Random Thoughts

What Keeps You Up At Night?

I'm an occasional guest (and former guest host) of the Crowd Forecast News trader's panel. The show's current host, Jim Kenney ("AKA The Options Professor"), often asks the guests a thought-provoking question:

"What keeps you up at night?"

Right, But Early

Twelve years ago, I received a phone call from a friend/colleague, "John." John's one of the brightest minds in the industry. He explained that the insane amount of leveraged spreading (arbitraging one market against another) was keeping him up at night.

Me: Spreading what?

John: You name it!, bonds against bonds, bonds against stocks, currencies, commodities... Everything! Everything against everything and with a ludicrous amount of leverage!

Me: Like Long-Term Capital Management? (LTCM)

John: YEAH!, like LTCM, but on steroids!

Me: Oh shit!

John: No shit, “oh shit!” It's going to end badly!

The 1998 Long Term Capital Management debacle. If it were not for the MASSIVE government bailout, it would have been a lot uglier. BTW, has the government ever bailed you out when you made stupid trading decisions? Just sayin'

Making The Move

John was so convinced of the forthcoming financial meltdown that he decided to pack it in-quite literally. He shut down his fund and was moving cross country. He asked if he could make an overnight pitstop at our house en route. We obliged.

A few days later, John, along with his lovely wife "Sharon," a couple of kids, a few animals, and a metric shit-ton of stuff (slight exaggeration. It was more like two metric shit-tons!) came rolling down our long driveway.

Later that night, Marcy and I lay in bed staring at the ceiling, processing the day's events.

Marcy: (breaking the silence) Sharon was concerned about the family being uprooted!

Me: Rightfully so! (I quipped back.)

Marcy: Yeah. (long pause) Do you think he's right?

Me: Oh yeah! He's right! He's right, but early!

That's The Same Thing, Mike!

If you haven't seen "The Big Short," stop reading and watch it. I'll wait. Okay, in it, Lawrence Field, a major investor in Michael Burry's fund, along with an associate, confront Burry on his fund's losses.

Lawrence: We have no confidence in your ability to identify macroeconomic trends. (He then proceeds to question the size of his short exposure.)

Burry: (explains the enormous exposure, all on one position)

Associate: (laughing sarcastically)

Burry: I may have been early, but I'm not wrong!

Associate: It's the same thing! It's the same thing, Mike!

(Upon further questioning, Burry explains that if the investors pull their money, the banks would then swoop in and the fund would be done.)

Associate: "Mother F-bombs" are then dropped.

So, How Do I Sleep At Night?

Sans a cold night when the covers are ripped off of me by Marcy, I usually sleep very well. Oh, when it comes to markets? Well, I usually sleep very well there too. Occasionally, when the market's trending but wide and loose, externally looking okay, but internally beginning to come unglued, not so much. Channeling Gelber, I'm cold and can't sleep because I'm wondering when the next winners will come along. Having three losing trades in a row stop out in my model account-which reflects my personal trading, doesn't help. Having clients remind me of the "Captain Obvious"-(that I suck) during these times excerbates the insomnia. When I can't seem to hit the side of the barn (from inside the barn!), I regroup and let the market come to me. This means mostly doing nothing. And, "doing nothing" creates a paradox. Trading is the only way to make money trading ("duh" implied). Trading is also the only way to lose money trading. Chaneling Ken Lambert, "Doing nothing is harder than it looks." This is especially true when you need money. And, seriously, when do you not need money? Further, why would you put yourself through the "trading wringer" if you didn't need money? There are far more fun things that you could be doing.

This is my view of a year in the life of a trader: Four out of twelve months you are hot. You are so excited that you can’t sleep at night. You can’t wait to get to work the next day; you’re just rolling. Two months out of the year, you are cold. You are so cold, you are miserable. You can’t sleep at night. You can’t figure out where the next trade is going to come from. The other six months out of the year, you make and lose, make and lose.

Brian Gelber

"Market Wizard"

How Are You Sleeping Now?

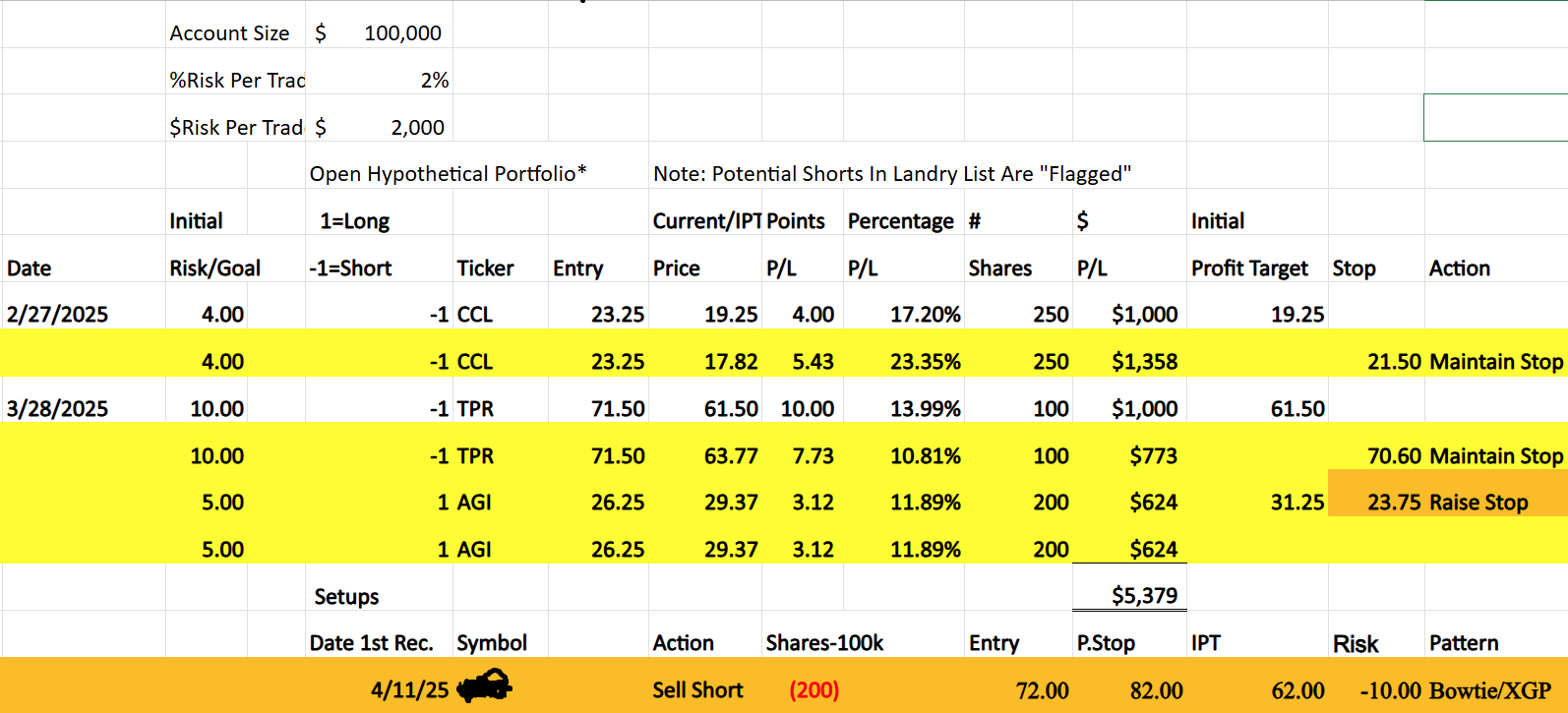

Well, I'm on the right side of the market. I know; check back often! We got knocked out on the remainder of a short position for a modest profit overall: 12.49% on half at the initial profit target and 4.02% on a trailing stop for a 1.3% gain overall on the model portfolio. The open portfolio consists of two shorts and one long gold position-about the only thing that's glittering right now.

Dave Landry's Core Trading Service model portfolio.

Keeping Your Head

Keeping your head while everyone is losing theirs is a good place to be. Oh, I'm not being schadenfreude or bragging. That's trend following. You eventually get on the right side of the market. Of course, as I know all too well, that's subject to change at moment's notice. So, again, I'm not being smug. It just feels good to be on the right side of the market after a long time of grinding it out. I know that in the not-so-distant future, I'll be grinding it out again!

What About Longer-term?

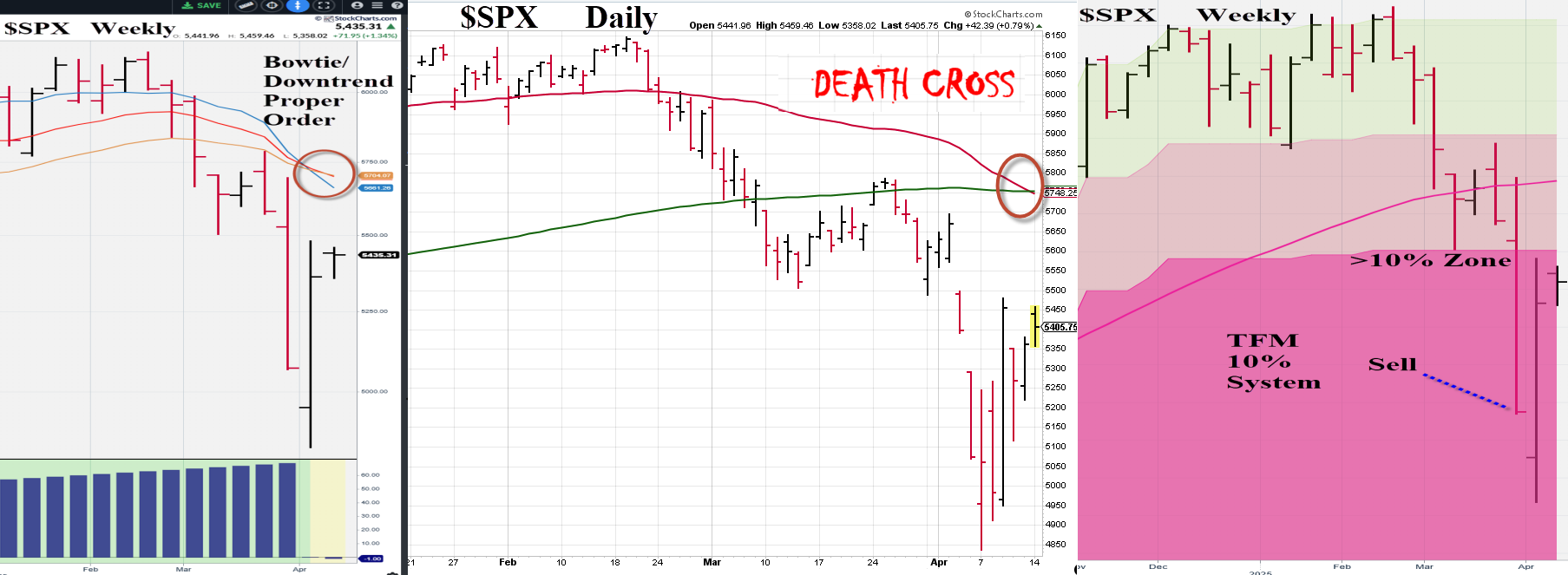

I'm often asked if I have any "longer-term" investments. Ideally, ALL of my positions would turn into longer-term winners. Occasionally, we do hold positions for months and even years. We let the market take us out (via stops)-be it today, tomorrow, or ideally 10 years from now (or longer!). Anyway, as far as "pure" longer-term stuff: I took the last long-term signal in the Qs (March of 23') with the TFM 10% System. This stopped out several weeks ago. I also "pulled" my daughters' left over college funds on the subsequent signal in the $SPX (see below).

Daily sell signals in the $SPX.

Longer-term sell signals in the $SPX.

So, Is This The Big One (Elizabeth Implied)?

Greg Morris, back when he was running over 5-billion, said that they treat ALL signals as if it will become the "big one." It was tough exiting on the TFM 10% System. My concerns were that the markets had dropped too far, too fast, and were due to snap back. However, channeling Greg, I rightfully decided not to "confuse the issue with facts" and take the signal seriously. And, what if it's not THE big one? That's trading. He who fights and runs away, lives to fight another day!

John's Still Right, But Is He Still Early?

Getting back to John. His argument has been furthered along through the years with the massive printing of money/skyrocketing government debt, artificially low interest rates, artificial intelligence, and a slew of other things that we're unaware of (like private "default swaps-"which was the subject of The Big Short).

Will John finally be vindicated? I'm going to say something that a guru has never said: I dunno. When markets go up, no one complains or cares why it is going up-even if it shouldn't be. When markets are going down, a scapegoat must be found. Tariffs are the obvious culprit at the moment. As right-but-early John has pointed out, there's a lot happening under the surface. The "powder keg" has been building for a long time. Tariffs might be the match.

So, What Do We Do?

Sans the gold stocks, I can't imagine as a trader that you'd have any longs left in your portfolio (unless you've thrown caution to the wind). Should you have such magical gravity-defying stocks, honor your stops since the falling tide will eventually sink all ships. On the short side, look to play the bounces. Ideally, since we are in the early phases of what could be something much bigger, focus on the stocks at high levels that are just beginning to break down (vs. those already in longer-term downtrends). The bigger they are, the harder they fall. Insurance would be a good example here. Above all, don't confuse the issue with facts. Yes, twelve years later, John might finally be right.

Just follow along and sleep at night.

May the trend be with you!

Dave Landry

*Fun fact: Red Foxx died on set of a heart attack. The cast and crew initially thought that he was just dicking around. Isn't that ironic? Don't you think?