CHWY-Yet Another Dog Of An IPO That Could Have Easily Been Avoided With This SIMPLE Setup

By Dave Landry | Random Thoughts

Well, it's Deja Vu all over again. The next well hyped crappy IPO is....drumroll.....Chewy (CHWY). So, here's a "rinse and repeat" article originally published for previously well hyped crappy IPOs: Uber (UBER)-(at least initially, keep reading), Blue Apron (APRN), Snap Chat (SNAP), and Lyft (LYFT).

Random Thoughts

By Dave Landry

To win at trading, it helps not to lose in the first place. The good news is that simple rules can often keep you out of a lot of trouble. This is especially true when it comes to initial public offerings (IPOs). The Blue Apron (APRN) debacle is yet another example that could have been easily avoided. Let’s explore this further and more importantly, a simple setup that will get you into good IPOs and keep you out of a lot of crappy ones!

But First, A Word Of Warning When Trading IPOs

Before we get into trading IPOs, just know that they are akin to the story of the sardines. They are “made for trading, not eating.” Yes, they can make some wonderful moves, but you need to make sure that you have a chair ready when the music stops. They are notorious for being risky but with that risk comes potential reward. Just know the devil you’re dealing with. Considering this, make darn sure that you have a good grasp of money management before attempting to trade IPOs. There, that should help to cover my ass.

Will Rogers Could Have Been An Excellent IPO Trader

Will Rogers once said to “Buy stocks that go up. If they don’t go up, don’t buy ‘em!” Ahmen, my brother from another mother! Now, obviously he was being “tongue-in-cheek,” but there is some truth to that when it comes to IPOs. Can you simply just buy the ones that go up and avoid the ones that go down? With a few small caveats, I think you can.

The Highs And Lows Of IPOs

IPOs often make a significant high or low during their first week of trading. In many cases, that high or low is never seen again-or at least, long enough to make trading (or avoiding) them worthwhile.

Many don't even make it a week-they fail on their first day of trading. The issue comes out with a blaze of glory and then fizzles fast. They’re priced too high, and then they die. Obviously, Blue Apron (APRN) is "exhibit a." Notice below that it not only failed on the first week of trading, but on day 1!

Other examples of making their all-time highs during their first week of trading and then subsequently selling off hard include (but not limited to) Cars.com (CARS), Park Hotels & Resorts Inc. (PK), Lyft (LYFT), and Ultra Petroleum (UPL). (Note: see the Q&A sessions under www.davelandry.com for current and recent examples)

And, UBER (UBER)-(at least initially).

Maybe it will have the mother-of-all rallies and turn around. For now though, it looks like another turd to me. NOTE: Since this piece was published, Uber has turned around. However, it will not be buy candidate until and unless it makes new highs-which it could do today-06/28/19 (keep reading for the setup rules).

Below is Chewy (CHWY), the latest dog of an IPO:

Look through your new issue list and notice how many just come public and then implode. This leads us to number one rule when trading IPOs.

NOTE: Since this article was written, in one presentation, I showed so many IPOs that died from the first week of trading (and could have easily been avoided) that the participants thought that I was building a case for avoiding IPOs. I was not. This brings us to my #1 rule for IPOs.

The #1 Rule To Trading IPOs: Wait 1-Week

Because many IPOs fail right out of the gate-or at least within the week, my first rule for trading them is to not even consider buying them until the close of day five.* This eliminates many stocks that are doomed from the start. BTW, In case some of all this looks familiar (and admittedly, I am often guilty of beating the dead horse-something that drives my wife Marcy crazy. Don’t worry, I’m not stupid enough to make the “short trip” joke), this article is a follow up on the recent Snap (SNAP) article. Although I didn’t know it at the time, this simple rule would have certainly kept you out of this turd too. Notice below that in just the second day of trading it made its all-time high. Since then, it has lost well over half of its value

The IPO Landrylight Setup

A lot of my discoveries come from making simple examples of what not to do. Back when writing about how to handle Snap (SNAP) and any other “hot” IPOs that were due to come along, I made the case for giving them at least 1-week to trade. When thinking about how to make that easy to recognize, I figured why not incorporate a 5-day moving average? That way, you would NOT have an average until at least day 6. Further, I needed some sort of rule to only buy if it was heading higher. For that I decided that it would have to make a new closing high. Since the first day of trading often sets the high, the close must also be above that high too. Making a new closing high suggests that the IPO is healthy, but I also needed something to suggest that the stock was accelerating higher. Therefore, I added the rule that there must also be “daylight”—the low must be above the 5-day moving average. Let's break that down...

Here’s the rules for Dave Landry’s IPO Daylight Setup

1. The IPO must close at a new closing high with the caveat that it must also close above the high of the first day of trading.

2. The low of the stock must be above the 5-day simple moving average (i.e. there is LandryLight)

3. Once 1 and 2 are satisfied, buy the stock on the close. Let’s take a look at an example of this setup in action:

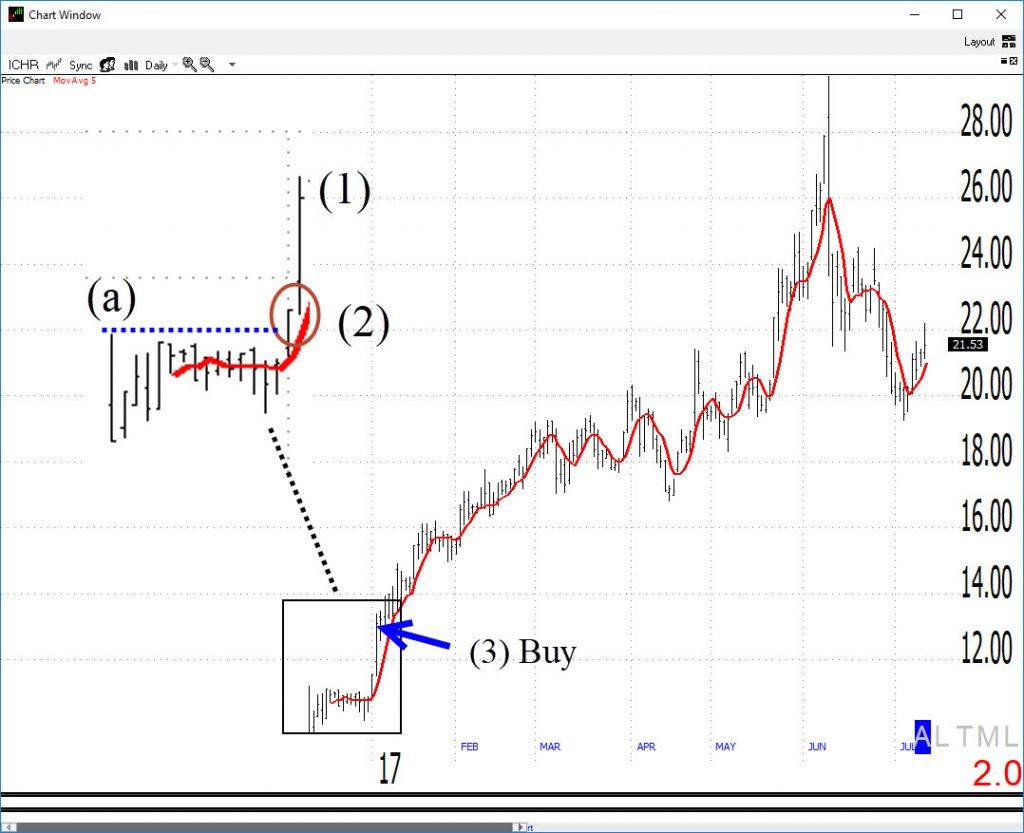

1. Notice that on 01/14/17 Ichor Holdings (ICHR) closes at a new closing high. This close is also above the high of the first day of trading (a).

2. The low is greater than the 5-day simple moving average.

3. Buy on the close.

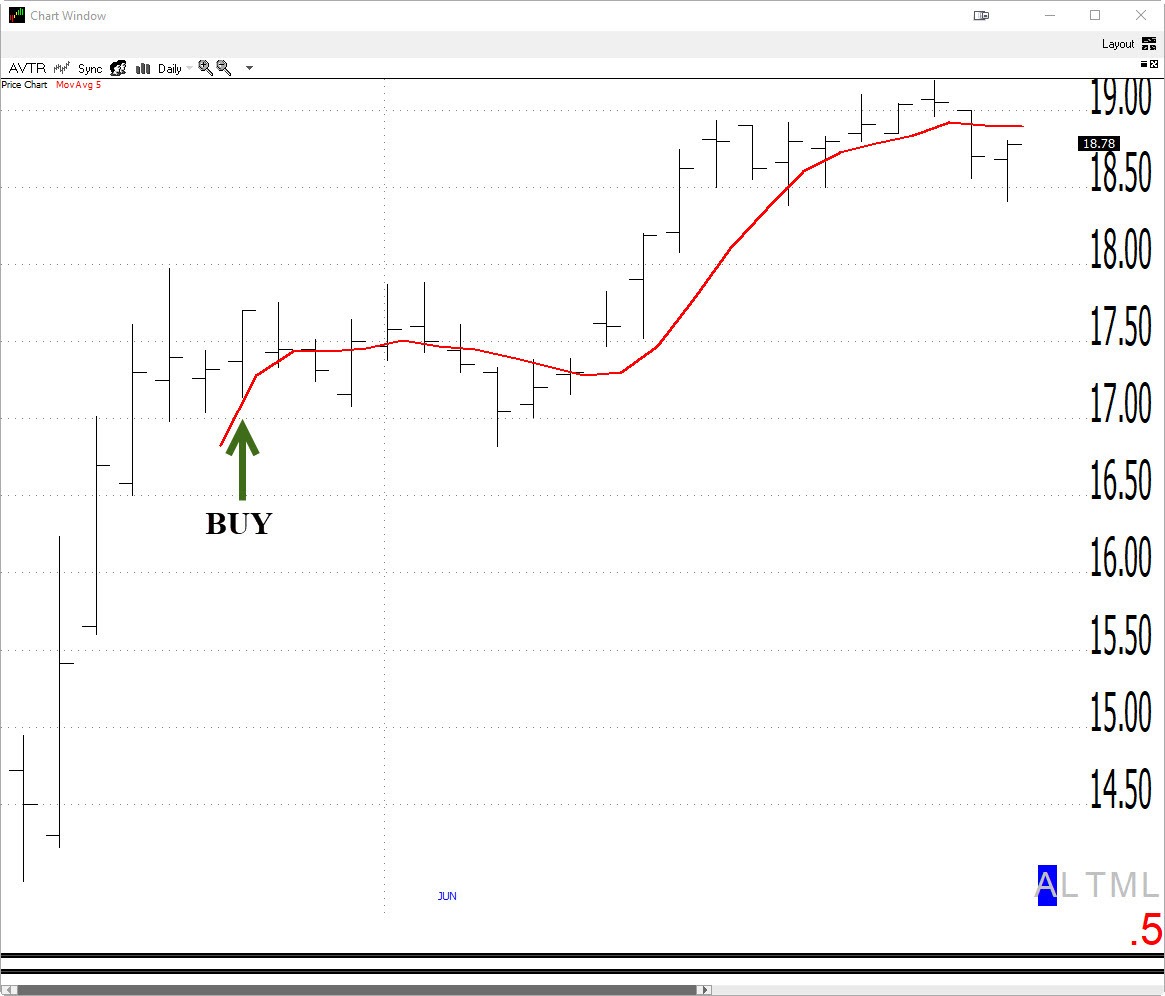

Here's another setup trigger. Full disclosure: I am long this stock from a similar setup ("Buy at B").

In Summary

So, what do you do when the next hot IPO comes along? Simple, buy it, but only if it goes up!

Best of luck with your trading!

Dave Landry

*The LandryLight setup triggers can only trigger on day 6 (or later). I do have other patterns (i.e. Dave Landry’s Buy At B) than can trigger on day 5, but no sooner! For more on Buy At B and other patterns, see the IPO Course. For potential upcoming IPO trades, see my Facebook Group (Gold Members Only). For more on trading IPOs in general, including the LandryLight setup, see the Methodology Course under www.davelandry.com/members.