Continue To Keep An Eye On The Bowtie

By Dave Landry | Daily Commentary , Random Thoughts

Random Thoughts

I’m fielding a few questions on Bowties and my bearishness. First, as discussed in Thursday’s webinar, we have the potential for a significant sell signal. It has to do two things though: 1) Complete the pattern and 2) Trigger. My discussion is just a “heads up” to a developing situation. Unless we get into a bona fide downtrend, I’m not going to label myself as a bear. In fact, labels can be dangerous.

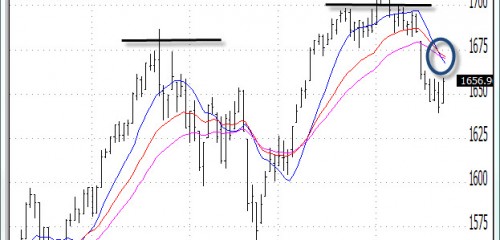

Let’s look at a chart. When the Bowtie moving averages come together and then spread out quickly, it suggests that the short-to-intermediate-term cycles have rolled over. Notice that these averages are on the cusp of flipping over from uptrend proper order (10SMA>20EMA>30EMA) to downtrend proper order (10SMA<20EMA<30EMA).

Bowties can occur fairly frequently so it is important to distinguish minor signals from major signals. Minor signals can occur during consolidations and mid-trend. I don’t pay much attention to minor signals but I occasionally notice that some bloggers do. Major signals are those that occur just after a market makes a major high or a major low. In the case of the Ps, the market made all-time highs and has now begun to rollover. Also notice that these highs aren’t much higher than the previous peak-see my recent webcasts for lengthy discussions on the nature of double tops. This action suggests that the market has lost steam longer-term. This combined with the Bowtie forming suggests that we should pay attention.

Again, it’s just a heads up. It is not the end of the world nor can you see it from here. A few big up days would make all the difference in the world.

Email me if you need the Bowtie pattern. Or, better yet stop being so cheap and buy Layman’s—or lazy and go to the library (Yes, they still exist. Tell them to get you a copy. They have to. That’s their job.)

Now, let’s look at yesterday’s action. All of the indices had decent days. So far though, they still look like they could be in potential trouble. This is especially true for the Rusty and the Ps based on overhead supply and the aforementioned potential bowtie situation.

On a positive note, I was impressed that the market shrugged off the glitch at the Nasdaq. On a personal note, I find this hiccup a little troubling. Hopefully, it’s just one and there’s not more to come.

I’m still not seeing a lot of shorts setting up just yet but based on the recent weakness in previously high fliers like Biotech, Retail, and Health Services I would imagine that this will change soon.

So what do we do? Even with Thursday’s rally, not much has changed just yet. So here’s your mostly cut and paste from Wednesday: Continue to keep an eye on the index ETFs for possible shorting opportunities. This will help you to gain exposure to the short side while looking for setups. Of course, the caveat is to make sure that you wait for entries. If the market decides to go straight back up then there is no trade-no trigger, no trade. Once again, with the notable exception of the recently mentioned Metals & Mining stocks, I’d avoid the long side for now. If the market is going to resume its longer-term uptrend then it will have to prove it to me by making new highs. I’m totally okay with giving up the first few percent of the move. You’ll always be a little late as a trend follower. You have to wait for the trend, and then, follow it. Makes sense, huh?

Futures are flat to firm pre-market.

Best of luck with your trading today!

Dave