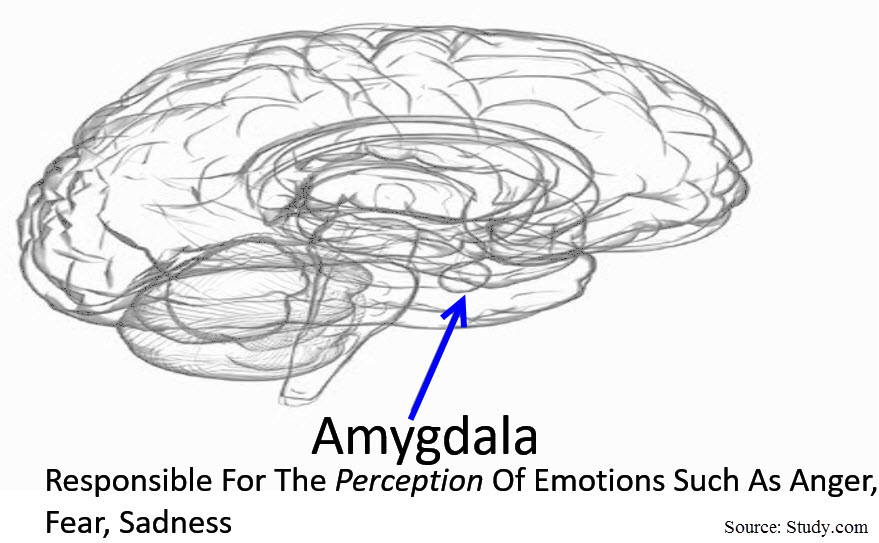

Sometimes the solution is as easy as taking a deep breath. Or, “wind the clock” (see "Investing With The Trend" by Greg Morris and lessons here in the member's area). It only takes a few seconds to bypass the small emotional part of our brains to get to the rest of what’s sloshing around up there.

Let Alerts "Watch Your Screens"

Alerts have been a Godsend for me. When I find myself watching the screen too much, I set alerts-lots of 'em! I set alerts near my stops and profit targets to alert me that action needs to be taken. In more recent times, inspired by Charlie Kirk (who sets hundreds of alerts), I've started setting more and more alerts to remind me when markets are moving and to keep me from watching them when they aren't! Lately, this has been in markets that have breakout characteristics like IPOs, where I set alerts for new highs. I also have been setting alerts on thinner, more speculative stocks such as the 420s—just to make sure that I don’t miss moves in the “church of what’s happening now.”

Stop In

I also often use stop entry orders to "stop me into" positions. This stops me from making unnecessary decisions about a potential position that I already planned. If I have decided that I want in, then I need to be in when it triggers. Many times, I'll get an email confirmation about a trade that I'd forgotten that I placed earlier in the day (note: use only day orders, and let the stock establish its opening range first. See Money Management under Member's for more details).

Take Small Steps FIRST, Then...

Try the above small things first. If these small commitment devices aren't helping, then it might be time to take slightly more drastic action. For instance, I have one client who often does quite well until he begins over trading himself into a serious drawdown-rinse and repeat! He finally became so frustrated that he moved his trading account over to an investment management firm. He now has to call in his trades. This has completely eradicated his unnecessary day trading because he doesn't want to "look like a lunatic.” (his words)

A Somewhat Extreme Commitment Device: One client does very well in following his trading plan-a plan which involves taking appropriate action around the market's open. Unfortunately, later in the day, he often finds himself firing off unnecessary trades. He came up with an interesting solution. After his morning orders/trades are complete, he hands his phone over to his assistant. She changes the password on his trading account and then hands the phone back.

In Summary

Short-term trading temptations will hinder your long-term goals. None of us are immune. Therefore, commit to commitment devices to protect you from you. These don't have to be difficult or complex. Tempting to do something that you shouldn't? Turn off your screens, go for a walk, or take your significant other to lunch.

May the trend be with you!

Dave Landry

*Notes and references:

This article was inspired by a blog post from James Clear and his book Atomic Habits.

Additional information came from the blog post from Aly Juma.

P.S. Are short-term trading temptations getting in the way of your longer-term goals? Well, if you’re human and trading, you probably. Leave a comment below to let me know what commitment devices you are using.